Macro Monthly

The importance of bonds

We remain of the view that the US and global economy will be resilient and avoid recession over the coming months.

![]()

header.search.error

Macro Monthly

We remain of the view that the US and global economy will be resilient and avoid recession over the coming months.

Highlights

US Treasury yields recently reached their highest levels in over a decade across the curve as solid domestic data bolsters the outlook for a higher-for-longer interest rate environment.

Over the past two years, the US bond market has had to grapple with back-to-back negative shocks that had staying power: 2022 was the year of inflation surprises, when price pressures were consistently underestimated around the world; 2023 has been a year in which US growth has continuously exceeded expectations by a considerable margin.

We believe that the durability of the US economic expansion is still underappreciated, and we are positioned accordingly: overweight equities and preferring cyclical and inexpensive stocks. Our view is that markets are pricing in too much easing by the Federal Reserve in 2024 given the resilience in economic data.

Nonetheless, sovereign bonds are still a crucial component of balanced, multi-asset portfolios, even in a higher-for-longer environment for central bank policy rates. Compared to the October 2022 local peak in government bond yields, the tactical argument for holding duration is stronger now, in our view. And while elevated inflation has reduced some of the typical hedging properties of sovereign bonds recently, we believe that government debt will retain its place as the most effective source of portfolio ballast in the event of negative shocks to growth.

The third quarter of 2023 will probably prove to be the high-water mark of this mini-reacceleration in US economic activity. The Atlanta Federal Reserve’s real-time “nowcast” of quarterly growth has approached six percent. While real growth is unlikely to come in this strong, consistent signs of US economic strength have forced traders to increase the market-implied probability that interest rates stay higher for longer.

But at the same time, we are also getting evidence that the US labor market is cooling. Job openings have declined, and the private sector quits rate has fallen to levels seen in the final years of the pre-pandemic economic expansion. Importantly, the slowing in nominal aggregate income growth will result in lower nominal spending growth, in our view, reducing both inflationary pressures and real economic activity. Fiscal policy is also less supportive of growth than it has been, with consumer spending further dampened by dwindling excess savings among lower-income earners and the restart of student loan repayments. We are of the view that this will be a slow slowdown, especially as we think inflation will continue to fall faster than nominal incomes, cushioning consumer spending. But markets often react forcefully to shifts in the second derivative – in this case, growth staying positive, but at a less robust pace.

Macro updates

Keeping you up-to-date with markets

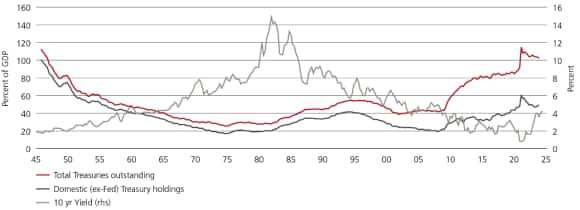

Certainly, other factors have played a role in pressuring bond yields to fresh cycle highs – most notably, larger than expected issuance plans for US Treasuries. While we acknowledge supply considerations can impact market pricing on a very short-term basis, history strongly suggests that cyclical variation in the economy will be the dominant driver of movements in government borrowing costs.

Outside the US, economic activity looks softer, with factory activity around the world stagnating and filtering through to a deceleration in services, as well. We still anticipate that a US-driven inventory restocking cycle should help put a floor under global manufacturing production and mitigate the potential for any broad-based retreat in services sectors. However, our expectations on the magnitude of this rebound have been tempered by the ongoing weakness in Chinese economic data. The measured policy support from Chinese policymakers to date is unlikely to serve as a meaningful reflationary catalyst for commodity prices or global activity, in our view.

The surge in inflation made price pressures not just a problem for safe assets like government bonds, but also a threat to the economic expansion and risk assets. High, accelerating inflation demands an aggressive central bank tightening campaign to cool demand. This attempt to dampen growth by significantly raising policy rates explains the positive correlation between stocks and bonds since 2022, as they have tended to rise or fall in tandem.

However, inflation is far from the only risk that can negatively impact returns. Growth shocks have historically been much more frequent than inflation shocks. Even as we see structural factors like fiscal policy, decarbonization, and deglobalization contributing to potentially higher trend inflation and inflation volatility going forward, protecting against declines in economic activity will remain a more common concern, in our view. After a slow start, the Fed has reasserted its credibility on inflation and for now we see little evidence to suggest monetary policymakers will allow inflation expectations to de-anchor.

Sovereign bonds have done a decent job of hedging during periods of relative underperformance in cyclical equities. In the event of more genuine evidence of economic softness, this negative correlation would intensify, in our view.

We continue to favor more cyclical parts of the US equity market, including mid-caps and the S&P 500 equal weight index, based on our expectation that growth will continue to be resilient even as inflation comes down. However, we are also cognizant that as activity moderates, it may at times be difficult for investors to have confidence that the economy will have a soft landing rather than a more pronounced downturn.

In our view, maintaining a neutral weighting on government bonds is an appropriate way to balance the potential that investors’ faith in the durability of the economic expansion may be shaken relative to our base case: decent US growth means that the amount of interest rate cuts expected by the market in 2024 is unlikely to be delivered by the Fed. In constructing robust portfolios for the long term, we have high conviction that allocations to government bonds will help smooth returns by remaining an effective offset at times when risk assets come under stress because the growth outlook has darkened.

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness as of 31 August 2023. The colored squares on the left provide our overall signal for global equities, rates, and credit. The rest of the ratings pertain to the relative attractiveness of certain regions within the asset classes of equities, rates, credit and currencies. Because the ACA does not include all asset classes, the net overall signal may be somewhat negative or positive.

Asset Class | Asset Class | Overall / relative signal | Overall / relative signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall / relative signal | Overweight | UBS Asset Management’s viewpoint | Robust activity increases odds that earnings grow, disinflation may support multiples. Prefer US equal weight. |

Asset Class | US Equities | Overall / relative signal | Overweight | UBS Asset Management’s viewpoint | Despite strong gains off the lows, equal weight index is not particularly expensive. |

Asset Class | Europe Equities | Overall / relative signal | Underweight | UBS Asset Management’s viewpoint | Funding US equity exposure out of Europe on soft manufacturing, stubborn inflation, and China weakness. |

Asset Class | Japan Equities | Overall / relative signal | Overweight | UBS Asset Management’s viewpoint | Still cheap after recent gains, solid earnings, corporate reform ongoing, Prefer to express in FX unhedged terms. |

Asset Class | EM Equities | Overall / relative signal | Neutral | UBS Asset Management’s viewpoint | EM outperformance still requires more China stimulus. Asia ex-China supported by tech goods rebound. |

Asset Class | Global Gov | Overall / relative signal | Neutral | UBS Asset Management’s viewpoint | Disinflation offset somewhat by resilient growth. Still decent carry and a useful hedge for recession risk. |

Asset Class | US Treasuries | Overall / relative signal | Neutral | UBS Asset Management’s viewpoint | Rates have repriced to reflect US economic strength, higher term premia. Now look more balanced. |

Asset Class | Bunds | Overall / relative signal | Neutral | UBS Asset Management’s viewpoint | Manufacturing weakness, bank stress but strong labor market and stickier inflation. |

Asset Class | Gilts | Overall / relative signal | Neutral | UBS Asset Management’s viewpoint | Still stubborn inflation, wages, but difficult for BOE to keep policy rate as high for as long as currently priced. |

Asset Class | Global Credit | Overall / relative signal | Neutral | UBS Asset Management’s viewpoint | Attractive all-in yields amid solid growth and disinflation. But limited room for spread compression. |

Asset Class | Investment Grade Credit | Overall / relative signal | Neutral | UBS Asset Management’s viewpoint | Narrow spreads means risk-reward confined to carry. |

Asset Class | High Yield Credit | Overall / relative signal | Neutral | UBS Asset Management’s viewpoint | Slight preference for IG versus HY. Moving up in quality in context of broader risk-on positioning. |

Asset Class | EMD Hard Currency | Overall / relative signal | Neutral | UBS Asset Management’s viewpoint | EMD attractive on decline in rate vol, higher real rates. Big divergence between EM IG and EM HY. |

Asset Class | FX | Overall / relative signal | - | UBS Asset Management’s viewpoint | - |

Asset Class | USD | Overall / relative signal | Neutral | UBS Asset Management’s viewpoint | Resilient US growth but disinflation offset to a broadly neutral USD. Bearish against high carry EM FX. |

Asset Class | EUR | Overall / relative signal | Neutral | UBS Asset Management’s viewpoint | Weak manufacturing beginning to bleed into services. Sticky high inflation keeps us neutral. |

Asset Class | JPY | Overall / relative signal | Overweight | UBS Asset Management’s viewpoint | JPY is cheap vs. USD and the BoJ is beginning to tighten. Safe haven JPY a good hedge against recession. |

Asset Class | EM FX | Overall / relative signal | Overweight | UBS Asset Management’s viewpoint | Not too hot, not too cold economy is good for carry. Prefer MXN & BRL. |

Asset Class | Commodities | Overall / relative signal | Neutral | UBS Asset Management’s viewpoint | Resilient demand, positive supply surprises may have run their course. Requires stronger China for more upside. |