This page is only available in English

Can AI power the market even higher?

AI matters

IT and communication services stocks—many driven by advances in AI—now account for 36% of the MSCI AC World index. And the top nine US tech stocks have driven 72% of the growth in the Russell 3000 US equity index over the past 12 months, highlighting their dominant role.

Investment in AI infrastructure is having a growing direct impact on the economy, with the contribution to US real GDP growth from information processing equipment and software rising from 0.2ppt in 4Q19 to 0.8ppt in 2Q25.

The surge in AI-driven stocks is also influencing consumer sentiment, with US household wealth held in equity markets up by USD 24 trillion in the past five years.

Looking ahead, we see two critical factors driving AI: the sustainability of capital expenditure (capex) trends and continued investor confidence in the long-term returns on these investments.

Estimated compute demand for chatbot, enterprise, and agentic AI

In exaFLOP/s

Capex: Engine of near-term growth

Robust AI capex has powered market performance. The Nasdaq Composite is up 107% in three years, and semiconductors (SOX index) have done even better (157%). Capex estimates have been exceeded threefold over the past two years.

For momentum to continue, tech leaders and investors must believe future demand justifies today’s significant investments. Recent data center expansion means installed chip capacity could support a 25-fold increase in chatbot usage. But it is not just chatbots—anticipation of the next wave, including agentic AI (multiple specialized agents collaborating to replicate knowledge work), physical AI (robots, autonomous vehicles), and AI video, could drive further capex growth.

Businesses are rapidly becoming major AI users; agentic AI could drive compute demand to five times today’s installed base by 2030.

Physical AI could push demand even higher. With millions of robots already deployed and projections for a million humanoid robots sold annually by 2030, the need for computing power could soar even further.

Overall, we project a further cumulative USD 4.7tr in global AI capex between 2026 and 2030, with USD 2.4tr already planned based on more than 40 announcements disclosed this year alone.

We expect USD 571bn of this spending to come in 2026 (versus our previous estimate of USD 500bn, and compared to an estimated USD 423bn in 2025), and project capex to grow by a 25% CAGR between 2025-30 to reach USD 1.3tr annually by 2030.

The revenue potential from AI is vast

CIO estimates, assuming a USD 117tr global economy

Monetization: A crucial test

While investment is driving the current phase of growth, the success or failure of AI-linked investments will ultimately hinge on whether companies can deliver attractive returns on those investments.

We believe the revenue potential is vast: If we assume that labor accounts for around 50% of the world economy, that AI can automate a third of tasks, and that vendors capture a 10% share of the resulting value, longer-term annual AI revenues from end-users could reach around USD 2tr.

Thus far, monetization is lagging capex. Capex as a percentage of operating cash flows for the largest tech “hyperscalers” has risen from around 40% in 2023 to close to 70% in 2025.

AI capex remains low in GDP terms

Historical investment impulses, % of global GDP

Nevertheless, history shows it is common for new technologies to launch at little or no cost to encourage uptake, with pricing power—and profits—emerging once users become reliant. This was seen in social media, cloud storage, and enterprise software.

For now, we believe the critical trends to watch are the breadth and depth of AI adoption and early signs of value creation. U.S. Census Bureau data show that around 10% of businesses are already using AI to produce goods or services, a level expected to rise to 14% within the next six months. Our analysis suggests adoption typically accelerates further after this threshold.

Early adopters already report tangible value creation and increasing reliance on AI. Multiple studies show daily time savings: Adecco found an average of one hour saved per day, while Forbes reported 52 minutes.

In turn, the accelerating cloud revenue growth and even faster backlog growth across leading platforms, as reported in the 3Q25 earnings season, reinforce our confidence in AI’s substantial monetization potential. Looking ahead, we expect value will increasingly shift from the enablers to the application layer.

Risks: Lessons from history

Can AI achieve escape velocity? Unlike in rocket science, where reaching escape velocity follows precise physical laws, the path for financial markets is rarely smooth or predictable.

No investment “lift-off” has occurred without turbulence—fears about oversupply, bottlenecks, pricing power, or obsolescence. If dealmaking among large firms becomes more circular, with repeated transactions or cross-investments, financial vulnerabilities may also emerge.

Still, the historical context is encouraging. Our AI capex projection of USD 1.3tr by 2030 would account for around 1% of global GDP, below historical infrastructure investment impulses over the past 150 years (railroads, automotive, computers, telecom), which ranged from 1.5% to 4.5% of global GDP annually.

While investors should remain mindful of the risks, we believe that trends in capex and accelerating adoption will be sufficient to push AI-linked stocks even higher in 2026.

Integrating transformational innovation into a portfolio

Recent history has shown that exposure to structural growth opportunities can improve the performance of equity portfolios. We believe that this will remain a feature of global markets in the years to come.

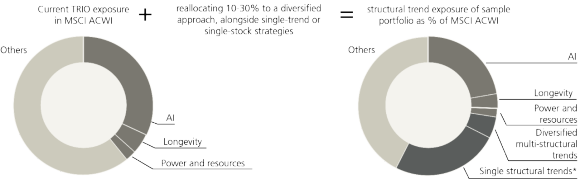

Most investors’ equity portfolios will likely already have some exposure to structural trends, intentionally or not. We estimate that a purely passive portfolio invested in the MSCI AC World already includes exposure of approximately 40% to our TRIOs (as of end of October 2025).

For investors looking to increase their potential for outperformance by investing more explicitly in structural trends, we broadly see three strategies to consider: investing in a range of structural trends, focusing on a single structural trend, or selecting single stocks linked to one or more trends.

In our report “Investing in structural trends through equities,” we explore how reallocating between 10% and 30% of a broadly diversified equity portfolio toward a blend of such strategies, can raise the structural growth exposure of a passive equity portfolio from 39% to between 45% and 58%. Practically, this could include up to a 10% allocation to a diversified approach, alongside 2-5 single-trend or single-stock strategies.

Allocation to structural investment trends can complement portfolio exposures

TRIO exposure in MSCI ACWI (in %) and resulting exposure (in %) in MSCI ACWI with additional 10-30% allocation to structural trends

The economic backdrop

US

We expect real US GDP growth of close to 2% for 2026, similar to 2025, though annual growth figures obscure an underlying acceleration.

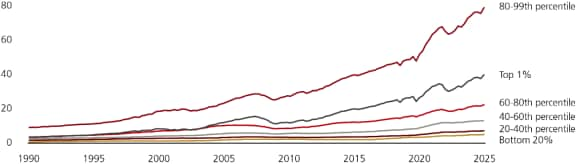

As we enter 2026, we could face a period of softness for the US economy as tariff-related pressures on prices and exports persist. Labor market conditions are also likely to remain soft, reflecting reduced labor supply and more cautious hiring. However, into the second half of the year, we expect growth to accelerate. Business sentiment should benefit from a shift in policy focus toward targeted tax cuts and deregulation as midterms approach, and we expect consumer demand to be underpinned by solid wage growth and healthy household balance sheets among middle- and upper-income groups.

We expect inflation to peak in the second quarter, at just over 3%. We expect the Federal Reserve to implement two additional rate cuts by the end of the first quarter, moving toward a neutral policy stance. While the appointment of a new Fed chair introduces some uncertainty, we expect monetary policy to remain data dependent.

Europe

We forecast Eurozone growth of just over 1% in 2026, though also expect growth to accelerate throughout the year. Consumer sentiment remains cautious, savings rates are high, and the region continues to face headwinds from US trade policy. But Germany’s fiscal stimulus and infrastructure investment are expected to provide support, with domestic demand benefiting from rising real incomes and a robust labor market.

While we think headline inflation will fall below the European Central Bank’s (ECB) 2% target in 2026, we also expect medium-term expectations to remain stable, allowing the ECB to keep rates steady. The Russia-Ukraine war remains a source of uncertainty, but a ceasefire and reconstruction could lead to a more favorable growth outlook.

Asia

We expect APAC ex-Japan growth to stay robust at just under 5%, but with a soft start and a stronger finish to 2026 as lower interest rates take effect. China is expected to set a growth target of 4.5-5.0%, prioritizing technology innovation and industrial upgrades under its new Five Year Plan.

On the policy front, the recent US-China trade truce is a positive development, though many details remain unresolved—especially regarding semiconductors. Meanwhile, China’s ongoing focus on domestic upgrades and supply chain diversification should help support economic stability in the face of global uncertainties.

Key regional macro themes include the expanded build-out of tech supply chains, domestic consumption upturn in Japan and India, and a revival in regional credit growth, which should benefit banks and consumer-related investment opportunities across the region.

US household finances remain solid, especially among middle- and upper-income groups

Total net worth across different income groups in US by percentile, in USD trillions

Postcards from around the world

Building a strategic equity portfolio

Building a strategic equity portfolio requires balancing long-term growth objectives with risk management and diversification.

For most investors, equities should form the core of a growth-oriented portfolio, typically comprising 30%–70% of total assets, depending on risk tolerance, investment horizon, and financial goals. Regular rebalancing back toward a long-term target is an important part of managing risk levels and maintaining discipline.

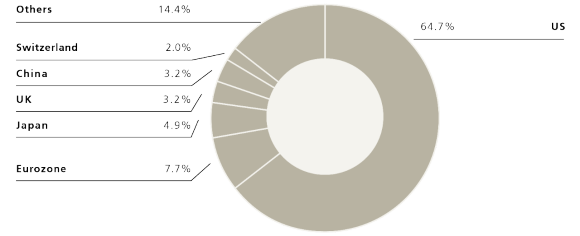

Regional diversification is essential. The MSCI All Country World Index (ACWI) offers a benchmark. As a rule of thumb, we think exposure to the US should typically account for at least half of a global equity portfolio, with at least 20% in other global markets.

We believe that investors looking to bolster potential for outperformance can consider reallocating up to 30% of an existing broadly diversified equity portfolio toward such strategies linked to structural growth (see page 21). To further enhance diversification, investors can also consider incorporating exposure to quantitative or factor-based strategies alongside traditionally constructed allocations.

US equities account for nearly two-thirds of the global MSCI ACWI benchmark

Country weights in MSCI ACWI, %

Building commodities into a portfolio

Commodities can play a valuable role in portfolios, but they can face periodic volatility. Returns are strongest when supply-demand imbalances or macro risks—like inflation or geopolitical events—are elevated. In such periods, broad commodity exposure can help diversify portfolios and protect against shocks. When the outlook is favorable, we typically suggest an up to 5% allocation to a diversified commodity index.

Investors can access commodities through diversified indices, ETFs, or structured investments, but should be aware of unique risks such as price swings and costs associated with futures or physical holdings. Commodities have also experienced long periods of strong out- and underperformance versus equities. Hence, we generally see them as a tactical, not permanent, component of a long-term portfolio.

Disclaimers

Disclaimers

Year Ahead 2026 – UBS House View

Chief Investment Office GWM | Investment Research

This report has been prepared by UBS AG, UBS AG London Branch, UBS Switzerland AG, UBS Financial Services Inc. (UBS FS), UBS AG Singapore Branch, UBS AG Hong Kong Branch, and UBS SuMi TRUST Wealth Management Co., Ltd.