With 24-hour coverage of major asset classes from 12 key financial hubs around the globe, our Chief Investment Office experts identify the latest investment opportunities and market risks for you. Get fresh perspectives on the topics that matter most to you and your investment goals.

Are you ready for the Year Ahead?

As we enter 2026, the world stands at a crossroads. The Year Ahead 2026 report from our award-winning Chief Investment Office - named the Best CIO in Private Banking at the PWM/ The Banker Global Private Banking Awards 2025 - will help you spot the signals that matter, cut through the noise, and act with confidence.

Benefit from our leading CIO insights, and find out more about:

- Investing under Trump 2.0: Uncertainty and market volatility could persist as Trump’s policies take shape. But investors can bolster their portfolios by positioning for several enduring trends.

- CIO House View: the impact of current economic trends on asset allocation based on our assessment of the global economy and financial markets.

- Economics. Without jargon. Daily insights on a wide range of topics from Paul Donovan, our Global Chief Economist.

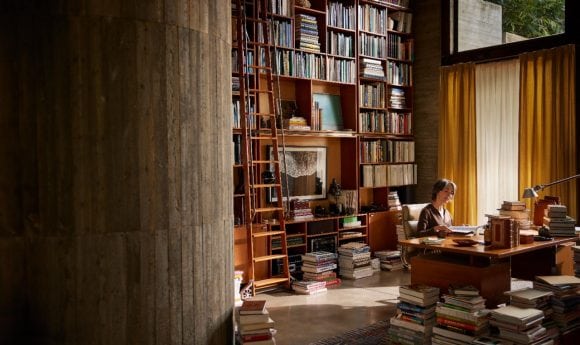

- Art collecting: expert insights into the development and management of an art collection.

Let's talk

Let's talk

Together, we can help you get the right insights.

Stay up to date with all things UBS Global Wealth Management