Apprenticeship at UBS

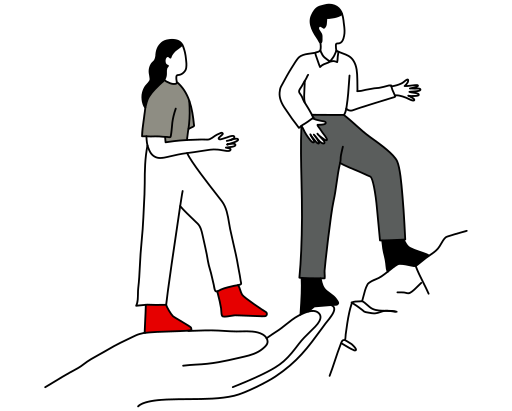

As one of the largest private sector trainers, we follow through on our words for successful lifelong learning. Today and tomorrow.

What is our goal?

At UBS, we place great importance on nurturing young talent and providing them with top-notch training. Today and tomorrow, we believe in education with a future. Our aim is to provide our apprentices with the best possible foundation for a successful career.

How do we achieve it?

Our training programs are specifically designed to offer our apprentices comprehensive and hands-on experience. We believe that our apprentices learn best when actively involved in real projects and can learn from experienced colleagues. Therefore, we give them the opportunity to work in various areas and gain valuable experience.

What lies ahead?

The development opportunities at UBS are endless and flexible.

Valerie, Banking Apprentice

With the IT apprenticeship you are well prepared for the professional world!

Jeremias, IT apprentice

I surpass myself every day!

Michèle, BEM Trainee

Everything that is created is used

Mike, Mediamatics apprentice

Are there career opportunities at UBS after completing the training program?

Yes, UBS places great value on promoting and developing its apprentices. After completing the training program, various career opportunities and further education possibilities within the company are available. Many apprentices transition to permanent positions at UBS or deepen their expertise through our 2-year Junior Talent Program (JUNA).

Throughout the entire training period, our apprentices are accompanied and supported by our vocational and practical instructors.

1. Online application

1. Online application

2. Review of your documents

2. Review of your documents

3. Personal interview

3. Personal interview

4. Welcome

4. Welcome