A Year of Inflections

Year Ahead 2023

Welcome

Year Ahead 2023

Navigating inflection points will be key to investment success in the year ahead. It will be our challenge and privilege to help guide you through them. We thank you for your trust and look forward to helping you realize your financial goals.

Insights on this page

Insights on this page

Jump down to a section of this report to learn more.

Key investment ideas

Key investment ideas

Explore related investment ideas to prepare your portfolio.

A Year of Inflections

A Year of Inflections

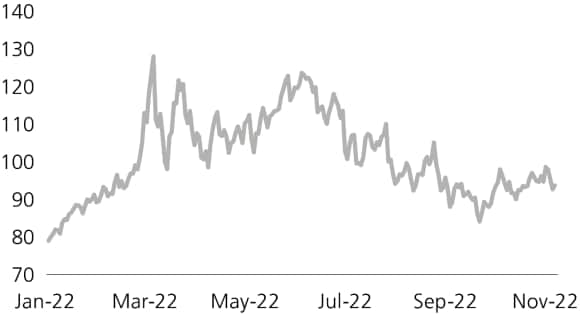

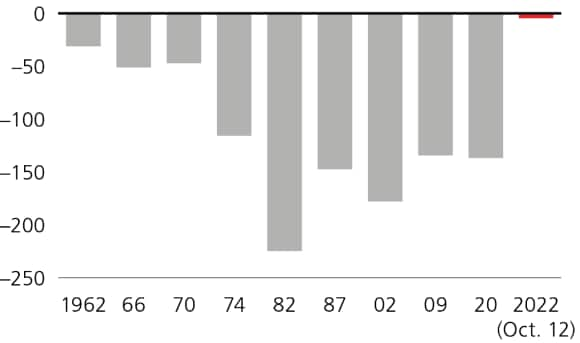

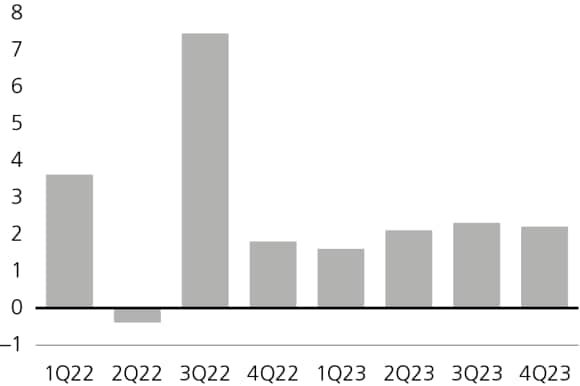

In 2022, inflation stayed high, interest rates rose, growth expectations fell, and both equity and bond markets suffered. 2023 will be a year of inflections as investors try to identify turning points for inflation, interest rates, economic growth, and financial markets against a complex geopolitical backdrop.

What does it mean for investors?

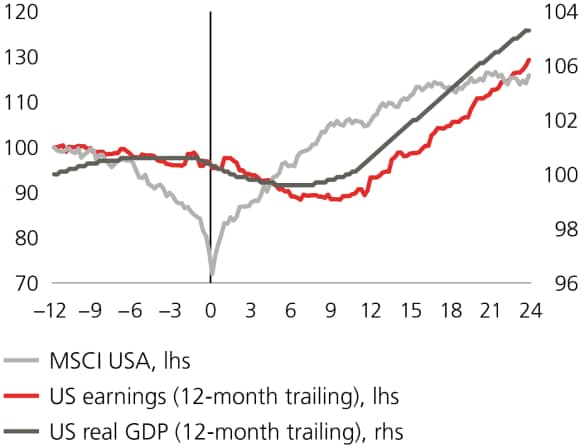

History tells us that durable turning points for markets tend to arrive once investors begin to anticipate interest rate cuts and a trough in economic activity and corporate earnings. As we enter 2023, high inflation and rising interest rates alongside elevated earnings expectations and geopolitical risks inform our investment themes of defensives, value, income, and safety. But we think the backdrop for risky assets should become more positive as the year progresses. This means investors with the patience and discipline to stay invested should be rewarded with time. Investors currently sheltering from volatility will need to plan when, and how, to rotate back into riskier assets over the course of 2023.

Key investment ideas

Key investment ideas

2022 in review

2022 in review

Four things we got right

Look beyond mega-cap tech

The US dollar would strengthen and gold would fall

Energy equities and hedge funds would help shield portfolios

Crypto is an "entertainment" trade, not an investment

Four things we got wrong

We did not expect the Russia-Ukraine war

Inflation would fall

Monetary policy would tighten modestly

Bond yields would rise slightly