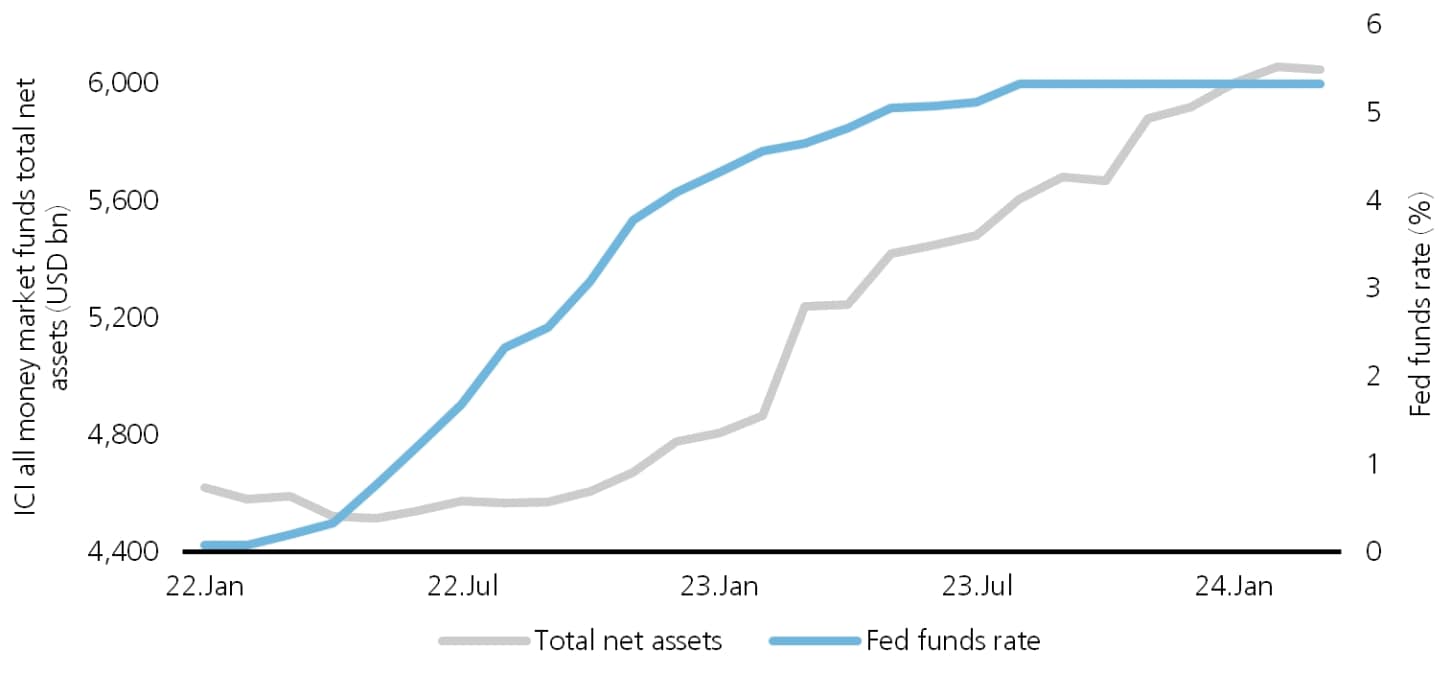

Cash piles have grown with higher rates. (UBS)

Is it time to reduce cash holdings? Yes.

The start of the global rate-cutting cycle makes this a critical time for investors to review cash-heavy portfolios: After all, as interest rates fall, cash will progressively deliver lower returns.

We think the Fed will find sufficient evidence of cooling in both inflation and the jobs market to start easing policy in the coming months, likely starting in June. We expect 75 basis points of rate cuts this year, with further reductions in 2025. And if US economic growth falters, we would expect policymakers to respond swiftly with more aggressive rate cuts.

Since we expect rate cuts in 2024, we recommend investors diversify beyond cash and money market funds through a combination of fixed-term deposits, bond ladders, and structured investment strategies.

Record net assets in money market funds. According to the Investment Company Institute, total money market net flows climbed to nearly USD 6.1 trillion in March after the Fed hiked rates, which elevated yields on cash accounts. Nearly USD 1.1 trillion were added by investors to US money market funds in 2023, with an additional USD 160 billion of net inflows since the start of 2024.

With rate cuts expected in 2024, investors face potential loss of income. As economic growth slows and inflation continues to moderate, interest rates on cash are poised to fall in 2024. Comments from Fed officials point to rate cuts later this year, but the timing of the cuts is data dependent. Policymakers want to see more evidence inflation is firmly on a path to their target before lowering interest rates.

Markets have dialed back expectations for rate cuts. Fed funds futures are now pricing in nearly 75bps of cuts (three cuts of 25bps), with the first cut likely in June. This has declined from the mid-January expectation for 170bps of rate cuts.

When the Fed starts to cut rates, falling yields will favor bonds over cash.

We believe this is a good time to lock in higher yields. We recommend investors lock in currently high yields since our base case remains that the Fed will begin to cut rates in June, with 75bps of total easing by the end of this year.

We recommend a well-diversified liquidity strategy for investors who wish to manage liquidity:

- Fixed-term deposits. Since we expect interest rates to fall in 2024, we believe investors who are interested in covering potential expenses and liabilities up to 12 months out should use fixed-term deposits to lock in currently high yields on cash. Investing in fixed-term deposits of different maturities can also help match liabilities and reduce interest rate and reinvestment risks.

- Bond ladders. We recommend investors lock in currently attractive bond yields. For expected portfolio withdrawals over the next 12–60 months, bond ladders involve buying a series of individual short-duration bonds of varying maturities, staggered to provide a steady stream of income, and aligned with the size and timing of expected portfolio withdrawals.

- Structured strategies with capital preservation features. These strategies are recommended for investors who intend to use cash in 3–5 years' time, but wish to participate in further equity gains while also limiting losses. The currently low equity market volatility improves the pricing of such strategies. Since costs may apply if investors need to sell before maturity, we suggest using these tools to cover longer-term liabilities.

Investors will face reinvestment and duration risks. - Reinvestment risk: the chance that cash flows received from an investment will earn less when put to use in a new investment. When yields fall, cash will experience more reinvestment risk than bonds, because their return comes from income. By contrast, bonds have a higher duration risk than cash, so they will experience price appreciation due to falling yields.

- Duration risk: the risk that a change in interest rates will either increase or decrease the market value of a fixed income investment. In past market cycles, high-quality bonds have experienced a much larger benefit from falling yields than cash due to their higher duration risk, even though short-term bond yields tend to fall more than longer-term yields and credit spreads tend to widen (which dampens high-quality bonds’ tailwind from falling Treasury yields).

Main contributors: Justin Waring, Investment Strategist, UBS CIO Americas, Jennifer Stahmer, Strategist, UBS Financial Services Inc., and Linda Mazziotta, CIO Investment Writer UBS AG Switzerland.