Embracing infrastructure opportunities

Infrastructure allocations gain momentum as investor interest grows

![]()

header.search.error

Infrastructure allocations gain momentum as investor interest grows

Infrastructure's youth underpins growth in allocations

The rise in infrastructure assets under management (AuM) has been driven more by internal growth in unrealized value in recent years, as opposed to the growth in dry powder. Challenging fundraising conditions throughout 2023 and 2024, against a backdrop of a resurgent deal market, have seen dry power stocks fall 12%1 over 2024. While fundraising has more recently picked up, returning to a record pace in 1H25, longer-term growth in fundraising inflows is fundamentally a function of investor allocations.

Drivers of investor allocations to different asset classes vary, with the inflation hedge offered by infrastructure a key attraction. More broadly, and in the longer term, drivers for investors include risk-return expectations, anticipated liquidity needs as well as regulatory constraints. Unlisted infrastructure, as a distinct asset class, is still relatively new, having emerged after 2000 as privatized industries and project finance vehicles created opportunities for new sources of potential returns for institutional investors.

Allocations – a moving target

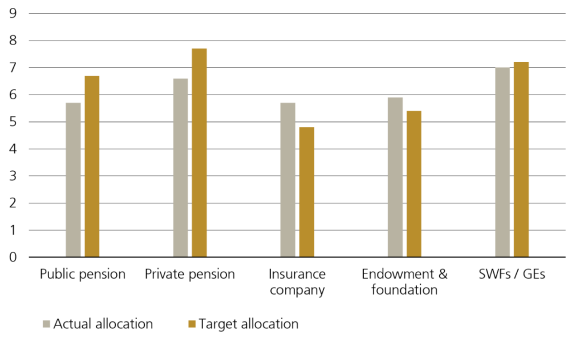

Managers closely monitor investors’ stated allocations as potential indicators of where they might source capital commitments. Various data sources offer slightly different perspectives on the broad landscape. Hodes and Weill Associates conduct an annual survey of major institutional investors regarding infrastructure allocations. Their latest survey suggests that the main types of institutional investors’ target allocations range from 4.8%2 of AuM for insurance companies up to 7.7% for private pension funds, based on a weighted AuM measure.

However, investors are not always fully allocated at their target levels, with actual allocations reported to be around 100 basis points below the 5.9% average target. This gap has narrowed compared to the previous year, when allocations were around 120 basis points below the 2024 average target of 5.5%. The relative youth of the infrastructure asset class aligns with the survey’s finding that 56% of investors report being under allocated, as targets have continued to rise.

Strong growth in infrastructure allocations

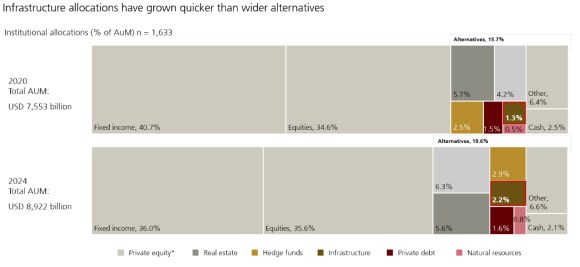

The data on the growth of allocations over time can be difficult to determine. Survey respondents may change over time, making results a less reliable indicator of growth rates. In their recent allocations report, Preqin addressed this by focusing on a fixed group of investors who consistently provide full asset allocation details over time. At the top level, this analysis of 1,633 investors, representing USD 8.92 trillion in AuM in 2024, showed that broad allocations to alternatives increased by 3.9 percentage points, from 15.7% in 2020 to 19.6% in 2024.3

For infrastructure, this sample started off with a lower allocation of 1.3%, compared to the average figures mentioned above. However, infrastructure allocations among this group grew the fastest of all asset classes, reaching 2.2% in 2024 – an increase of 76% in just four years. Alongside the increase in AuM for this group, their overall invested capital has more than doubled over the period.

Performance underpins attractiveness

The strong relative performance of infrastructure in recent years has attracted the attention of investors, particularly those who have yet to seek exposure to private infrastructure’s risk/return profile.4 Macquarie, one of the largest infrastructure fund managers, conducted a strategic asset allocation study early last year to model potential optimal allocations across a range of asset classes based on long-term historical performance.5 This study unsmoothed raw private market performance data – this accounts for the fact that less frequent private reporting may artificially lower volatility, allowing a more accurate comparison with public markets. The results suggest that optimal allocations to private infrastructure lie between 7.8% for an investor looking to minimize overall portfolio volatility, up to 9.5% for a mean variance optimization targeting maximum risk adjusted returns (see Figure 3).

Continued positive sentiment

The strong rebound in fundraising saw 2025 deliver a record annual capital raised in final closes – this aligns with evidence suggesting investor sentiment in the asset class is leading across alternatives. Preqin’s short-term commitment intention index, which measures the net balance between investors planning to raise, maintain or reduce short-term commitments, indicates that infrastructure is currently the most favored asset class in the near term, even ahead of private debt (see Figure 46– above 50 suggests expansion, while below 50 indicates contraction). However, this sentiment should be taken with a pinch of salt, given that infrastructure has maintained a net positive balance of commitment intentions for more than seven years, despite 2023/24 fundraising activity being weaker than in other asset classes.

Over the longer term, allocations appear to be clearly rising, as shown by a variety of alternative measures. This trend could lead to stronger inflows, which would help to replenish dry powder and further support a deal market that has recovered strongly from the impact of higher interest rates. Investors with higher current allocations could stand to benefit if exits improve via increased demand for exposure to this growing part of the alternative markets.

Want more insights?

Subscribe to receive the latest private markets perspectives and insights across all sectors directly to your inbox.