Investing in private markets

Taking the long-term view

What are private markets?

What are private markets?

Private markets are an umbrella term for assets that are not traded on public exchanges.

Why invest?

Why invest?

Private market exposure is an increasingly important part of global diversification and a key driver of wealth accumulation.

Our latest views

Our latest views

Find out about latest developments of the market and most interesting opportunities for investors.

The outlook for private market investments

Key investment takeaways

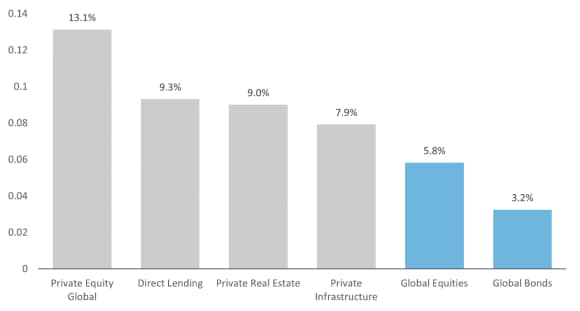

Private assets can play a key role in a long-term investment plan with benefits both in terms of potentially better risk-adjusted performance over traditional asset classes and enhanced diversification. In today’s market, we see good entry points across private market strategies.

In private equity, we would seek exposure to value-oriented buyout and secondaries funds, and themes such as software, health, education, and climate-related solutions, while leaving pure AI exposure to venture investors.

In private credit, pricing and yields look attractive, and return prospects for direct lenders have improved. We continue to see good potential for both direct lending and distressed/special situation funds.

Finally, we stay selective in private real estate while we continue to like infrastructure given government support and the asset class’ stable return and inflation-hedging properties.

Investing in private markets

Investing in private markets

We think it has become increasingly important for investors to consider exposure to private markets. In our view, private markets offer a combination of high potential returns, a long-term focus, and access to innovative and fast-growing businesses.

Investors should, however, keep track of the risks inherent to private markets. These include illiquidity, longer lockup periods, leverage, concentration risks and limited control and transparency of underlying holdings. While risks cannot be fully eliminated, it is possible to mitigate them through extensive due diligence and strict manager selection, and by diversifying across vintage years, strategies and geographies. See also the more detailed section on risks at the end of the page.

Twice a year, our Deep Dive – Private Market Outlook video series will update you on the latest developments in private equity and broader private markets, and where we see the best opportunities. Explore the latest video.

Three reasons for private markets now

- Lower valuations, increased focus on smaller deals and active ownership are driving opportunities in private equity.

- Private credit sees improved return prospects for direct lenders amid higher yields and improved negotiation on newly issued loans.

- The case for private real estate as a diversifier remains intact, but we remain selective and focus on assets with strong fundamentals such as logistics, multifamily apartments and data centers.

What are private markets?

Private markets are an umbrella term for assets that are not traded on public exchanges. Investors in private markets face a wide menu of options in terms of asset class, investment strategy, or mode of investment.

Private markets are still very much overshadowed by listed assets in scale. Assets under management for private equity are equivalent to roughly 5% of the value of publicly traded stocks. But private markets are gaining in popularity. While private market investments require investors to lock up funds for longer, they have historically been rewarded with higher returns.