The gravity shift in asset allocation to China

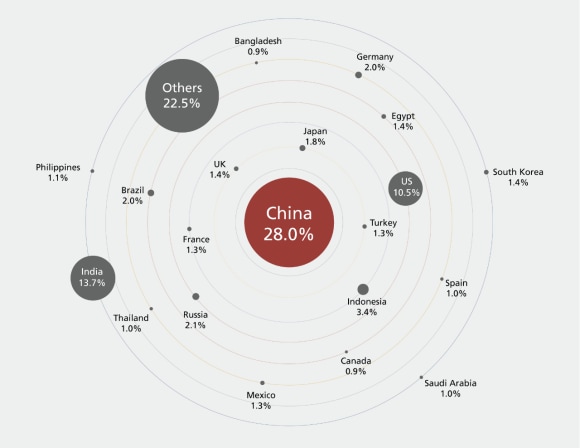

If the world economy is a solar system, then China is at the heart of it. What does it mean for asset allocators?

Global allocation shift to China

Global allocation shift to China

- If the world economy is a solar system, then China is at the heart of it;

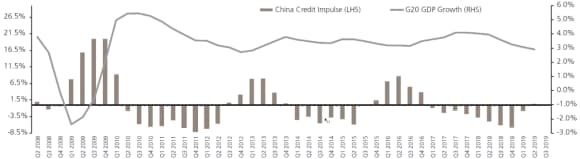

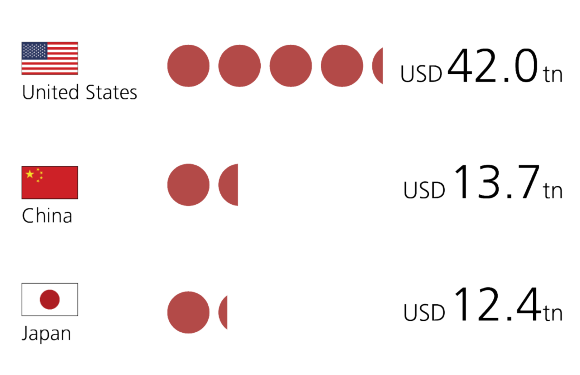

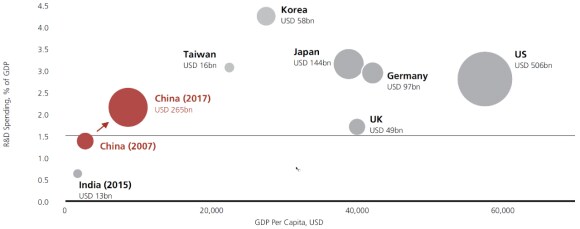

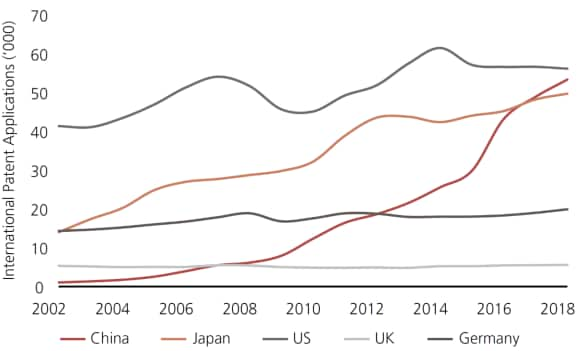

- Global monetary policy, consumer demand, and tech innovation are three of many fields where China's influence is profound and wide-ranging;

- China is the source of a wide range of investible trends that are changing the world we live in;

- A dedicated strategy to China is no longer a 'nice to have' as it offers investors greater potential to participate in China's growth story.

A dedicated China strategy is no longer a "nice to have"

A dedicated China strategy is no longer a "nice to have"

A dedicated strategy for China

Barry Gill, Head of Investments, talks about how opportunities in China for asset allocation

China/US tech race

Bin Shi, talks about China/US tech race. Watch here

Need to learn more?

Need to learn more?

Create your dedicated China allocation strategy

A standalone allocation offers investors greater potential to be part of China's growth story. Choose your starting point below.

Go multi-asset for China

Onshore or offshore assets? Equities or fixed income? RMB or USD?

Consider All China equities

China A or H stocks? Tap into the high growth sectors in both markets

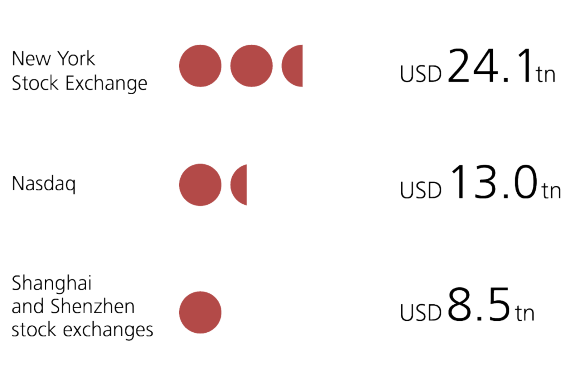

Think China bonds

Are you missing out on the world's 2nd largest bond market?

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.