We expect the upcoming inflation data to be soft enough to give the Fed sufficient confidence to begin cutting interest rates by June. (UBS)

The February US Consumer Price Index (CPI) data was not as bad as some participants had feared. Although core services inflation remained elevated in February, investors were reassured by cooling shelter and rent inflation, as owners' equivalent rent was not as strong as the surprisingly high number in January's report. Despite noisy February CPI data across segments, we believe the US economy continues to be in good shape and is heading for a soft landing. We expect the Fed to begin trimming rates at the June meeting, for a total of 75 basis points of cuts (three cuts) in 2024.

The data within the February CPI report showed:

- Headline CPI : The gain in monthly headline CPI was 0.4% from January, meeting expectations. While energy prices rose 2.3% from January, food prices were little changed.

- _C_ore CPI (excluding food and energy): The increase in core CPI was 0.4% m/m, versus consensus estimates for a 0.3% m/m gain. Core CPI continues to be driven by core services inflation.

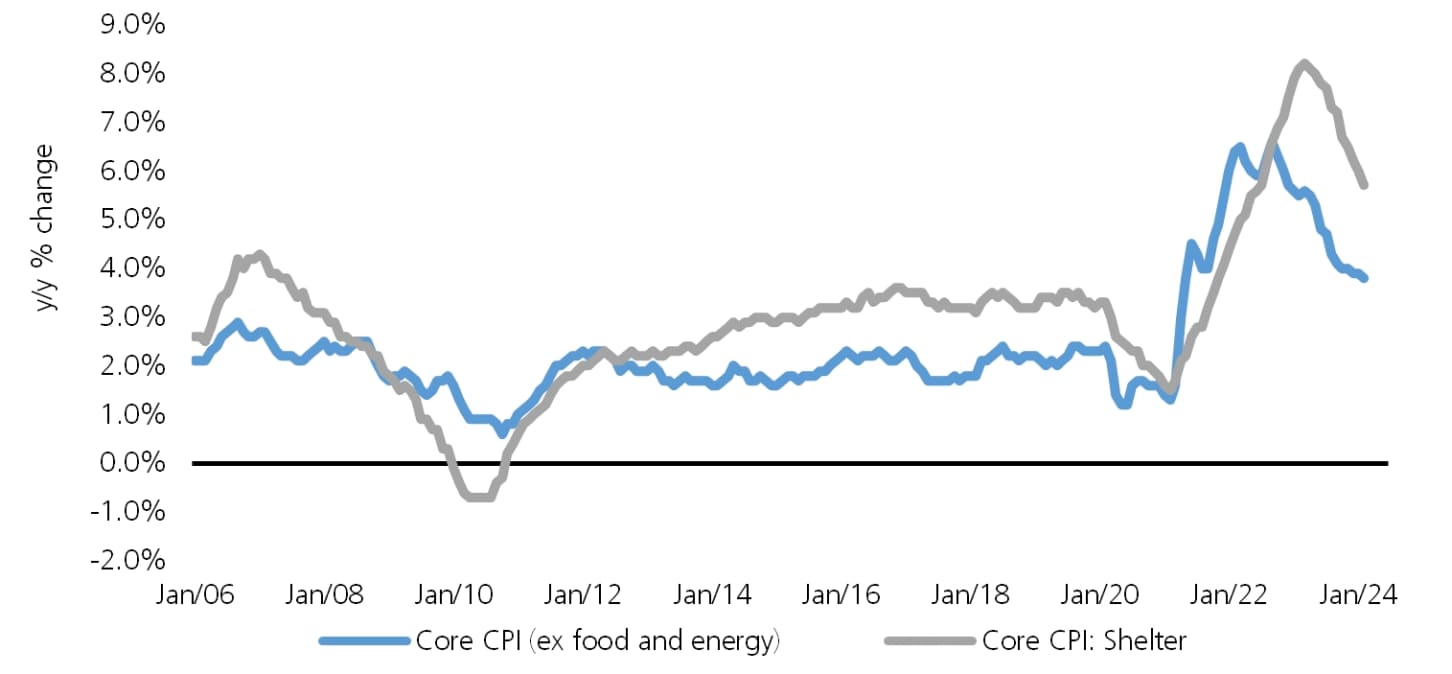

- Core services inflation remained elevated (0.5% m/m) with shelter prices a main driver. Within the shelter category, owners' equivalent rent cooled to 0.4% m/m from the 0.6% m/m rise in January.

- Core goods inflation experienced smaller price gains (0.1% m/m).

We expect rate cuts to begin in June, since we believe the core services CPI (+5.2% year-over-year in February) will continue to trend lower.

We expect a softer labor market, slower economic growth, and further moderation in shelter inflation to help overall CPI trend lower in the coming months.

While the releases of economic data may create volatility in markets, we continue to believe the overall macro backdrop of receding inflation and the likelihood of lower rates mean that investors should ensure they are sufficiently invested and diversified. We recommend investors manage liquidity, lock in attractive bond yields, and complement their core equity holdings with small-cap stocks in anticipation of rate cuts ahead.

See our blog, Inflation picture remains complicated , 12 March, 2024.

Main contributors: Brian Rose, Senior US Economist, CIO Americas and Jennifer Stahmer, Strategist, UBS Financial Services Inc. (UBS FS).