These instructions apply to the following cards:

These instructions apply to the following cards:

- Debit Cards (Visa & Mastercard)

Tip: The best way to activate online payments for your UBS Debit Card is directly via the UBS Mobile Banking App – It’s easy, fast, and free!

How to activate online payments

How to activate online payments

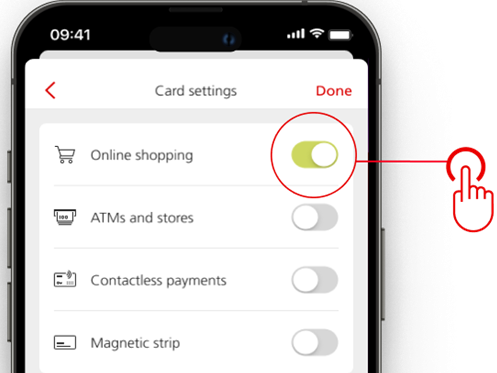

On your smartphone

1. Log in to the Mobile Banking App

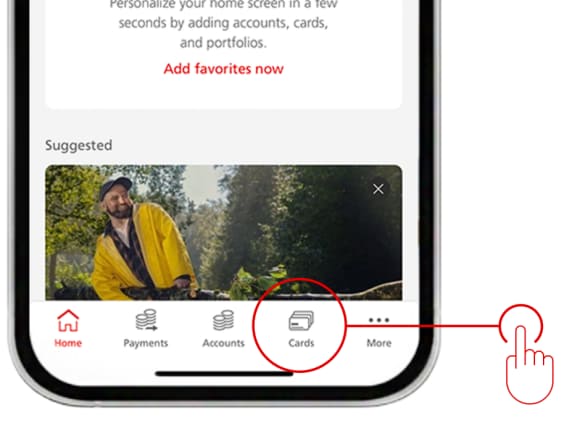

2. Tap Cards

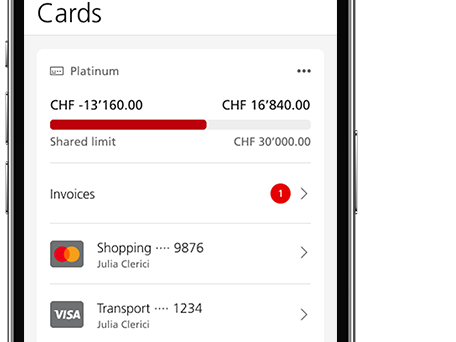

3. Tap the debit card you’d like to activate online payments for.

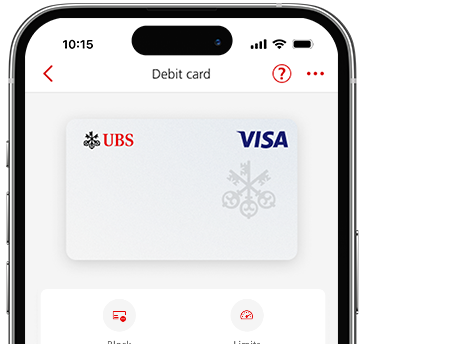

4. Tap the three points on the upper right.

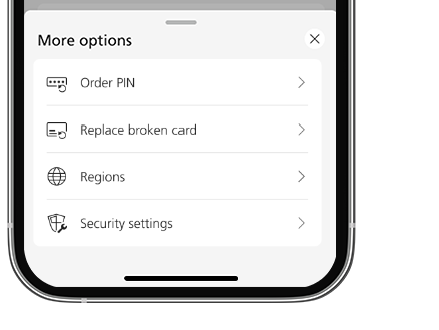

5. Tap Security settings

6. Activate Online Payments

You will be able to use your debit card for online purchases immediately.

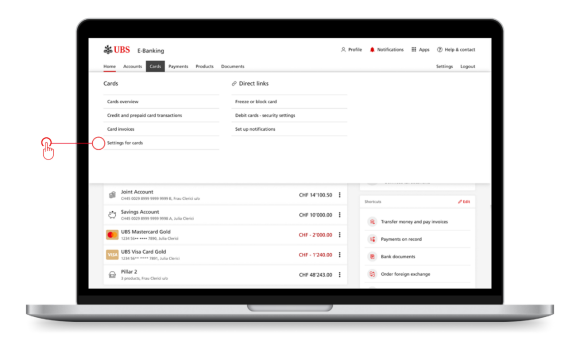

On your computer

1. Log on to UBS E-Banking

2. Navigate to Cards > Settings for cards

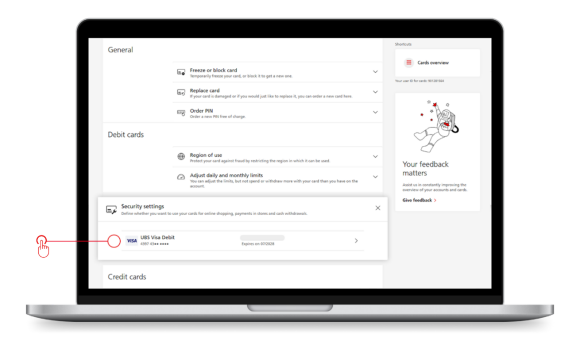

3. Under Debit cards, click on Security settings, then choose your debit card

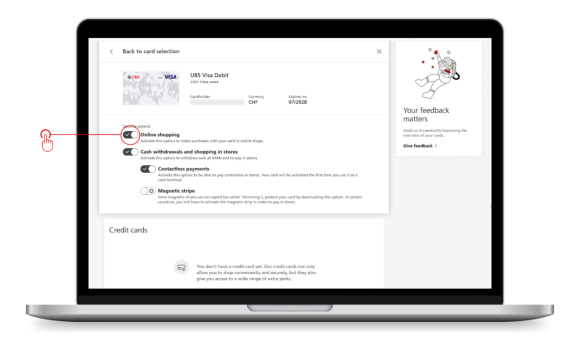

4. Click on activate Online shopping, to enable online payments

You will be able to use your debit card for online purchases immediately.

Other important help topics

Other important help topics

Was this page helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.

Check out this selection of frequently asked questions

Check out this selection of frequently asked questions