The five-year market perspective

We explore four different growth-inflation scenarios and the potential impact on traditional portfolios. The results underscore the importance of alternative assets as a portfolio diversifier.

Louis D. Finney

Co-Head of Strategic Asset Allocation Modeling

Find detailed insights below

Find detailed insights below

Our Investment Solutions team provides estimates of capital market returns across a wide array of asset classes and from multiple currency perspectives with a focus on our five-year baseline expected geometric returns.

Although the recovery has at times sputtered, we estimate that pent-up demand, highly accommodative government policies, newfound productivity from working from home and reshuffling of workers into more productive activities should keep growth in the 2.0% range.

Changes in the macro environment

Changes in the macro environment

Our inflation estimates have moved up slightly, though not as dramatically as changes in breakeven rates imply. Although we see short-run inflationary pressures, we expect central banks to be successful in controlling inflation. We tend to side with the Fed that this is a temporary spike in inflation and that the deflationary forces of technology and a high degree of substitution will keep sustained inflation in check.

The global 60/40 approach continued to have solid returns. A 60% MSCI ACWI unhedged and 40% Bloomberg Barclays Global Aggregate hedged return 31.2% in the past year and 9.8% over last five years.1 However, on a forward looking basis, we have lowered our return expectations.

We expect the stock-bond correlation to continue to be negative, though the relationship has weakened a bit and is vulnerable to a reversal with a breakout of inflation and possible Fed interest rate hikes.

We view China as unique: neither a developed nor an emerging market, it continues to offer unique diversification benefits for global investors. China continues to have a different business and market cycle than the rest of the world. The correlation of Chinese equities with the S&P 500 (local to local currency) was 0.03 over the past year. In fixed income, Chinese government bonds continue to have a low correlation with other government bond markets, despite the recent deceleration in Chinese credit growth.2

With equities rallying 14.2%3 from November through April, valuations have become even more stretched and will require extraordinary earnings growth and continued low rates to be justified.

Although cash rates barely budged, government bond yields in developed markets moved up anywhere from 8 bps (Japan) to 89 bps (Canada). The emerging markets also saw a substantial increase in yields. China is one outlier, with their benchmark 10-year government bond yield declining by 9 bps.4

In general, with the US dollar getting closer to fair value, we see limited gains from currency exposure for unhedged non-USD assets in USD terms. Conversely, we see smaller losses for foreign investors investing in USD-denominated assets.

Inflation and capital market expectations: Four scenarios

Inflation and capital market expectations: Four scenarios

One of the biggest market concerns is a sustained bout of inflation. For at least a decade, global inflation has missed central bank targets5. Heightened concern is warranted, as a flood of debt issuance that can't be absorbed in the market may ultimately cause inflation. It can be argued that we already see this in asset prices and now the real economy is catching up to this.

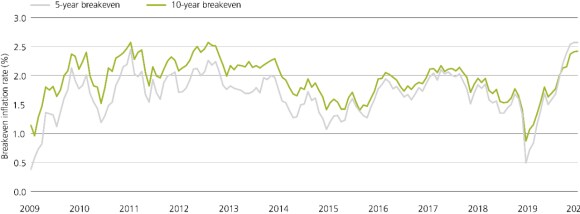

Short term measures of inflation have risen sharply in the past few months. Back in November breakeven rates were around the average inflation rate for the last dozen years (1.7%). But in 2021 inflation has shot up 70 to 90 basis points to hover around 2.6% for the US. (One interesting recent development is that shorter-term measures of expected inflation are higher than longer-term measures. For example, the 5-year breakeven inflation rate, the difference between nominal Treasury and inflation-adjusted (real) Treasury yields as measured in the TIPS market, is 2.6% while the 10-year is 2.4%. And the 1-3 TIPS sector compared with the 1-3 Treasury sector indicates a 2.8% inflation rate.)

US breakeven inflation: 2009–April 2021

US breakeven inflation: 2009–April 2021

We explore four different inflation scenarios. In each of these scenarios we are assuming a continuation of growth and above-average inflation in the second half of 2021. Thus, the negative and positive effects begin to show themselves in early 2022.

- Growth inflation: Strong growth and high inflation.

- Baseline: Moderate growth and moderate inflation.

- Stagflation scenario: Low growth and high inflation.

- Stagnation: Recession in late 2022 followed by low growth and low inflation.

When analyzing scenarios, we combine growth and inflation to produce nominal growth rates. We project that nominal growth could be as high as 6.3% and as low as 3.0%. However, we ultimately want to judge returns in real terms and significant differences in inflation can cause a notable difference between the nominal and real results.

5-yr Scenario Analysis

5-yr Scenario Analysis

Scenario | Scenario | Nominal Rate | Nominal Rate | Real Growth | Real Growth | Inflation | Inflation |

|---|---|---|---|---|---|---|---|

Scenario | 1. Inflationary Growth | Nominal Rate | 6.3% | Real Growth | 3.1% | Inflation | 3.1% |

Scenario | 2. Base | Nominal Rate | 4.6% | Real Growth | 2.4% | Inflation | 2.1% |

Scenario | 3. Stagflation | Nominal Rate | 4.7% | Real Growth | 1.5% | Inflation | 3.1% |

Scenario | 4. Stagnation | Nominal Rate | 2.9% | Real Growth | 1.3% | Inflation | 1.5% |

Scenario | 20-yr Avg Current (2021) | Nominal Rate | 3.8% | Real Growth | 1.9% | Inflation | 2.1% |

Scenario | 20-yr Avg 2001 | Nominal Rate | 6.2% | Real Growth | 3.3% | Inflation | 3.5% |

Scenario | 20-yr Avg 1981 | Nominal Rate | 9.1% | Real Growth | 3.9% | Inflation | 5.6% |

Projected annualized 5-year returns through June 2026

Projected annualized 5-year returns through June 2026

Index | Index | 1. Inflation Growth (Nominal returns) | 1. Inflation Growth (Nominal returns) | Base (Nominal returns) | Base (Nominal returns) | 2. Stag-flation (Nominal returns) | 2. Stag-flation (Nominal returns) | 3. Stag-nation (Nominal returns) | 3. Stag-nation (Nominal returns) | 4. Inflation Growth (Real returns) | 4. Inflation Growth (Real returns) | Base (Real returns) | Base (Real returns) | Stag-flation (Real returns) | Stag-flation (Real returns) | Stag-nation (Real returns) | Stag-nation (Real returns) | Nominal (Range) | Nominal (Range) | Real (Range) | Real (Range) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Index | US Large Cap Equity | 1. Inflation Growth (Nominal returns) | 7.7% | Base (Nominal returns) | 3.9% | 2. Stag-flation (Nominal returns) | 0.2% | 3. Stag-nation (Nominal returns) | 0.2% | 4. Inflation Growth (Real returns) | 4.4% | Base (Real returns) | 1.9% | Stag-flation (Real returns) | -2.9% | Stag-nation (Real returns) | -1.2% | Nominal (Range) | 7.5% | Real (Range) | 7.2% |

Index | 1-3 yr Treasury | 1. Inflation Growth (Nominal returns) | 0.4% | Base (Nominal returns) | 0.2% | 2. Stag-flation (Nominal returns) | 0.1% | 3. Stag-nation (Nominal returns) | 0.1% | 4. Inflation Growth (Real returns) | -2.7% | Base (Real returns) | -1.8% | Stag-flation (Real returns) | -2.9% | Stag-nation (Real returns) | -1.3% | Nominal (Range) | 0.2% | Real (Range) | 1.6% |

Index | 1-3 yr TIPS | 1. Inflation Growth (Nominal returns) | 0.9% | Base (Nominal returns) | -0.3% | 2. Stag-flation (Nominal returns) | 0.6% | 3. Stag-nation (Nominal returns) | -0.3% | 4. Inflation Growth (Real returns) | -2.2% | Base (Real returns) | -2.3% | Stag-flation (Real returns) | -2.4% | Stag-nation (Real returns) | -1.8% | Nominal (Range) | 1.2% | Real (Range) | 0.6% |

Index | 1-3 yr Credit | 1. Inflation Growth (Nominal returns) | 0.7% | Base (Nominal returns) | 0.5% | 2. Stag-flation (Nominal returns) | 0.5% | 3. Stag-nation (Nominal returns) | 0.5% | 4. Inflation Growth (Real returns) | -2.4% | Base (Real returns) | -1.5% | Stag-flation (Real returns) | -2.6% | Stag-nation (Real returns) | -1.0% | Nominal (Range) | 0.2% | Real (Range) | 1.6% |

Index | 10-yr Treasury | 1. Inflation Growth (Nominal returns) | -0.4% | Base (Nominal returns) | 1.1% | 2. Stag-flation (Nominal returns) | 0.1% | 3. Stag-nation (Nominal returns) | 1.6% | 4. Inflation Growth (Real returns) | -3.4% | Base (Real returns) | -1.0% | Stag-flation (Real returns) | -2.9% | Stag-nation (Real returns) | 0.1% | Nominal (Range) | 2.0% | Real (Range) | 3.5% |

Index | 10-yr TIPS | 1. Inflation Growth (Nominal returns) | 0.7% | Base (Nominal returns) | 0.0% | 2. Stag-flation (Nominal returns) | 1.4% | 3. Stag-nation (Nominal returns) | -0.3% | 4. Inflation Growth (Real returns) | -2.3% | Base (Real returns) | -2.0% | Stag-flation (Real returns) | -1.6% | Stag-nation (Real returns) | -1.7% | Nominal (Range) | 1.7% | Real (Range) | 0.7% |

Index | US Inv Grade Credit | 1. Inflation Growth (Nominal returns) | 0.2% | Base (Nominal returns) | 1.3% | 2. Stag-flation (Nominal returns) | 0.3% | 3. Stag-nation (Nominal returns) | 1.4% | 4. Inflation Growth (Real returns) | -2.8% | Base (Real returns) | -0.8% | Stag-flation (Real returns) | -2.8% | Stag-nation (Real returns) | -0.1% | Nominal (Range) | 1.1% | Real (Range) | 2.7% |

Index | US High Yield Credit | 1. Inflation Growth (Nominal returns) | 2.2% | Base (Nominal returns) | 1.7% | 2. Stag-flation (Nominal returns) | 1.1% | 3. Stag-nation (Nominal returns) | 1.5% | 4. Inflation Growth (Real returns) | -0.9% | Base (Real returns) | -0.4% | Stag-flation (Real returns) | -2.0% | Stag-nation (Real returns) | 0.0% | Nominal (Range) | 1.1% | Real (Range) | 2.0% |

Index | Commodities | 1. Inflation Growth (Nominal returns) | 5.3% | Base (Nominal returns) | 2.0% | 2. Stag-flation (Nominal returns) | 4.8% | 3. Stag-nation (Nominal returns) | -1.8% | 4. Inflation Growth (Real returns) | 2.1% | Base (Real returns) | 0.0% | Stag-flation (Real returns) | 1.6% | Stag-nation (Real returns) | -3.2% | Nominal (Range) | 7.0% | Real (Range) | 5.3% |

Index | Gold | 1. Inflation Growth (Nominal returns) | 2.0% | Base (Nominal returns) | 2.0% | 2. Stag-flation (Nominal returns) | 4.5% | 3. Stag-nation (Nominal returns) | 1.0% | 4. Inflation Growth (Real returns) | -1.1% | Base (Real returns) | 0.0% | Stag-flation (Real returns) | 1.4% | Stag-nation (Real returns) | -0.5% | Nominal (Range) | 3.6% | Real (Range) | 2.5% |

Index | Real Assets | 1. Inflation Growth (Nominal returns) | 5.9% | Base (Nominal returns) | 2.3% | 2. Stag-flation (Nominal returns) | 2.3% | 3. Stag-nation (Nominal returns) | 2.3% | 4. Inflation Growth (Real returns) | 2.6% | Base (Real returns) | 0.2% | Stag-flation (Real returns) | -0.8% | Stag-nation (Real returns) | 0.8% | Nominal (Range) | 3.6% | Real (Range) | 3.5% |

Index | Cash | 1. Inflation Growth (Nominal returns) | 1.4% | Base (Nominal returns) | 0.7% | 2. Stag-flation (Nominal returns) | 0.1% | 3. Stag-nation (Nominal returns) | 0.0% | 4. Inflation Growth (Real returns) | -1.7% | Base (Real returns) | -1.3% | Stag-flation (Real returns) | -2.9% | Stag-nation (Real returns) | -1.4% | Nominal (Range) | 1.4% | Real (Range) | 1.6% |

Index | Inflation | 1. Inflation Growth (Nominal returns) | 3.1% | Base (Nominal returns) | 2.1% | 2. Stag-flation (Nominal returns) | 3.1% | 3. Stag-nation (Nominal returns) | 1.5% | 4. Inflation Growth (Real returns) | - | Base (Real returns) | - | Stag-flation (Real returns) | - | Stag-nation (Real returns) | - | Nominal (Range) | - | Real (Range) | - |

When we look at real returns across these four scenarios, we find no asset class generates a positive real return across all scenarios and fixed income is locked into negative real returns in almost all scenarios. Portfolios invested entirely in equities and fixed income have no place to hide if inflation were to jump to the 3.0%+ range for an extended period.

Alternatives offer a potential source of protection. Like equities, real estate's brightest days may be behind them, but steady returns with some ability to ratchet up income as inflation increases should do better than fixed income and rival US equity returns in all scenarios, though stagflation would clearly be the worst.

Forward looking expectations

Forward looking expectations

Our expected returns for equities—especially US equities--are the lowest in years. Pockets of equities outside the US offer more compelling returns. Offsetting this is an increase in government bond yields, though this has stabilized in the last couple of months.

When it comes to asset returns and inflation, we see that the market is little prepared for a big breakout. In the short run there is no place to hide from negative real returns.

We expect alternatives to suffer the least as commodities, gold and real estate gain relative to other asset classes. Again, the backdrop to the type of inflation is important. Growth inflation should benefit real estate, while a Stagflation outcome would probably be very positive for gold. Commodities would probably be one of the drivers in inflation and clearly should do better in an inflationary growth environment. In short, the market opportunities to truly profit from inflation are few.