Our expertise

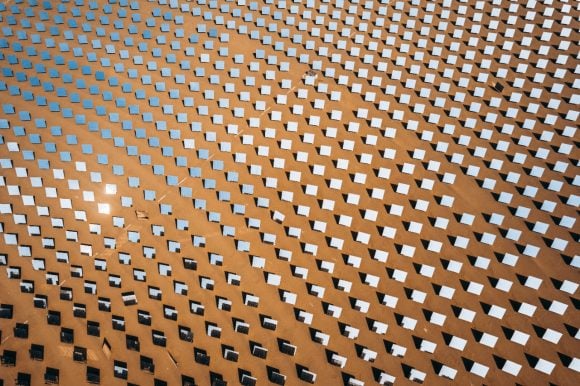

The world is changing at a rapid pace and structural forces of change such as population growth and aging, urbanization, technological advances, resource scarcity, and societal changes are all reshaping our future.

Zoom out and cut through the short-term noise: our thematic framework is aimed at gaining from secular trends, so that investors can unlock long term investment opportunities.

Our experienced teams focus on identifying exciting and attractively valued companies that are at the cutting edge of innovation.

What sets us apart

Investing for tomorrow

Our thematic products are forward looking and supported by powerful megatrends, whereas traditional investing is often based on current market values and past winners.

Diversify away from traditional benchmarks by focusing on potential future winners.

Access to early-stage companies

Innovative companies that can adapt to megatrends and evolving demands by developing new products and services stand to benefit from significant growth potential. Our investable companies are defined by their exposure and level of purity to the theme. We offer both pure-play1 and blend solutions to give investors an opportunity to gain from more focused or broadly diversified exposures.

Subject matter experts

Our investment teams focus on specific themes and market niches. As a result, they become experts in their areas of competence.

We interact with industry leaders and academics while conducting our bottom-up, propriety research based on company fundamentals to find innovative growth opportunities.

Thematic investing at UBS Asset Management

Our pure-play range

Learn about our pure-play approach to investing and discover our suite of strategies that offer focused exposure to exciting themes shaping the future.

Find out more

Funds in your market

Risks

- Diversification is no guarantee against loss. All investing involves risk including loss of principal. Investors may lose part or all of their invested amount.

- Equity markets can be volatile. Investors may lose part or all of their investment.

- A focus on specific themes can lead to significant sector, country, and regional exposure.

- Sustainability and ESG (Environmental, Social, Governance) considerations may have adverse impacts on stock price performance.

- In cases of significant inflows or outflows, there may be a disparity in the value date between stocks from different countries, which can result in unintended short-term currency exposures.