Bond Bites Expand from the core

Explore why a broader allocation to G20 countries provides greater income opportunities than the narrowly focused G7.

Nobel Prize winner Richard Feynman was widely regarded as the most brilliant, iconoclastic, unconventional and remarkable theoretical physicist of his time. In his famous series of lectures he posed an interesting question; if, in some cataclysm, all of science knowledge were to be destroyed, and only one sentence passed on to the next generations of creatures, what statement would contain the most information in the fewest words? For Feynman, the answer was simply the atomic hypothesis that 'All things are made of atoms'1.

Trying to pass dull days during the UK lockdown I mused on the fewest words that would convey a huge amount of information about the art and science of bond fund management2. For me, the answer would be 'Everything is connected'. I will not be troubling the Nobel Committee ever, but the simple point of this hypothesis has been made in the opening few weeks of 2021; a sharp move higher in US bond yields squeezed and stretched global equities, bonds, currencies, commodities and emerging markets in several interesting directions. This intertwining of assets and markets is a key reason why my colleague Kevin Zhao and I rely on a broad team of specialists around the world to help inform our decision making – at the last count they help us assess about 300 different interrelated factors which contribute to our Global Bond strategy construction.

Managing to the complexity and entanglement of markets is especially important today, because in a world where inflation and bond yields may face upward pressure, margins of safety in some bond markets are very low. To illustrate, consider the history of the ICE BofA ML US Broad Market Index, which is a broad universe of US dollar denominated bonds tracked by many investors. To the end of February 2021, the total return this year was -2.6% (those rising yields meant falling prices for everyone). These are very early days but if that negative performance carries over for the whole year then 2021 will be a very unusual one.

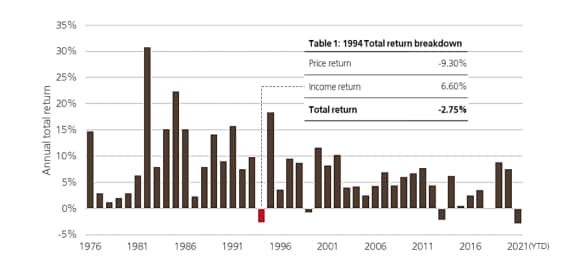

Chart 1 shows that since 1976 there have been only three calendar years when the US broad market had a negative return in US dollar terms. This is what we mean by a long-term secular bull-market in bonds; lower and stable inflation meant lower bond yields and drove a long history of positive returns for bond holders.

Chart 1: US Broad Market Index total returns 1976- YTD 2021

Chart 1: US Broad Market Index total returns 1976- YTD 2021

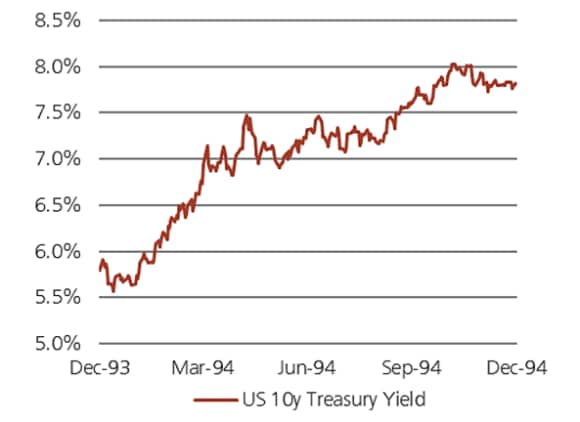

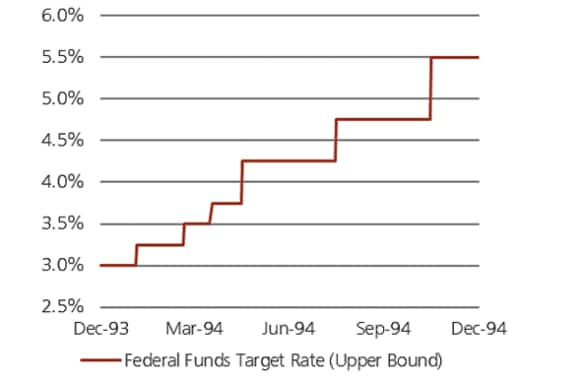

But what about periods when bond yields rose – why didn't we see greater losses? The answer is that mostly bond yields were a lot higher in the past. That income provided a cushion against losses, but one that is almost sub-atomically sized in many developed markets today. Let's take 1994 as an example. As table 1 above shows, the return for the year as a whole was -2.75% – almost the same as the 2021 year-to-date return. For those who did not live through it, I may surprise you by saying that 1994 was – and still is – known as 'The Great Bond Massacre'. Billions of US dollars were lost in a mark-to-market repricing in a global bond sell-off that was led by the US (10-year yields rose by nearly 3%) and spread rapidly around the world; it triggered one of the most infamous US municipal collapses in the failure of Orange County in California and was a factor in huge volatility in emerging markets.

But look closely at the returns in table 1, although prices fell nearly 10%, bond coupons (income) were a very large cushion indeed against bigger losses overall – nearly 7%, to leave a net loss of 'only' 2.75% (but there was no 'only' about it for almost everyone caught up in the rout).

My point is that, at the start of 1994, US 10-year Treasuries yielded nearly 6%3 and that income was crucial in partially offsetting price losses over the year. Now, think again about the start of 2021 when 10-year yields were at just less than 1%; the cushion that income can provide against mark-to-market losses as yields move up is obviously very much lower.

This is a broader challenge for investors – bond markets of all the world's largest developed economies, as represented by the G74, have coalesced at a very similar point. And remember, Japanese and Eurozone government bonds with negative nominal yields have no cushion at all. It is a key reason why we advocate a much more expansive and flexible approach to global bond allocations over time – one that must embrace the full opportunity set of the G20 which includes developing nations that account for a growing share of the global economy.

A global bond allocation that relies too heavily on core G7 government bond markets to drive future returns will likely mean lower returns and more risk of large mark-to-market losses than has been the case for the past 30 years or so.

To be clear, my reference to the Great Bond Massacre is only to illustrate the importance of income to bond returns and, in some places, the lack of it today. The rout of 1994 was initially triggered by a series of unexpected rate hikes from the Federal Reserve in a complacent market (see below).

Chart 2: US 10-year Treasury Yield

Chart 2: US 10-year Treasury Yield

Chart 3: Federal Funds Target Rate

Chart 3: Federal Funds Target Rate

It drove a near 3% move higher in bond yields. The Fed's own current base-case for the timing of the next rate hike is measured in years, so this is not an imminent risk. But the implication of very low yields in developed markets is a key consideration behind our much-diversified approach today.

Of course, owning non-core markets does not break the link between US interest rates and asset markets around the world – as I said at the start – everything is still connected. But, appropriately managed, it gives investors a fighting chance that their portfolios can still deliver the income and capital protection that they demand from their bond allocations over time.