Concerns over market concentration in US stocks have continued with the largest stocks driving strong market gains. At the time of writing the S&P 500 was heading towards its 14 th all-time high of the year, in just two months.

There is no doubt that the US equity market has become more concentrated as the so called Magnificent Seven stocks have seen their market cap rise steadily, as market expectations of the potential of AI technology have increased. These companies alone represent about 30% of the S&P 500 index, with one stock of the group rising 60% year-to-date.

But the dominance of tech-driven companies and concerns over market concentration in the US should be put into broader context.

This week saw the publication of the Global Investment Returns Yearbook, a comprehensive and industry-leading historical record of asset class returns with data stretching to 1900 -- a UBS collaboration with professors at London Business School.

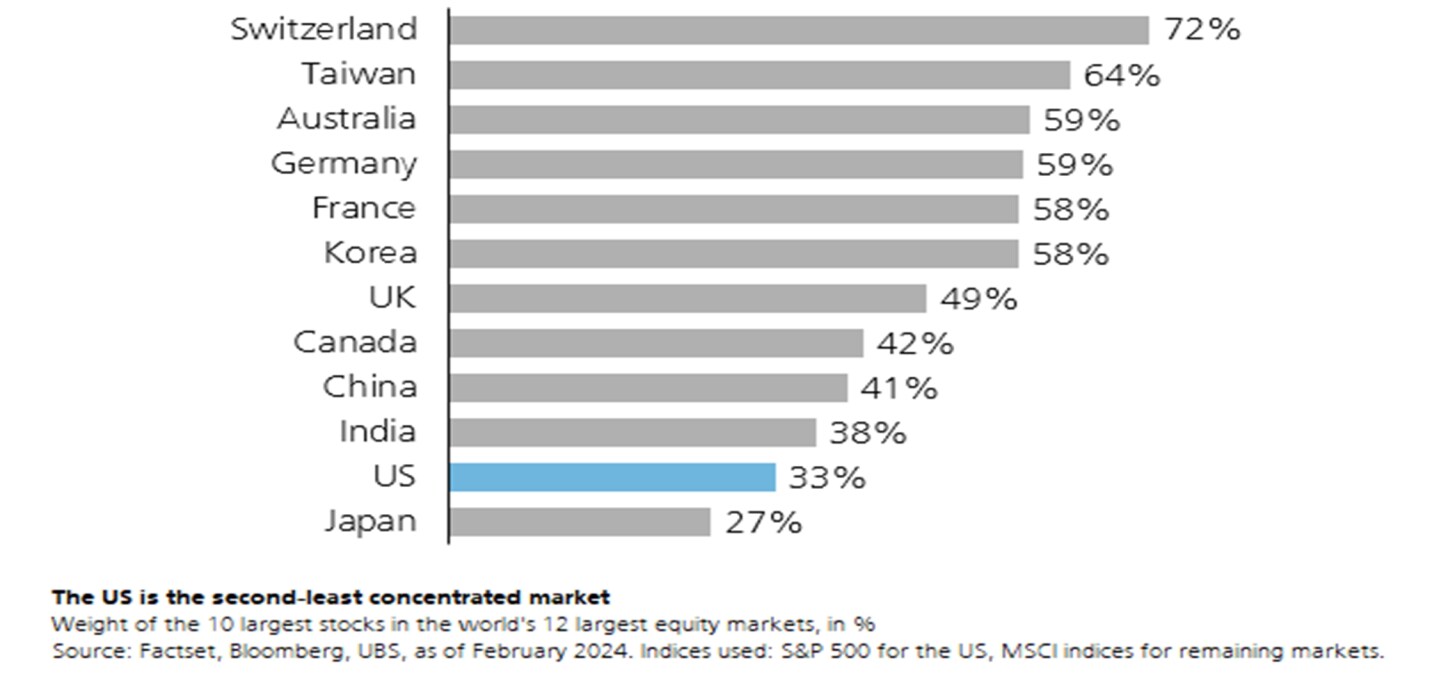

The study shows that at the end of 1899, the US represented about 15% of the world’s equity markets. Today, the US makes up 61% of the world’s equity markets, and as the chart shows, among the world’s 12 largest equity markets, it is the second least concentrated equity market.

In the US, the weight of the 10 largest companies at ~33% is high, but not extreme compared to other key equity markets. Switzerland, a small economy (~USD 800bn in nominal GDP) has the largest concentration with the 10 largest stocks representing 72% of the MSCI Switzerland Index. Concentration in the Swiss equity market is even higher in its blue-chip SMI Index (82%) as the country is home to large multinationals including Nestlé, Novartis, and Roche. Other countries have big weights too: France in the luxury sector for example, with LVMH Moet Hennessy Louis Vuitton SE representing ~12% of the CAC 40.

We think that while concentration in the US has increased, mainly driven by the tech sector, both the US and the US tech sector remain attractive.

US tech companies are leading the AI revolution, and we think generative artificial intelligence will be a major trend in the coming decade with AI revenues growing around 70% a year until 2027, based on our expectations. Big companies in generative AI—which are present across multiple stages of the value chain, from the cloud and connected hardware to large language model development and applications—are mainly in the US tech sector.

We also think that US large-cap stocks should make up a substantial portion of equity allocations for the long-term positioning of investors’ portfolios. The US is not only the largest and most liquid equity market. It also offers exposure to the country’s resilient and valuable consumer market (US consumption is around USD 19 trillion annually) and its largest multinationals (about 35% of S&P 500 sales are generated outside the US).

As the Yearbook highlights, the growth in the US share of the global stock market since 1900 reflects "the superior performance of the US economy, the large volume of IPOs, and the substantial returns from US stocks. No other market can rival this long-term accomplishment."

The Yearbook offers very timely insights. This one in particular: The US is an opportunity no investor should miss.