4Q Quarterly Investment Forum

Quarterly Investment Forum: Finding solutions in a low-yield world

In an environment of lower expected returns across publicly-traded risk assets, the time is now for investors to expand investment horizons.

The four-decades long rally in developed market sovereign bonds has created diversification and income generation difficulties for investors going forward. COVID-19 exacerbated this development, as annualized expected five-year returns for sovereign bonds flipped from positive to negative over the past year, according to our latest capital market assumptions.

The outlook for a traditional 60/40 portfolio has dimmed, with geometric returns over the next decade poised to shrink to 5% relative to 7% over the past 10 years. This makes it more urgent than ever for investors to explore options to sustain higher returns and augment diversifying assets beyond developed-market sovereign bonds. Asset management as a whole has a wide range of solutions to address these problems. Including alternative assets, allocating to hedge funds, adding Chinese bonds to the fixed income portfolio, utilizing macro-aware liquid diversifiers, and adopting volatility and risk control strategies are some of the key ways investors can achieve a better risk/return profile going forward.

The discussions at this Quarterly Investment Forum serve as an overview of a series of papers from UBS Asset Management further detailing how you can upgrade your asset allocation amid this challenging low-yield environment.

Fixed Income

Fixed Income

Jonathan Gregory, Head of Fixed Income UK, Senior Portfolio Manager

Charlotte Baenninger, Head of Fixed Income, President of UBS Asset Management Switzerland

Embracing flexibility and freedom will be essential given the low starting point for bond yields. Typical benchmarks may lock in some of the negative aspects of the asset classes, such as duration risk and portions of the market guaranteed negative hold-to-maturity returns.

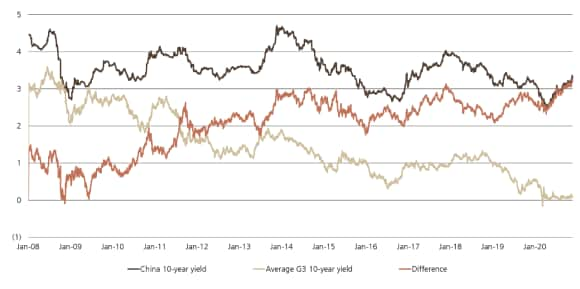

We believe that adopting a total return approach targeting an overall volatility level is preferable. Chinese debt stands out as particularly attractive. Foreign demand is poised to increase as it remains under-owned by most global investors, especially as these bonds are included in more benchmarks. Since directional strategies in bonds are unlikely to post the same returns as in the past, relative value positions are likely to become a more important driver of success in this asset class. So too will active selection in credit markets given the degree of spread compression from the 2020 wides.

Chinese government bonds are structurally attractive

Chinese government bonds are structurally attractive

Substantial 10-year yield premium relative to G3 average

Equities

Equities

Patrick Zimmermann, Head of Quantitative Investments

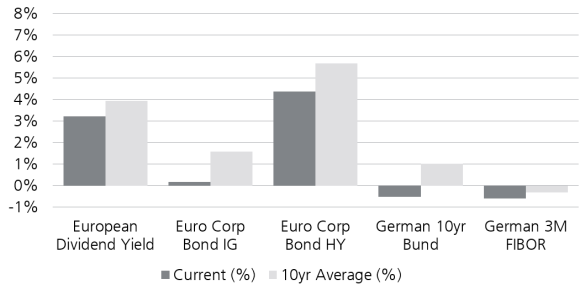

Within equities, investors have multiple levers to pull to generate income: dividends, buybacks, and covered call strategies. Dividend-oriented equities remain attractive relative to history, and allow for income and capital appreciation. A focus on quality criteria like profitability and low financial leverage may help ensure that yield generation is sustainable with the potential to grow over time.

Cumulative cash positions are re-approaching peak levels, which should allow buybacks to resume their role as an attractive source of income in the year ahead. Covered call strategies provide a source of income that buffers portfolios during prolonged corrections or sideways trading, while putting a ceiling on gains. Dynamic strike setting – adjusting the moneyness of the strike to attain a predefined level of yield – can allow investors to participate more fully in any equity market rebounds from a period of market volatility, offering an improvement compared to a more static approach.

Equity dividend yield remain attractive

Equity dividend yield remain attractive

As of 30 September 2020

Real assets

Real assets

Joseph Azelby, Head of Real Estate and Private Markets (REPM)

Opportunities in real estate and infrastructure offer inflation protection as well as a yield quite in excess of what is available in the bond market. The complexity and illiquidity of real assets warrants a premium relative to public investments, and the magnitude of this premium is currently elevated.

For active managers, there is powerful profit potential in some pockets of the real estate market. Lingering uncertainty surrounding COVID-19, which is poised to dissipate over time, creates a window of opportunity as uncertainty has pushed capitalization rates higher and interest rates lower. In infrastructure, alternative energy and telecom initiatives are preferred activities. Low interest rates, the proximate cause of this challenging income outlook, actually benefits managers in real assets by incentivizing the use of leverage to increase returns.

Hedge fund strategies

Hedge fund strategies

Chris Bae, Head of Trading & Quantitative Strategies

Kevin Russell, CIO, O’Connor

Hedge funds are prized for their ability to deliver consistent, bond-like, but uncorrelated performance. Utilizing a broader set of instruments such as Fra-OIS swaps, cross currency basis swaps, and forward rate agreements, can both create income without extending duration and provide downside protection during equity market selloffs. Such strategies have proved quite effective over the past three years.

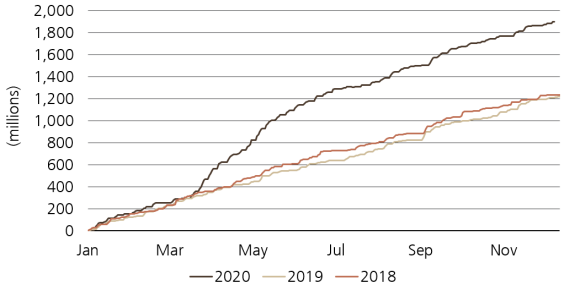

Many investors are also viewing multi-strategy hedge funds as a substitute for high-yield exposure. Relative value trades in credit following the deluge of issuance in 2020, an emerging “golden age” for long-short strategies in China, and exploiting inefficiencies in the swelling SPAC market are poised to be key alpha drivers going forward. The fertile ground in these market segments should allow multi-strategy hedge funds to extract excess returns that are lower than equities, but with much lower volatility, and superior to fixed income.

Record year for credit issuance

Record year for credit issuance

US IG Issuance year-to-date

US IG Issuance year-to-date

US HY Issuance year-to-date

US HY Issuance year-to-date

Converts Issuance year-to-date

Converts Issuance year-to-date