Source: UBS

In my previous Thought of the Week, I explained how Swiss investors with a strong equity exposure to the domestic market and a concentration in a few large-caps missed out on substantial returns over the past years. Due to this home market bias, they did not participate in developments in areas of global equity markets that have recently shown particularly impressive performance. This includes notably the technology sector and some specific life-sciences companies that developed new treatments for overweight individuals based on diabetes medications. Even Swiss investors heavily invested in the broad Swiss Performance Index, which comprises over 200 stocks, held only 2% exposure to the technology sector. In comparison, the market capitalization share of all technology companies in the global equity market is around 30%. And global tech stocks (MSCI World Information Technology Index) have gained 130% since 2020.

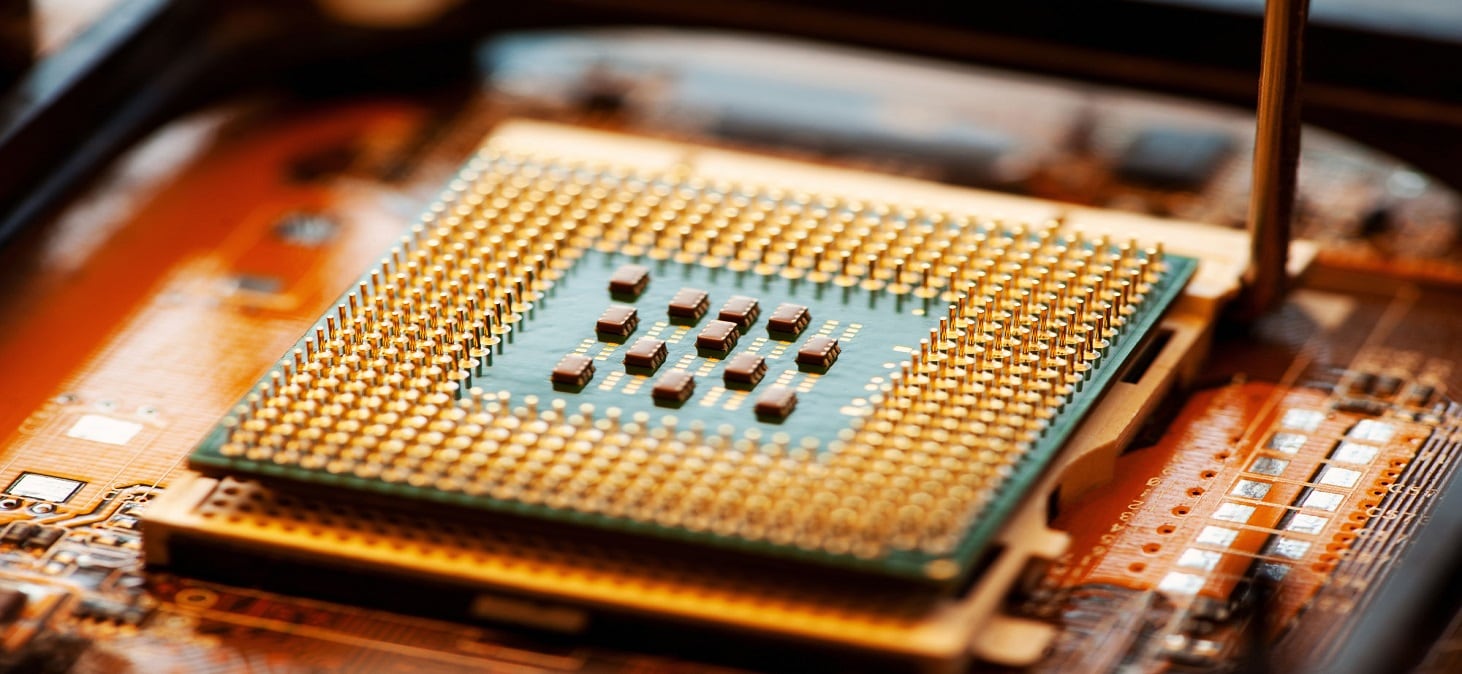

Recently, we published a comprehensive study titled “Artificial intelligence: Sizing and seizing the investment opportunity,” which focuses on the impressive developments in the field of artificial intelligence (AI). In it, we distinguish three levels of the AI value chain and recommend that investors align their engagements along these levels. Currently, the action in the AI sector is primarily happening at the foundational "Enabler Level"—the companies that provide the foundations for AI development, from semiconductor production to chip design, cloud and data centers, to companies involved in power supply.

Next up is the "Intelligence Level"—the companies that convert computing and energy resources from the Enabler Level into intelligence. This includes those who develop large language models, as well as companies that possess datasets that can be transformed into intelligence.

The third value creation level is the "Application Level"—the companies that embed tools from the Intelligence Level into specific applications. Currently, we believe the most promising application areas include copilots, coding assistants, digital advertising, call centers, and research and development in healthcare, cybersecurity, and fintech. We are convinced that an investment strategy focused on these value chain levels within the AI sector can offer return opportunities over a longer period. So, it is particularly important for investors who are otherwise more focused on the Swiss market to critically reassess and align their strategic allocation. Ideally, this should be done with a core investment in a broadly diversified portfolio across international markets and sectors. Those who want a specific focus on the promising technology sector can additionally implement this with satellite investments in select themes.

Please read the legal disclaimer applicable to this publication.