Equities in a shut-down?

The lasting changes caused by the pandemic

The surge in equity market volatility during the current COVID-19 crisis is indicative of the overwhelming uncertainty and fear investors are feeling. This environment creates tremendous opportunities, but diligence and adherence to a well-defined investment process is key. In this market, there is no substitute for seasoned judgement and experience.

Webinar key takeaways

Webinar key takeaways

- The equity market downturn during the first quarter was one of the quickest sell-offs in history and has resulted in wide price differentials between different stocks and sectors. This creates investment opportunities for active investors.

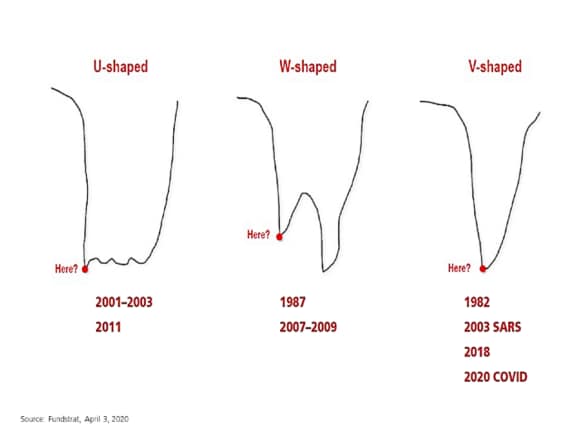

- While there remains a high degree of uncertainty, the pathway to a recovery from the pandemic is beginning to take form. If the economy is able to gradually begin opening back up within the next two months we should see a quicker recovery. Markets have started to recover from very depressed levels and Equities should continue to provide strong long term returns

- We believe that many business sectors at the 'epicenter' of the downturn will be the slowest to recover. In this case, we believe consumer services will take longer to recover.

- The social distancing measures put in place to slow the spread of the coronavirus have accelerated some ongoing trends which will create winners and losers.

- We expect companies involved in cashless payments, online shopping and virtual or remote work will do well during the recovery, while department stores and travel related businesses will have more trouble.

Ian McIntosh, Head of Active Equities

Ian McIntosh, Head of Active Equities

The equity market downturn during the first quarter was truly shocking, one of the quickest sell-offs in equity market history. In the US, this resulted in a 20% performance differential between small-cap and large-cap stocks.

One explanation may be that small-cap companies tend to have much more leverage; more so in the US than in Europe.

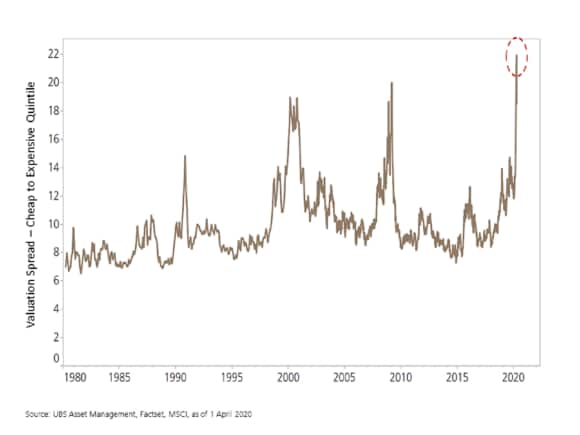

The valuation dispersion from the cheapest quintile of the market to the most expensive is higher than during either the 2000 tech bubble or the 2008-2009 Financial Crisis.

The speed at which valuation spreads widened over the last month was remarkable. This underscores the headwinds that currently exist for value investors, and also the opportunity on a forward looking basis.

Our base case

Our base case

The roadmap to recovery from the current crisis has three phases. Phase 1, which we are in now, is slowing the spread of COVID-19. Phase 2 is the gradual reopening of the economy and the relaxation of controls. The final phase is relaxing controls completely, once a vaccine is available.

Our base case at this stage is that we'll see a movement to the gradual reopening of the US economy in the next 2 months. Equities have provided positive long term returns over all rolling ten year periods, and setbacks have provided good entry points, as we believe to be the case this time.

The consensus long term is bullish for equity markets. Never bet against equity markets over the long run.

Maximilian Anderl, Head of Concentrated Alpha Equity

Maximilian Anderl, Head of Concentrated Alpha Equity

The 'epicenter' of this crisis is concentrated in the service sector, which historically is more stable, but which is being hit hard by social distancing measures.

Small business owners and the self-employed, such as dentists, lawyers, coffee shops, and restaurants for example are hit the hardest. But the positive to this crisis is the support from central banks, which has come very early compared to the Financial Crisis of 2008-2009 and amounts to about 3% of global GDP, much of it aimed at small business.

The increase in commercial loans is one example of the extraordinary support. We do not think this time we will have the same systemic consequences, unlike during the Financial Crisis.

Where to invest for the recovery

Where to invest for the recovery

One example of how a recovery might look is already here, as recovery is already underway in China.

Economic activity there, which generally drops during the Chinese New Year, usually bounces right back after the festivities end.

The New Year drop was substantially prolonged this year due to the pandemic, but as China gets the virus under control, the economy has begun to come back, with about 80% of sectors recovering relatively quickly. The other 20% will take some time.

We see signs that the crisis has accelerated trends that already existed, which has implications for investors.

The movements from offline to online services, shopping and cashless payments are getting a boost as more people were forced to move to digital providers during the pandemic. The success of remote work may slow the recovery of travel-related sectors.

For investors who are absolute return, lower risk oriented consumer staples and healthcare will offer yields and we think these companies will perform better than cash and bonds. On the more risk-taking side that seeks to outperform benchmarks, we consider quality cyclicals that have been hit hard as worth considering, from semiconductor equipment to software providers and cloud operators, healthcare equipment.

We also see opportunities in value but prefer operationally geared companies to financially geared companies, which means cyclical characteristic companies with either a good balance sheet or that are very stable. New facets of sustainability, in terms of self-sustainability, medication, drugs, masks, etc. will become more important going forward.

Peter J. Bye, Portfolio Manager / Senior Investment Analyst

Peter J. Bye, Portfolio Manager / Senior Investment Analyst

There are a myriad of forms this crisis and recovery can take, and we need to understand how each of them can play out. Investors can learn valuable lessons from former US Defense Secretary Donald Rumsfeld's famous comment about how his team examined intelligence, "There are known knowns. There are things we know we know. We also know there are known unknowns. That is to say, we know there are some things we do not know. But there are also unknown unknowns, the ones we don't know we don't know."

In times of uncertainty, always be mindful of keeping sight of your process. What are good returns? What has a defensible model? What is sustainable? What is substitutable and what is essential? Those are the kinds of things we are dialing in on.

How are we approaching the current crisis?

How are we approaching the current crisis?

We use a similar approach to dealing with any market crisis. Our first job is to quantify the 'knowns' and 'unknowns,' using a variety of data in addition to financials.

For example, real time data ranging from web traffic to credit card transactions from our Quantitative Evidence and Data Science team has been helpful in giving us a clearer picture of what is changing, and to determine which changes are transitory and which are secular.

We see remote working, e-commerce, telemedicine as secular changes that were already happening but are accelerating due to the crisis. This helps us develop the opportunity set, while being mindful of following our core investment process.

Avoid the crisis epicenter

Avoid the crisis epicenter

Among the 'known knowns,' are the lessons we learned from previous crises. One big lesson is to avoid the 'epicenter' of the crisis. After the 2000 tech bubble, it took 15 years for tech stocks to revert back to their 2000 highs.

But within that segment, quality growth names were much quicker to recover. We saw the same pattern with financial stocks, the epicenter of the Financial Crisis of 2008-2009. Financial ETFs recovered their pre-crisis level just last year, but even within financials, some did much better than others.

In this crisis, the consumer segment is most exposed and appears to be the epicenter, though that could evolve into financial and some part of industrials, depending on the duration of the crisis. And again, we expect some areas within the epicenter to recover more quickly than others.

In the post-COVID-19 world, we like four themes:

- Digital transformation. This was a top corporate priority before the crisis and will emerge as an even stronger priority. This includes cloud infrastructure and e-commerce.

- Health care. This includes biotech, medical technologies and laboratory research. So-called 'elective' medical procedures such as cosmetic surgery will resume and we see opportunities in oversold medical technologies.

- Consumer. As the epicenter of the crisis, the recession will deal a critical blow to marginal players, but durable IP and brand power should allow some 'storied' companies to prosper.

- Fintech. Companies connected to the digitization of money. For example, merchant acquirers and the trenches of the payment systems we see opportunities all around there.

Q&A

Q&A