Macro Monthly Time to trade the growth slowdown

We are optimistic the US economy will avoid a recession in the next year, but market pricing of recession risk is likely to increase.

Highlights

Highlights

- We are optimistic that the US economy is strong enough to weather headwinds and avoid a recession in the next 12 months.

- However, market pricing of recession risk is likely to increase over the next few months.

- Equity valuations are still expensive relative to bonds. Moreover, we believe that signs of a durable bottom in economic growth or a Fed pivot to a less hawkish stance are unlikely in the near term.

- Should global economic momentum accelerate against our expectations, we feel that Chinese equities are an attractive way to express this view.

A key debate about the stock market concerns the likelihood and proximity of a US recession. Equity bears think an end to the expansion is imminent. Bulls expect a substantial rebound in the stock market so long as the economy avoids such a negative scenario. We disagree with both camps.

In our view, it is unlikely the US enters a recession within the next year – but even so, we continue to find equities unattractive at the index level. We believe market pricing of recession risk is more likely to increase rather than decrease from here, and still- expensive valuations do not provide adequate compensation for the downside risks to activity and earnings. For asset allocation purposes, this sequencing is critical: Before we can position for economic resilience, we believe it is first appropriate to position for a growth scare.

Over the next twelve months, economic strengths trump vulnerabilities

Over the next twelve months, economic strengths trump vulnerabilities

As we’ve said, this cycle is different, characterized by a higher nominal growth environment. Private balance sheets remain strong, consumer spending is rotating, not shrinking, and core inflationary pressures are likely to cool, in our view. Over a twelve- month period, these positive factors are likely to outweigh the vulnerabilities caused by tighter financial conditions, aggressive Federal Reserve rate hikes, softening in the goods sector, and elevated inflation.

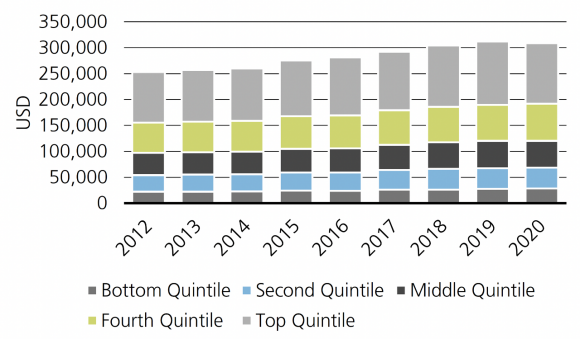

The overall private sector – households and businesses combined – has accumulated a significant financial surplus, the flip side of the massive fiscal deficits since the pandemic. For businesses, this net saving increases their ability to weather shocks to demand without facing financial stress. Even more importantly, for households these funds provide a cushion to maintain spending. Of the seven US recessions in the past five decades, all but one included a contraction in real consumption. Lower-income households have already begun to draw down on savings in the face of high inflation, and elevated energy costs may add more of a drag on discretionary consumption. But critically, the top 40% of US households by income account for 60% of US spending – and this is where the excess savings are concentrated at present.

Related

Macro updates

Macro updates

Keeping you up-to-date with markets

Exhibit 1: Higher-earning quintiles account for the majority of US consumption

Average annual expenditure by income quintile.

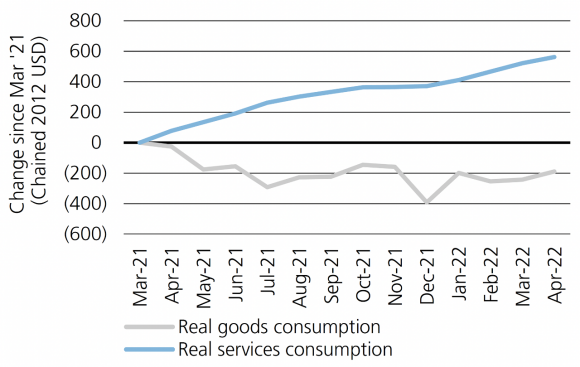

Exhibit 2: The rotation in US consumption is well underway

The ongoing mean reversion of above-trend US goods spending is affirmation of the progress made towards retaining pre-pandemic norms – not a harbinger of a domestic recession. Since the March 2021 peak in real US goods spending, services are up by twice as much as goods have decreased. As we think that the aggregate wherewithal to spend remains robust, there is little reason or evidence to suspect this underpinning of US growth over the past year is about to take an abrupt turn for the worse.

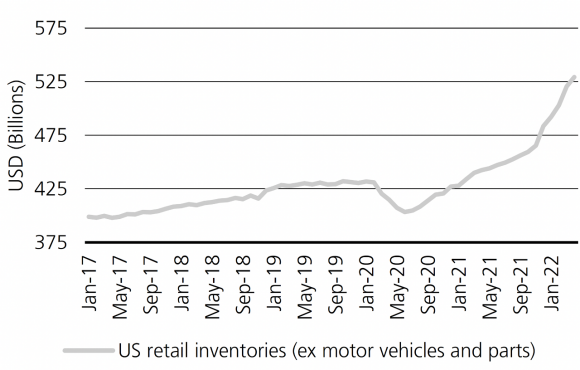

If inflationary pressures emanating from goods and the labor market diminish, so too should the threat to the US expansion posed by Federal Reserve tightening. Elevated inventories (ex autos) and moderating shipping rates suggest sharp disinflation, if not outright deflation, in core goods prices may be in the offing. Since these anomalous increases in goods prices have driven above-trend inflation, we believe the downside here will more than offset any upward price pressures from services.

A continued rebound in labor supply would dampen wage growth and bring the job market into more balanced territory, and would provide even more significant evidence that underlying inflation pressures are durably cooling. The aforementioned decline in savings among lower-income households should serve as a push to reintegrate into the labor force. Much of the employment shortfall and elevated job openings relative to pre-pandemic levels are in lower-wage industries – particularly leisure and hospitality. That sector also has also enjoyed by far the highest rate of pay growth since the onset of the pandemic, which could help pull would-be workers back in.

Over the next few months, equity risks outweigh rewards

Over the next few months, equity risks outweigh rewards

Our call for US economic resilience over the next 12 months is not yet actionable from a tactical asset allocation perspective.

Stocks are still unattractive on a valuation basis, and need to cheapen further to entice us to add risk absent a material change in the macro backdrop. The equity risk premium is still moderately tight, and markets do not typically bottom when stocks are this expensive relative to bonds.

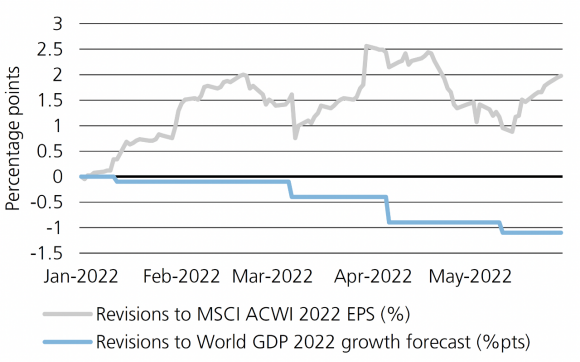

Earnings face downside risks as well. Analysts have revised per share profit estimates for global equities higher by roughly 2% year-to-date even as projected global growth has been trimmed by 1.1 percentage points. Bottom-up estimates suggest the compound annual growth rate of earnings for the MSCI ACWI from the end of 2021 through 2023 will be over 9%, vs. less than 3% from 2010 through 2019. These estimates are so elevated that we believe that there is room for them to come down in an environment of slowing growth, even without a recession.

Exhibit 3: Inventory destocking likely to be disinflationary

Exhibit 4: Downside risks to profit estimates due to slowing growth

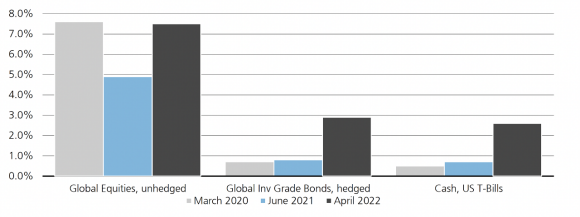

Exhibit 5: Expected returns are improving

Five-year geometric projected returns, USD terms

Our baseline process incorporates current valuations, market conditions are key forward-looking inputs to generate our five year expected returns by asset class and region

Note: March 2020 cash estimate made in April 2020

Volatility in profit growth has often been linked to the performance of goods-production sectors and the manufacturing PMI cycle. While an inflation peak could provide some relief for equity valuations relative to bonds, a descent of inflation could also reflect margin compression or deteriorating demand that adversely affects operating performance. Already, the breadth of earnings revisions is quite poor. Excluding the commodity-linked energy and materials sectors, earnings per share revisions have stagnated in aggregate for US equities.

Historically, risk assets have not troughed until there is a positive inflection in manufacturing purchasing managers’ indexes or there has been a dovish pivot from the Federal Reserve. Neither catalyst is imminent, in our view. The sharp tightening in financial conditions year-to-date is consistent with below trend growth later this calendar year. And even if inflation decelerates, it will likely remain elevated, making it difficult for the Fed to pivot in a less hawkish direction.

Asset allocation implications

Asset allocation implications

This is a challenging environment for asset allocation. In our view, investors are likely to continue to take a glass-half empty view of economic developments in the near term – not distinguishing between deceleration and an outright downturn. It is optimal to trade that path before we trade the destination.

That means staying underweight stocks, where we are more inclined to fade any bear market rallies, and staying positioned relatively cautiously in equities, where health care is our preferred defensive sector.

We also believe in selectively embracing cyclicality, particularly in commodities and energy equities. If consumer demand holds up, oil prices are likely to remain firm. And if energy markets suffer additional negative supply shocks, we believe that spending on other more discretionary items is likely to come under more pressure than fuel – a development already cited by several major retailers on their first-quarter earnings calls.

The most attractive investment to play for an unexpected increase in global economic momentum is Chinese risk assets, in our view. Markets are cheap, and unlike other major economies, policy is easing rather than tightening. Of the three largest headwinds we see for markets this year (aggressive Fed tightening, Russian invasion, and Chinese activity), we believe this final one is the most likely to be first to turn into a tailwind.

Given our view that the economic expansion will endure, we are also approaching levels where credit looks more interesting given the all-in move in yields from spread widening and higher government bond yields.

Stepping back, the silver lining of this year-to-date weakness across financial assets is the improvement in expected forward returns as valuations reset and risk-free yield becomes more ample (as noted in Exhibit 5). In our view, exercising a degree of caution on risk assets now leaves us better positioned to be able to capitalize on opportunities as our valuation or macroeconomic milestones are met.

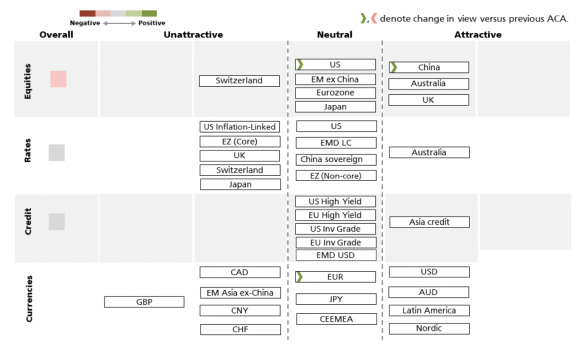

Asset class attractiveness (ACA)

Asset class attractiveness (ACA)

The chart below shows the views of our Asset Allocation team on asset class attractiveness as of 1 June 2022. The colored squares on the left provide our overall signal for global equities, rates, and credit. The rest of the ratings pertain to the relative attractiveness of certain regions within the asset classes of equities, rates, credit, and currencies. Because the ACA does not include all asset classes, the net overall signal may be somewhat negative or positive.

Asset Class | Asset Class | Overall/ relative signal | Overall/ relative signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall/ relative signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Equities | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed market Equities | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets (EM) Equities (ex-China) | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | China Equities | Overall/ relative signal | Light Green | UBS Asset Management’s viewpoint |

|

Asset Class | Global Duration | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | US Bonds | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed-market Bonds | Overall/ relative signal | Light Red | UBS Asset Management’s viewpoint |

|

Asset Class | US Investment Grade (IG) Corporate Debt | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | US High Yield Corporate Debt | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Debt US dollar Local currency | Overall/ relative signal | Grey Grey | UBS Asset Management’s viewpoint |

|

Asset Class | China Sovereign | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Currency | Overall/ relative signal | - | UBS Asset Management’s viewpoint |

|

A comprehensive solutions provider

A comprehensive solutions provider

UBS Asset Management Investment Solutions manages USD 170bn as of March 31, 2022. Our 100+ Investment Solutions professionals leverage the depth and breadth of UBS's global investment resources across regions and asset

classes to develop solutions that are designed to meet client investment challenges. Investment Solutions' macro-economic and asset allocation views are developed with input from portfolio managers globally and across asset classes.

For more information, contact your UBS Asset Management representative or your financial advisor.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.