Conversation with Kevin Russell — Key alpha drivers and opportunities

CIO at UBS O’Connor, Kevin Russell takes a look at the key drivers to the attractive alpha environment and identifies potential opportunities for 2021 and beyond.

China has been a priority for O’Connor for the past few years, how has the news flow and market moves over the past several months impacted your approach to China?

China has been a priority for O’Connor for the past few years, how has the news flow and market moves over the past several months impacted your approach to China?

Chinese equity markets attracted attention following their strong performance amid the pandemic. But more recently, the changing regulatory landscape has caught many investors by surprise and has led to a broad de-risking in Chinese equities, with the CSI 300 among the worst performing equity indices in 2021.

Investors are debating whether China will abandon its market-oriented reform policies in favor of a more aggressive regulatory regime as evidenced by recent policy changes in education, internet and the consumer space.

We are firmly of the view that China will strike the right balance between these opposing approaches to reform and view the market changes over the past several months more of an opportunity than a risk for investors.

Our core approach to China has been to align portfolio positions with our view of the regulatory agenda and to focus on China transitioning from a beta story to an alpha story for investors. Following these simple principles has served investors well, particularly over the past several months.

We are not at all shying away from China and continue to see it as the one of the largest alpha opportunities in the global financial markets.

Kevin Russell is the CIO and Global Head of O’Connor.

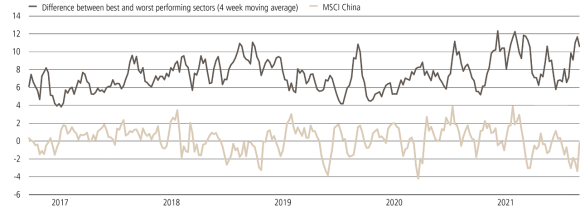

Exhibit 1: Dispersion in Chinese stock sector performance

Exhibit 1: Dispersion in Chinese stock sector performance

Somewhat lost in all the market commentary and anxiety about Chinese equities has been the enormous dispersion of performance across segments of the market with companies driving China technology independence and the energy transition meaningfully outperforming internet, education and consumption stocks.

O’Connor has commented a lot about inflation and it's impact on sector and factor performance within equity markets. Where do you see this debate and positioning right now?

O’Connor has commented a lot about inflation and it's impact on sector and factor performance within equity markets. Where do you see this debate and positioning right now?

The evolving timeline for the Fed to begin tapering and the spread of COVID variants have kept interest rate volatility, and by extension equity factor volatility, elevated a bit longer than expected into the third quarter.

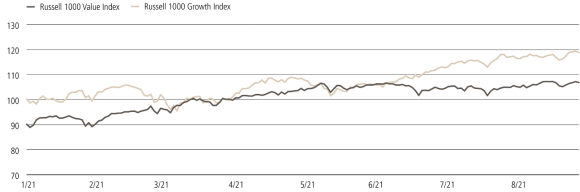

Exhibit 2: Growth and Value factor rotation in 2021

Exhibit 2: Growth and Value factor rotation in 2021

We continue to think that the frenetic rotations between growth and value that characterized the first three quarters of 2021 will dissipate into the end of the year and allow thematic and idiosyncratic performance drivers to retake the focus of investors. Against this backdrop, many of our equity teams are focusing on companies that offer a GARP (Growth at a Reasonable Price) profile, which we think have gone underappreciated by investors in this obsession between growth and value.

Credit markets have seemed quiet, what should investors be looking at there?

Credit markets have seemed quiet, what should investors be looking at there?

Credit markets have indeed been quiet, with spreads grinding tighter and seeming immune from the inflation anxiety that has beset equity markets.

Although we have seen good performance in capital structure driven trades and continue to monetize liability management opportunities in the credit markets, our credit team has been spending a lot of time on the working capital segment of corporate credit.

We see this as a big frontier of value and opportunity as the operational complexity and recent challenges of several market participants have kept many investors on the sideline, creating a compelling relative value opportunity for those who understand the market and ecosystem.

Working capital finance offers larger yields, shorter duration and seniority relative to bonds, and we believe that this will likely be a structural market opportunity for the next several years that investors should follow more closely.