Macro Monthly Job market resilience could prolong the late-cycle

Investors may be surprised at the resilience of the global economy in 2023. Here, the Investment Solutions team discuss how the Fed’s desire to keep financial conditions tight means risk assets are not out of the woods.

So far this year, the US Federal Reserve has raised rates over six straight meetings by a total of 375 bps. Assuming the Fed follows through with an expected 50 basis points hike in December, it will have delivered the most cumulative tightening in any calendar year since 1980. The speed and magnitude of rate hikes is, by design, weighing on the US economy in order to bring inflation down.

Amid this backdrop, over 75% of fund managers think a recession is likely over the next 12 months – a level roughly on par with peak pessimism during the global financial crisis in 2009 and the COVID-19 pandemic in 20201.

While a recession is a very real possibility, investors may be surprised by the resilience of the global economy – even with such a sharp tightening in financial conditions. The labor market will certainly cool, but healthy household balance sheets should continue to support spending in the services sector. Moreover, some of the major drags on the world economy emanating from Europe and China are poised to get better, not worse, between now and the end of Q1 2023.

Avoiding a recession would clearly be good news; however, it would not signal an all-clear for risk assets. A more resilient economy may also mean central banks need to do more, not less, in order to get inflation durably back to target. And this raises the risks of a harder landing down the road. But, in our view, it is too early to pre-position for very negative economic outcomes. A longer-lasting late cycle environment can persist for some time, and investors will have to be flexible and discerning in 2023 given these potential dynamics.

The Fed vs. the US labor market

The Fed vs. the US labor market

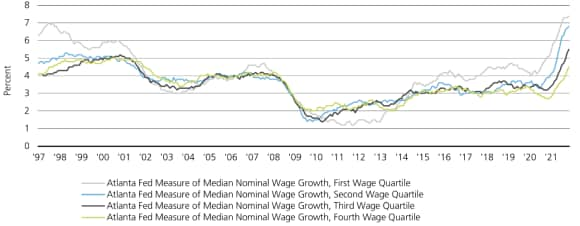

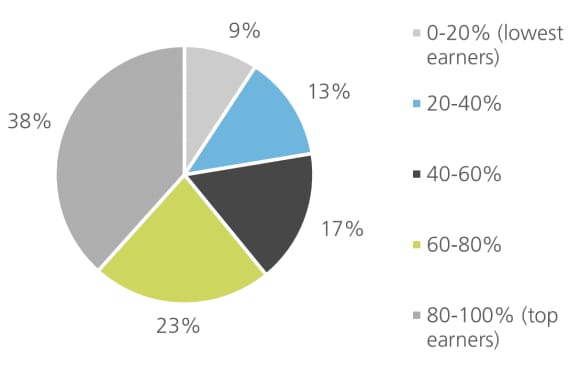

To best understand US economic dynamics, it is necessary to break down the US labor market into lower and higher income cohorts. Lower wage employees, who are disproportionately employed in the service sector, are experiencing very strong wage growth (Exhibit 1). This is happening in large part because higher income workers still have a lot of excess savings, which they are ready and more than willing to spend in the service sector . While high earners have a lower marginal propensity to consume (that is, they spend a smaller percentage of their income compared to lower earners), they also account for the lion’s share of total consumption (Exhibit 2).

Related

Macro updates

Macro updates

Keeping you up-to-date with markets

Exhibit 1: Income growth is strongest among the lowest earners

Exhibit 2:Share of US consumption by income quintile, 2021

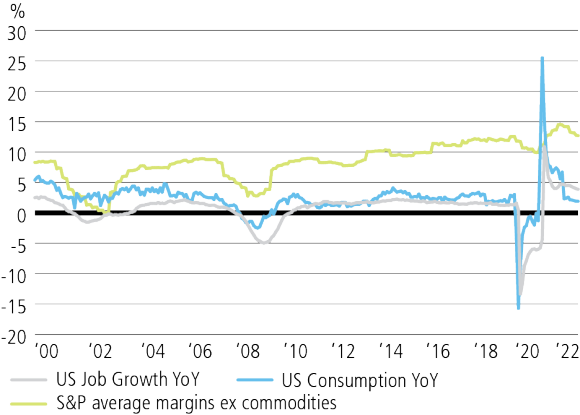

It is the Fed’s job to cool this situation down, and make sure it doesn’t turn into a wage-price spiral. The Fed’s tightening of financial conditions has meant some progress in slowing aggregate labor income, cooling the housing market and bringing down goods consumption. But the service spending dynamics mentioned above are unique to this COVID-19-driven cycle and arguably tougher to break. We believe this means the US economy (and earnings) probably don’t fall off as sharply as many are projecting, and, however, also the Fed will need to keep rates higher for longer.

In the meantime, China is signaling the relaxation of zero-COVID-19 measures, even in the face of elevated case counts. In our view, this suggests a commitment to such a shift in policy, which should allow for a boost in consumption. The process is unlikely to play out in a straight line, but the direction of travel seems pretty clear, to us. Our confidence that the bottom is in for China is fortified since these adjustments to COVID-19 policy are taking place in tandem with the most comprehensive support for the property sector to date. A rebounding China may provide a needed boost as developed economies slow, but will also likely lead to higher commodity prices. This too may make it difficult for the Fed and other central banks to back off too quickly.

Asset allocation

Asset allocation

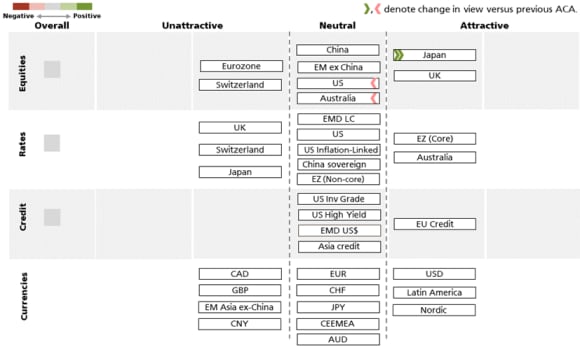

Macro and cross-asset volatility are unlikely to fade away along with the calendar year. And the distribution of outcomes remains much wider than investors became accustomed to in the previous cycle. Our focus is therefore on positioning over the coming months as opposed to the coming year, and we are ready to pivot as the business cycle evolves.

Going into 2023, we expect global equities at an index level to remain range-bound. They will likely be capped to the upside by the Fed’s desire to keep financial conditions from easing too much. However, we expect some cushion on the downside from a resilient economy and rebounding China.

The relative value opportunity set across global equities appears fertile. Financials and energy are our preferred sectors. This is because we believe cyclically-oriented positions should perform if what appears to be overstated pessimism on global growth fades in the face of resilient economic data. Activity surprising to the upside and a higher-for-longer rate outlook should benefit value stocks relative to growth, in our view – particularly as profit estimates for inexpensive companies are holding up well relative to their pricier peers. On a regional basis, Japan is buoyed by a rare combination of accommodative monetary and fiscal stimulus.

We are neutral on government bonds. The Fed is likely to be slow in ending or reversing its hiking cycle as long as the US labor market bends but does not break, while signs that overall inflation has peaked may reduce the odds of over-tightening. However, price pressures are likely to remain stubbornly high – a side effect of a US labor market that refuses to crack. China’s reopening should fuel a pick-up in domestic oil demand, offsetting some of the downward pressure on inflation from goods prices. In credit , US and European investment grade bond yields look increasingly attractive as a balance between a potentially resilient economy and more range-bound government bond yields.

We see commodities as attractive both on an outright basis and for the hedging role they serve in multi-asset portfolios. Already low inventories can continue to shrink in an environment of slowing growth so long as supply remains constrained – as is the case across most key commodity markets. Securing sufficient access to energy is not a problem that will be solved at the end of this winter – and may grow more intense as Chinese demand increases if mobility restrictions are removed. In addition, commodities have a track record of strong performance during months when stocks and bonds suffer meaningful declines.

In currencies, we believe we have moved from a strong, trending US dollar to more of a rangebound trade in USD. Our catalysts for a broad turn in the dollar are for the Fed to stop hiking interest rates, China’s zero-COVID-19 policy to end, and energy pressures in Europe stemming from Russia’s invasion of Ukraine to subside. None of these have fully happened yet, but all three appear to be getting closer. A more rangebound dollar coupled with a global economy that is still growing, but slowing, could provide a very positive backdrop for high carry, commodity-linked currencies. We prefer the Brazilian real and Mexican peso.

Exhibit 3: S&P 500 margins tend to be positive correlated with job, spending growth

Asset class attractiveness (ACA)

Asset class attractiveness (ACA)

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness as of 29 November 2022. The colored squares on the left provide our overall signal for global equities, rates, and credit. The rest of the ratings pertain to the relative attractiveness of certain regions within the asset classes of equities, rates, credit and currencies. Because the ACA does not include all asset classes, the net overall signal may be somewhat negative or positive.

Asset Class | Asset Class | Overall/ relative signal | Overall/ relative signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities

| Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | US Equities | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed market Equities | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets (EM) Equities | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | China Equities | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Global Duration | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | US Bonds | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed-market Bonds | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | US Investment Grade (IG) Corporate Debt | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | US HY Corporate Debt | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Debt | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | China Sovereign | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Currency | Overall/ relative signal |

| UBS Asset Management’s viewpoint |

|

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.