The Cantonal Competitiveness Indicator (CCI) reveals where the regional conditions for future economic growth are currently most promising. The current issue also examines the export dependency of the cantons and highlights their economic resilience to external shocks.

Results

Results

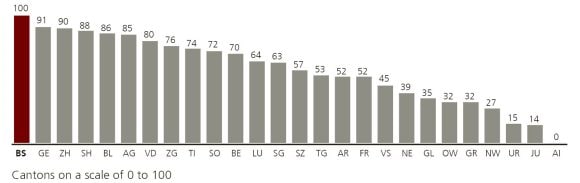

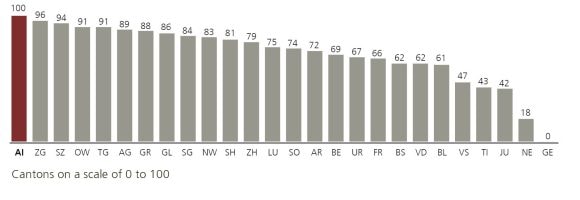

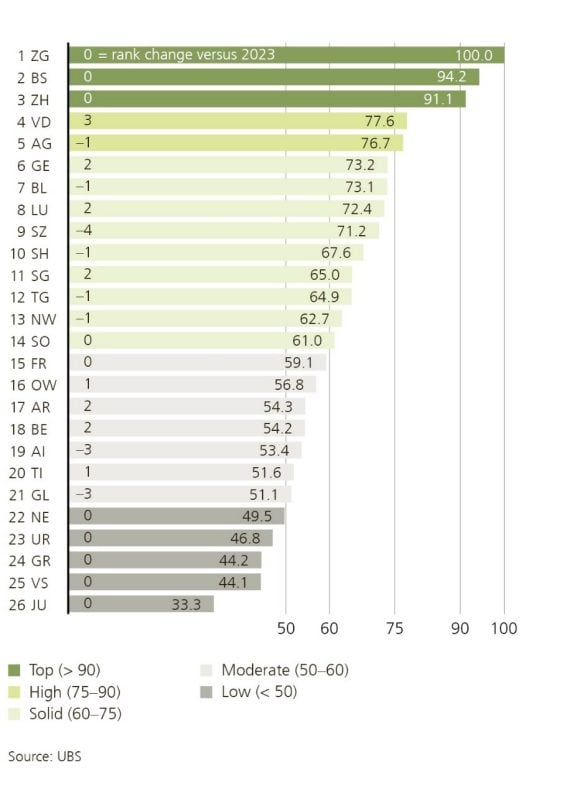

According to the Cantonal Competitiveness Indicator (CCI) 2025, the canton of Zug demonstrates the highest long-term competitiveness among all Swiss cantons. Basel-Stadt ranks second, with Zurich completing the top three. Vaud and Aargau also exhibit high competitiveness, albeit at a clear distance from the leading group. The broad midfield comprises nine cantons with solid growth prospects, lModerate competitiveness is observed in seven cantons. In the mountain cantons of Uri, Graubünden, and Valais, as well as in Neuchâtel and Jura, long-term growth prospects are assessed as comparatively low relative to the other cantons.

Vaud and Geneva on the rise

Vaud and Geneva on the rise

Compared to the previous edition of the CCI from 2023, the growth prospects of the cantons of Vaud and Geneva have improved significantly—they have gained three and two places respectively. Ticino has also advanced by one position. In German-speaking Switzerland, notable progress was observed in Lucerne, St. Gallen, Appenzell Ausserrhoden, and Bern. These improvements are contrasted by relative declines, particularly in the cantons of Schwyz, Glarus, and Appenzell Innerrhoden.

The most significant changes in long-term growth prospects are attributable to developments in the labor market and cost environment. dimensions. The aging of society will lead to a greater shortage of skilled labor in the coming years. Despite persistently high immigration, the working-age population in certain cantons is expected to decline over the next few years, which will negatively affect their competitiveness. Tax competition has lost some significance due to the OECD minimum tax. For the majority of companies, however, tax differences have hardly changed. A supportive tax environment will therefore remain important when assessing the attractiveness of a canton’s location.

Cantonal Competitiveness Indicator 2025

Cantonal Competitiveness Indicator 2025

Economic resilience in the face of rising tariffs

Economic resilience in the face of rising tariffs

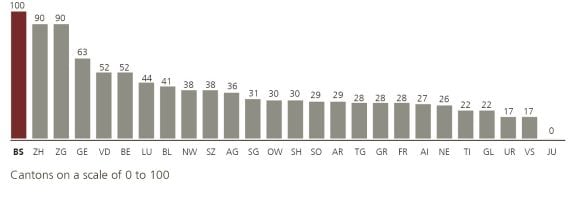

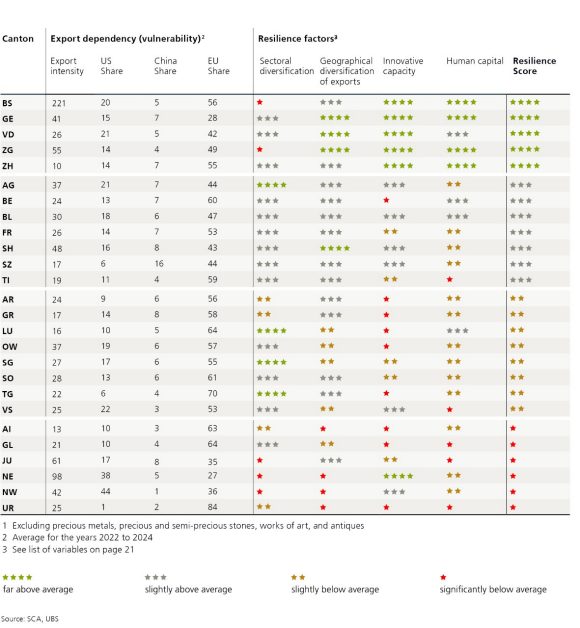

In addition to the long-term outlook, the current CCI also examines the export dependency of the cantons. Globally, industrial policy is experiencing a renaissance, accompanied by growing protectionism – most recently evident in the country-specific tariffs imposed by the US government. Stricter tariff measures pose a significant risk, especially for export-oriented cantons. The cantons of Nidwalden and Neuchâtel are particularly affected by US import tariffs, as 44 and 38 percent of their exports, respectively, are destined for the USA.

However, broad sector diversification, globally distributed exports, high innovative capacity, and well-educated human capital can strengthen the adaptability of the cantons. The highest resilience to trade barriers is found in the cantons of Zurich, Vaud, Geneva, Zug, and Basel-Stadt. Among these cantons, however, Basel-Stadt could face particular challenges in the short term due to its focus on the export-dependent pharmaceutical sector. In comparison to other cantons, Appenzell Innerrhoden, Glarus, Jura, Neuchâtel, Nidwalden, and Uri have only limited resilience to trade barriers.

Export dependence and resilience to tariffs and trade barriers; by canton

Export dependence and resilience to tariffs and trade barriers; by canton

Sorted by resilience score (cantons within the same score listed in alphabetical order); export intensity: exports¹ as a percentage of cantonal GDP; export shares in percent; resilience factors according to CCI.

The eight pillars of competitiveness

The eight pillars of competitiveness

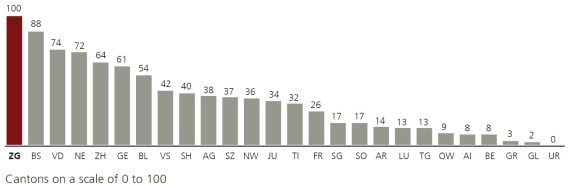

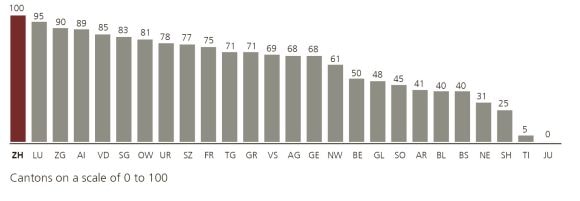

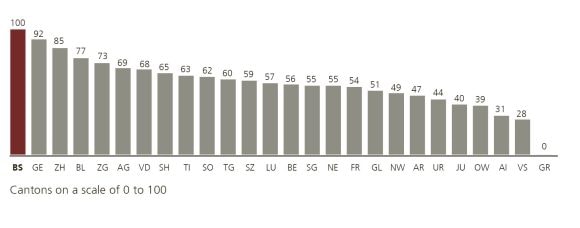

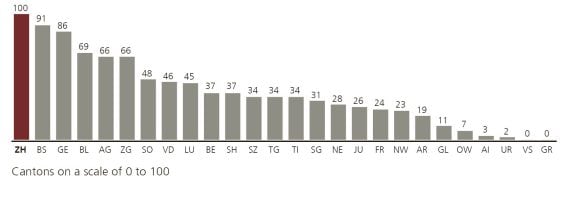

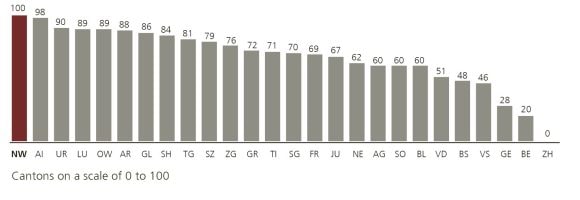

The Cantonal Competitiveness Indicator covers 57 individual indicators of cantons’ competitiveness. The individual indicators are grouped into eight competitive pillars: Economic structure, innovation, human capital, labor market, accessibility, catchment area, cost environment and government finances. For each competitive pillar, cantons are given a relative score between 0 and 100.