This page is only available in English

How will governments manage rising debt?

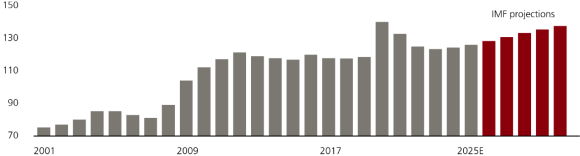

Rising government debt is one of the defining macroeconomic challenges of the decade. The International Monetary Fund (IMF) estimates G7’s gross government debt to reach around 126% of GDP this year, up from 85% two decades ago. This surge largely reflects extraordinary shocks, including the 2008 financial crisis and COVID-19 pandemic, but we see the upward trend continuing. The IMF estimates debt levels could climb to 137% of GDP by 2030, driven by aging populations (which trigger higher spending and a smaller tax base) and increased defense spending.

A risk is that debt could reach its own “escape velocity,” where persistent deficits and higher interest costs make it hard to bring debt levels back to earth.

In this environment, the question is not whether governments will act, but how—and what those choices mean for investors.

Government debt is projected to keep rising

G7 economies‘ gross government debt, % of GDP, including IMF projections

Potential policy responses

Fiscal consolidation

The textbook solution is fiscal consolidation—raising taxes or cutting spending to reduce deficits. Partisan divides make consensus difficult. France’s attempts at modest deficit reduction in 2025 were blocked by a polarized parliament. In the US, deficit reduction has not been a priority for either major party, and Japan’s ruling LDP has chosen further fiscal stimulus instead of austerity. Meaningful fiscal consolidation is likely to remain the exception.

Skewing the maturity profile

Another tactic is to shift government borrowing toward shorter maturities. By issuing more short-term debt, governments avoid locking in high borrowing costs for decades, hoping that rates will fall or fiscal conditions will improve. While this can buy time, it also increases rollover risk and leaves governments more exposed to future inflation and yield spikes. Ultimately, this postpones rather than solves the underlying problem.

Financial repression

Rather than relying solely on politically difficult spending cuts or tax hikes, we believe a more subtle, likely pervasive approach is “financial repression,” which refers to policies that keep interest rates artificially low, making borrowing costs more manageable.

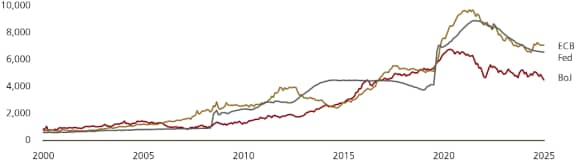

Financial repression is about managing demand for government debt through mechanisms like bank, pension, and insurance rules, as well as central bank purchases. By doing so, governments indirectly “tax” cash savers by reducing real returns. As a result of such policies, central bank balance sheets have already grown substantially in the past 20 years, and we expect them to remain high (see chart below).

Market implications

For investors, an immediate risk is that concerns over debt sustainability and credit rating cuts could trigger periodic volatility in bond yields. However, we believe that interventions will become more frequent to help stabilize or lower yields.

Over the medium term, more frequent interventions are likely to anchor interest rates and bond yields at lower levels than debt fundamentals might suggest. Aggressive yield suppression may increase FX volatility, as currencies absorb more of the adjustment. Historically, exchange rates were fixed and bond yields floated. Today, both are market-determined, but we may be moving toward a regime of more fixed borrowing costs, with currencies absorbing more of the adjustment.

What does it mean for investors?

Asset prices could rise initially: If governments and central banks increasingly intervene to manage yields, equities, government bonds, and commodities could perform strongly (in local currency terms) in the immediate aftermath, as real yields fall.

Diversify income and return sources: With public debt potentially facing periods of volatility a diversified approach to income generation is essential. Greater central bank intervention could also increase equity-bond correlations, increasing the importance of alternatives in a portfolio.

Consider currency risk: If yields are increasingly fixed, currency markets may become the primary shock absorbers for rising debt. For investors, a strategic approach to currency exposure will be key to avoiding asset-liability mismatches.

Central bank balance sheets have grown substantially over the past two decades

Fed, ECB, and Bank of Japan balance sheets, total assets in USD bn

Building a fixed income portfolio

A robust fixed income allocation provides stability and income while managing risk. Allocating between 15% and 50% of total assets to fixed income is a typical benchmark, tailored to risk tolerance, income needs, and investment horizon. Higher allocations suit those prioritizing stability; lower allocations fit growth-oriented investors. Regular rebalancing is needed to keep allocations on target as markets, maturities, and coupon payments can shift portfolio weights.

Currency risk can be a bigger contributor to returns in fixed income than in other asset classes. We therefore recommend aligning holdings with an overall currency strategy, using a mix of currency-hedged funds, local bonds, and international bonds to manage this risk.

Duration measures how sensitive bond prices are to interest rate changes. We believe an average duration of five to seven years balances risk and return for long-term investors, especially when rates are expected to change gradually.

We recommend diversifying across developed market government bonds (for stability), corporate and emerging market bonds (for higher income), and, in low-yield environments, supplementing with equity income and yield-generating structured investments—such as equity-linked notes—to support portfolio income.

Our currency views for 2026

USD

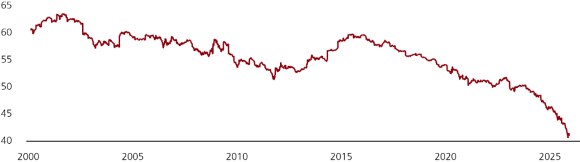

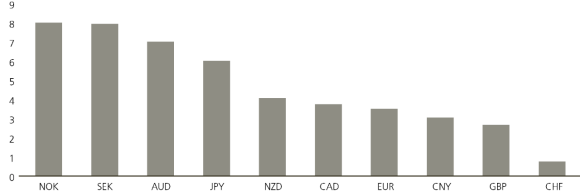

We expect US dollar weakness to persist into the first half of 2026. As the Federal Reserve’s rate cuts pause and policy rates inch lower toward 3%, downward pressure on the dollar should ease somewhat. However, a strong USD recovery remains unlikely: The currency’s elevated valuation, persistent fiscal and current account deficits, and ongoing efforts by global institutions and private investors to diversify away from the dollar all present structural headwinds.

Institutions are reducing dollar exposure

Bloomberg Intelligence USD share of global foreign currency reserves, in %

EUR

With the European Central Bank likely at its terminal rate, we expect policy to remain on hold for the coming quarters. As France’s political uncertainty fades, the euro should regain ground against the dollar, with Germany’s fiscal stimulus and potential for private sector re-leveraging also providing support. That said, EUR upside may be capped if Asian currencies remain closely tied to the USD, as a stronger euro could limit Europe’s competitiveness globally.

CHF

The Swiss National Bank has reaffirmed its stance on negative rates, and market expectations now align with our view of no further cuts. The SNB’s tone will likely be shaped more by global developments than domestic factors. We expect EURCHF to remain stable or edge higher, suggesting the Swiss franc should underperform the euro and other higher-yielding currencies on a total return basis, given its strong yield disadvantage.

GBP

The pound remains sensitive to fiscal uncertainty but offers attractive carry, in our view. We anticipate only two Bank of England rate cuts in 2026, meaning that UK yields are likely to stay above US and Eurozone yields in the coming months. Accordingly, we expect the GBP to deliver positive returns against the USD and the UK’s fiscal challenges to keep the GBP steady against the euro, which we believe will rise on fiscal spending.

JPY

Prime Minister Sanae Takaichi’s late-2025 election led to pressure on the yen due to expectations of loose fiscal and monetary policies. With these expectations now largely priced in, we expect a gradual yen recovery versus the USD in 2026 amid further narrowing in US-Japan yield differentials.

CNY

The yuan strengthened against the dollar in 2025. We expect this to continue into 2026, supported by progress in US-China trade talks, the central bank guiding CNY fixings stronger, the ongoing conversion of elevated onshore FX deposits into local currencies, and a resilient current account.

AUD

We believe the Australian dollar offers attractive carry and solid fundamentals in 2026. Resilient commodity exports and a neutral stance from the central bank should be supportive for the currency. Moreover, with Australia’s sound fiscal position and the cash rate now on hold, yield differentials should become more favorable, while we also see greater stability in Chinese growth. We rate the AUD as Attractive and expect positive returns for the AUDUSD pair.

USD is expected to underperform all G10 currencies on a spot basis

CIO estimates for spot appreciation of major currencies against the USD by end-2026, %

What about crypto?

Crypto like Bitcoin has become more accessible, regulatory recognition is rising, and the assets are viewed by some investors as long-term “buy-and-hold” opportunities, similar to gold or equities. While adding crypto to a traditional portfolio has sometimes improved returns in recent years, this comes with important caveats. Crypto remains highly volatile, and a short history makes extrapolation challenging.

There is a path by which crypto could become a more established part of investor portfolios, including by becoming less volatile, with more stable correlations to other assets, and with more widespread institutional investor adoption. For now, for those who believe in the long-term potential of crypto, a small, buy-and-hold allocation may be appropriate, but it should only represent a modest portion of a portfolio. With risks still significant, any crypto position should be sized so that even a total loss would not materially affect an investor’s overall investment plan or risk profile.

Building the right currency exposure

Currency markets have been volatile in 2025, and with governments and central banks likely to intervene more to manage yields and debt in the future, volatility may remain high. Aligning a portfolio’s currency mix with expected future spending reduces the risk that currency swings will undermine financial goals.

For globally oriented investors, or those with assets far exceeding future consumption, we recommend diversifying across major currencies to preserve long-term global purchasing power. This means not relying on a single reference currency, but spreading exposure across currencies with strong fundamentals. We suggest considering metrics such as long-term valuation trends, safe-haven status, the issuing country’s current account balance, the currency’s share of global trading, and reserve currency status.

Disclaimers

Disclaimers

Year Ahead 2026 – UBS House View

Chief Investment Office GWM | Investment Research

This report has been prepared by UBS AG, UBS AG London Branch, UBS Switzerland AG, UBS Financial Services Inc. (UBS FS), UBS AG Singapore Branch, UBS AG Hong Kong Branch, and UBS SuMi TRUST Wealth Management Co., Ltd.