Trade anywhere, anytime with e-trading

Our tools and resources enable you to develop a trading plan and execute trades on the go. Explore our personalized investment content, trade on the go and benefit from preferential pricing on selected transactions.

Get flexible access to the global markets, whether trading equities, funds, fixed income or executing across asset classes.

Enjoy reduced pricing on selected online transactions.

How to get started on UBS securities trading

How to get started on UBS securities trading

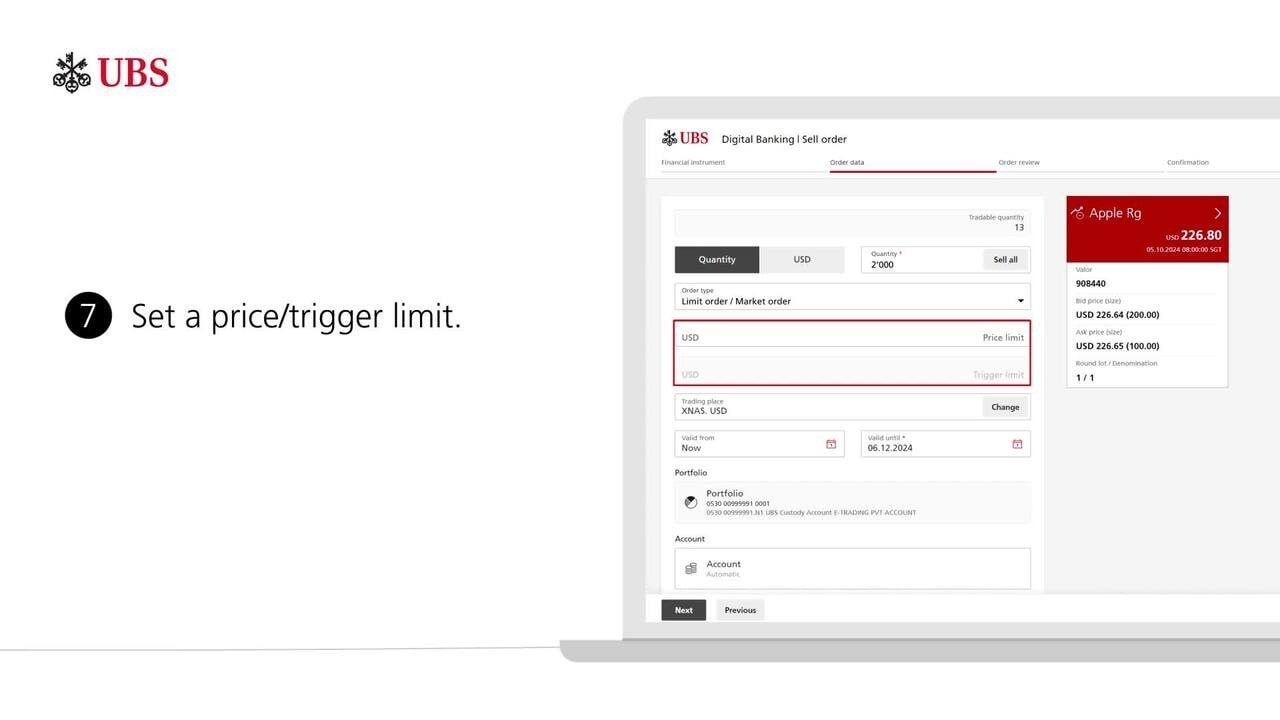

As an existing UBS client, you can get started right away by following two simple steps in our UBS securities trading how-to video guide.

UBS E-Banking

UBS Mobile Banking

Benefit from our online preferential pricing

Benefit from our online preferential pricing

Listed equities and list exchange traded funds1 (ETF) | Minimum fee waived for selected markets

Online Channel6 | Online Channel6 | Commission2 by market | Commission2 by market | Commission2 by market | Commission2 by market | Commission2 by market | Commission2 by market | Commission2 by market | Commission2 by market |

|---|---|---|---|---|---|---|---|---|---|

Online Channel6 | Transaction amount (USD) | Commission2 by market | Hong Kong & Singapore3 | Commission2 by market | USA & Canada | Commission2 by market | Key European & APAC Markets4 | Commission2 by market | Rest of the World |

Online Channel6 | Up to 100,000 | Commission2 by market | 0.20% | Commission2 by market | 0.30% | Commission2 by market | 1.00% | Commission2 by market | 1.20% |

Online Channel6 | Over 100,000 to 1 million | Commission2 by market | 0.20% | Commission2 by market | 0.30% | Commission2 by market | 0.8% | Commission2 by market | 1.00% |

Online Channel6 | Over 1 million | Commission2 by market | 0.20% | Commission2 by market | 0.30% | Commission2 by market | 0.60% | Commission2 by market | 0.70% |

Online Channel6 | Minimum commission5 amount | Commission2 by market | N/A | Commission2 by market | N/A | Commission2 by market | SGD 200 (SGD 218 w/GST) | Commission2 by market | SGD 200 (SGD 218 w/GST) |

Investment funds

Investment funds

Subscriptions into investment funds1 are subject to a commission2,3 applied to the subscription amount. The percentage rate applied to each order depends on the amount of the subscription into the investment fund.

Online Channel6 | Online Channel6 | Commission4 by fund type | Commission4 by fund type | Commission4 by fund type | Commission4 by fund type | Commission4 by fund type | Commission4 by fund type |

|---|---|---|---|---|---|---|---|

Online Channel6 | Transaction amount (USD) | Commission4 by fund type | Money market | Commission4 by fund type | Fixed Income | Commission4 by fund type | Equity, asset allocation |

Online Channel6 | All | Commission4 by fund type | 0.10% | Commission4 by fund type | 0.75% | Commission4 by fund type | 1.00% |

Online Channel6 | Minimum commission5 amount | Commission4 by fund type | SGD 50 (SGD 54.50 w/GST) | Commission4 by fund type | SGD 50 (SGD 54.50 w/GST) | Commission4 by fund type | SGD 50 (SGD 54.50 w/GST) |

Have a question?

Find quick answers to issues and everything you need to know from the most frequently asked questions about securities trading.

Flexible access to the foreign exchange market for spot, forward and swap trades. Get price information in real time and an overview of current transactions.

Supported foreign exchange transactions

Supported foreign exchange transactions

- Spot

- Forward (maximum period 1 year)

- Swap/ Uneven Swap (maximum period 1 year)

Foreign exchange (FX)

Foreign exchange (FX)

The Bank may earn a profit in the form of a mark-up applied to rates obtained from market side counterparties (UBS Investment Bank or other market side counterparties). Such mark-up will be calculated as a percentage of the notional amount of the transaction1.

FX/PM spot mark-up

Channel | Channel | Product type | Product type | Up to 50,000* | Up to 50,000* | Over 50,000 to 1,000,000* | Over 50,000 to 1,000,000* | Over 1,000,000* | Over 1,000,000* |

|---|---|---|---|---|---|---|---|---|---|

Channel | All (other than UBS E-Banking) | Product type | Major currencies3 | Up to 50,000* | Up to 0.50% | Over 50,000 to 1,000,000* | Up to 0.40% | Over 1,000,000* | Up to 0.20% |

Channel | All (other than UBS E-Banking) | Product type | Other currencies & precious metals3, 4 | Up to 50,000* | Up to 0.80% | Over 50,000 to 1,000,000* | Up to 0.60% | Over 1,000,000* | Up to 0.40% |

Channel | UBS E-Banking5 | Product type | All currencies | Up to 50,000* | 0.10%6 | Over 50,000 to 1,000,000* | 0.10%6 | Over 1,000,000* | 0.10%6 |

Have a question?

Find quick answers to issues and everything you need to know from the most frequently asked questions about FX trading.

Use the latest UBS research and insights to build your own virtual portfolio. View all of your instruments in one place. Track price movements and set up price alerts to keep tabs on investment opportunities and price matches.

Have a question?

Find quick answers to issues and everything you need to know from the most frequently asked questions about virtual portfolio.

All the right notes

All the right notes

UBS Structured Products Digital allows you to access different exchanges across time zones and capture rapidly changing market opportunities. And instead of reaching out to your Client Advisor, you can customize your structured products and execute your trades from the comfort of your home, on the road, or anywhere you happen to be.

Have a question?

Find quick answers to issues and everything you need to know from the most frequently asked questions about UBS Structured Products Digital.

We’re here to help

We’re here to help

UBS Digital Banking hotline

Available from Monday - Friday: 7am - 8pm; Saturday: 9am - 5pm