Long-term investing Invest in long-term themes with innovative investment ideas

Our experts have put the megatrends of tomorrow into a new investment fund offering an attractive investment opportunity.

The global markets are facing big challenges. Three major megatrends are looming between now and 2050:

Population increase

- The world's population will rise to 10 billion by 2050 from the current 7.3 billion.

- This growth will take place primarily in lower or middle income countries.

Urbanization

- People will continue to move from the countryside to the cities.

- By 2030, about 9% of the world's population will live in 41 megacities, each with a population of more than 10 million.

Aging

- The world's population is getting older. Population growth is concentrated in emerging and developing countries.

- By 2030, there will be more people over 60 than under 25 in the industrialized countries.

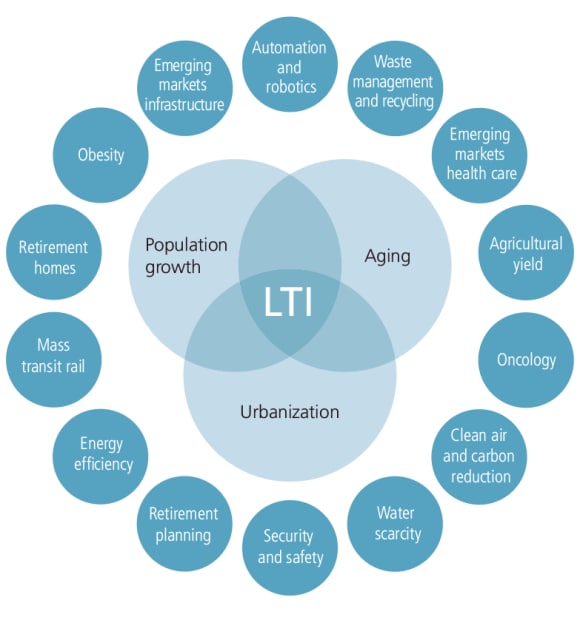

The new UBS investment fund for long-term investing takes up these megatrends and invests for a better future: in themes for which companies are offering solutions for the challenges of tomorrow. We combine valuation and risk analyses with our sustainability rankings. This combination makes the fund unique. Together with our team of experts throughout the world, the Chief Investment Office (CIO) has defined 14 themes with an innovative character and long-term focus. Our investment fund brings together issues of the future such as robotic technology, energy efficiency and water scarcity.

Features of the fund

- Investment themes: investments focused on three megatrends with up to 14 investment themes.

- Portfolio structure: 40-80 global stocks diversified by themes, countries and sectors.

- Hedging: local currency exposure is not hedged.

Key benefits

- Future: investments in companies that have solutions for the challenges of tomorrow.

- Team: close cooperation between the Chief Investment Office (CIO) and Asset Management.

- Diversification: optimization of the risk profile thanks to allocations across several themes.

- Simplicity: easy access to the long-term ideas of the CIO.

- Sustainability: the fund portfolio has a robust sustainability profile.

Risks

- Fluctuations in value: because the value of the fund could be subject to major fluctuations in value, a minimum investment horizon of five years is required.

- Performance: the active management style means that the fund's performance could differ considerably from that of the benchmark index.

- Derivatives: the use of derivatives could cause risks.

- No hedging: exchange rate fluctuations may impact the value of the fund.

These risks require risk tolerance and risk capability.

Are you interested in a long-term investment in sustainable, innovative and future-oriented themes? Are you attracted by opportunities to invest in interesting companies with growth potential? Invest with us for a better future! With UBS Manage or UBS Advice you can benefit from our tailored solutions – for long-term investments as well.

Financial Personality Test

Financial Personality Test

If you want to find the right investment strategy, it’s important to assess your risk tolerance correctly. That’s where the UBS Financial Personality Test comes in.