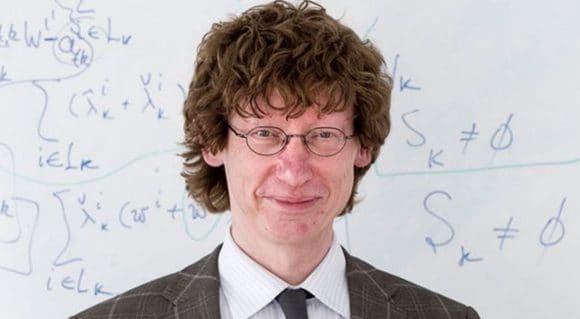

Professor Hens, the investment environment has changed dramatically over the last few years, with yields on many government bonds in negative territory. Should private investors adapt to this new reality or stubbornly stick to their existing strategy?

Investors should adapt to this situation. Ultimately, interest rates are a key parameter for an investment strategy. The first thing to do in a period such as this is to consider whether to invest money at all, or if you should borrow instead. Interest rates are not at low levels to punish investors, but instead to stimulate economic growth. As a result, people can borrow money and invest it productively.

So does this mean that we should allow the central banks to tempt us into taking on debt?

Those who moan about having to make investments when there are low interest rates, but don’t use capital productively, have only themselves to blame. There are various options, particularly for large investors. You can invest in products that use leverage, or you can borrow money and invest it in equities, for example. This lets you participate in productive capital. You can also invest in private equity or venture capital funds, which are highly leveraged themselves. Now is also not the time to pay off your mortgage if you have your own home. Instead, this is the time to add an extension to an existing home, or to buy a larger house.

Isn't it too risky to borrow money to speculate on stocks?

Of course, this is a risky investment strategy, but at the present time it makes sense for sophisticated investors who are able to take risks. It's obviously a bad idea to speculate using all your assets. You can give the bank the holdings in your equity portfolio as collateral, which means that this is your maximum loss. For example, if I already own a house and still have CHF 100,000 left over, I can invest this money in equities. Or I can borrow against my portfolio and then invest CHF 140,000 in equities. Of course, if the worst comes to the worst the money will be gone. You should give this careful consideration beforehand.

In the past, it was always considered taboo to borrow money to speculate on stocks.

This is true in normal times, but not at these interest rates. The Swiss National Bank is doing the same thing. It is investing its interest and foreign exchange income on the stock market.

But the SNB can print more money. In addition, the equity market has had a long boom. Is the risk-return profile still good?

The valuation of the US equity market is now fairly high at an average price/earnings ratio of 25, but valuations in Europe and Japan are relatively cheap. So investors could buy European and Japanese stocks.

If the US Dow Jones stock market barometer falls by 20%, it is highly unlikely that the SMI will rise by 10%. Instead, it will also fall sharply. So surely, these better valuations don't help me as an investor at all?

Because of the debt crisis, European stocks have lower valuations. Of course, European stocks will also decline if the Dow Jones falls. But this will mean that valuations here will still be more attractive. There is no doubt that investors will have a problem in the event of a stock market crash. However, this would also be the case if they were heavily invested in bonds and there was a swift and sharp interest rate reversal.

You are an expert in behavioral finance. What psychological traps are there that could be a risk to investors at the moment?

Some investors are too fixated on target returns. For example, many institutional investors wish to achieve a return of 3% or 4% and take higher risks. However, they could reduce their administrative organization - and then a return of 2% to 3% would be enough. Another typical trap is what is known as the gambler's fallacy. This is like in roulette, when the ball has landed on red ten times in a row and people think it’s more likely that black will come up next. Many investors have been waiting for an interest rate reversal for years and have shortened their durations too often. Whether the interest rate reversal will come depends not on past trends in interest rates, but on the future performance of the economy.

You also advocate the idea of evolutionary financial markets. What does this mean?

According to traditional financial market theory, you are only rewarded for taking risks. Evolutionary financial market theory sees the financial market as a competition between investment strategies. These strategies are battling for capital. Where there is a winner, there is also a loser. Evolutionary financial market research is the only research that takes into account, in addition to risk premiums, other sources of returns that arise from dynamic interactions, such as behavior in crash phases.

How does this help private investors?

Instead of spreading assets across equities, bonds or money market paper, they could implement a strategy allocation and combine rebound, value, illiquidity or insurance strategies. My theory states that we should not think in static terms. The system is evolutionary, and opportunities will keep arising. For example, the migration movements from the south to the north are a major phenomenon at present. So we can think about how to help the refugees while at the same time generate returns – for example, by investing in companies that build cheap housing. This is how I seek to exploit an opportunity, as with a rebound strategy, where for example, you would buy shares of VW at under 100 because they are valued very cheaply at the time.

So you don't believe in the efficient market theory?

There are phases when the market is efficient, and others when it is less so. If the latter is the case, opportunities will arise – one example would be the Fukushima disaster, or the surprising decision by the SNB to abandon the euro floor. However, this is not necessarily something that private investors should consider. It is more suited to experts, since in phases like this you need to act quickly yet sensibly.

If it's as simple as this, why have academic studies repeatedly come to the conclusion that active asset management is not worthwhile?

There are two reasons for this. Firstly, investment funds are measured by returns, which are calculated theoretically in academic papers and come out much higher than equity returns. Yet even the authors of these prize-winning papers, such as Eugene Fama and Kenneth French, have not managed to achieve these paper returns in practice in 20 years. If we only measure investment funds against the market, for example versus the S&P 500, there are many investors who beat the market over decades. Secondly, this is because most successful managers charge such high fees that the gains are eaten up. As a good active manager, I don't give away my returns to other people, but keep them for myself. As an investor, what you need to try to do is entrust your money to managers who have a good strategy but do not have a long track record. These managers cannot demand such high fees.

Financial Personality Test

Financial Personality Test

If you want to find the right investment strategy, it’s important to assess your risk tolerance correctly. That’s where the UBS Financial Personality Test comes in.