China multi asset investing strategy Q&A (March 2020)

China multi-asset investing. What's the current strategy, where are the opportunities, and what does coronavirus mean for China multi-asset investors in 2020?

What is China multi-asset strategy, how can investors benefit, where are the risks, what are the opportunities, and what's the outlook for China's economy? Gian Plebani, Portfolio Manager, Investment Solutions; Rob Worthington, Global Head of Investment Specialists; and Kenly Wong, China Allocation Opportunity Investment Specialist explain it all in a lengthy Q&A.

China multi-asset investing: strategy Q&A – key takeaways

China multi-asset investing: strategy Q&A – key takeaways

- Regarding coronavirus and strategy, we are keeping a neutral position on risk for now and are closely monitoring the rapidly evolving situation;

- China onshore government bonds have become more attractive because of the easier policy stance taken recently by the People's Bank of China, China's central bank. We believe yields will likely trend lower;

- Turning to US/China trade issues. The revival of negotiations toward a 'phase 2' agreement might present risks, perhaps on the upside. We believe there is little appetite in the White House in a US election year to threaten global risk assets by renewing trade hostilities;

1. The coronavirus outbreak really began in January, how have you adjusted your China multi-asset strategy?

1. The coronavirus outbreak really began in January, how have you adjusted your China multi-asset strategy?

We were neutral to risk assets prior to Chinese New Year in January and maintained our position in view of the outbreak of coronavirus.

In February, the growth rate of new cases turned downward, the number of cases of recovery increased, and the ratio of deaths to total cases also decreased. This suggests a shift from a virus outbreak stage toward a recovery in China.

However the crisis has evolved from a Chinese to a global pandemic with increasing risks for a recession. China looks now on a better track than many other countries globally as they are only in the early stages of the outbreak.

The Chinese economy will however not be isolated from a global slowdown over the next quarters and hence we keep a neutral position on risk for now and we are closely monitoring the rapidly evolving situation.

China looks now on a better track than many other countries globally

2. China has eased monetary policy recently, how have you adapted?

2. China has eased monetary policy recently, how have you adapted?

Onshore government bonds have become more attractive because of the easier policy stance taken recently by the People's Bank of China, China's central bank.

We believe yields will trend lower because government policy has become more accommodative in order to stabilize the economy and fight against the impact of coronavirus.

We also believe the ongoing opening up of China's capital markets and flows from international investors due to benchmark inclusion will also put downward pressure on yields in the future.

Learn more about China's recent monetary policy moves and the impact on the economy in China Translated here:

3. Property sales in mainland China have slowed, what implications are there for Chinese property developers and USD bonds? Do you expect the default risk will increase in the near term?

3. Property sales in mainland China have slowed, what implications are there for Chinese property developers and USD bonds? Do you expect the default risk will increase in the near term?

Measures to limit the spread of coronavirus mean short-term disruption to sales activities across China's industries, including the real estate sector, but we don't expect a longer term structural drag to China's economy.

The downward trend of the new confirmed cases observed in China along with higher business resumption rate compared to some weeks ago are all positive signs that point to the gradual resumption toward normal business activities.

We purposely hold USD denominated bonds issued by credible and leading names in real estate sector within our portfolio given their sound credit fundamental and their ability to re-finance.

The China's real estate sector, is undergoing consolidation with larger players increasing market share at the cost of smaller ones.

While default risk might rise for some of the sector players, particularly small-scale ones, we are confident in the companies we hold and believe diligent credit research will be ever more critical to protecting returns and minimizing potential capital loss in today’s environment.

4. China investing in 2020? What are the major risks for investors?

4. China investing in 2020? What are the major risks for investors?

The major risk for this year is the global spread of the coronavirus and related increase in recession probability globally.

As the situation in China stabilizes, the rest of the world just entered the early stages of this global pandemic. Drastic measures to contain the virus have a strong but likely short-lived negative impact on economic activity.

We expect the Chinese economy to hold up relatively well thanks to decisive policy measures but it won't be isolated from a global slowdown.

If the duration of the virus proves to be longer than anticipated, there are chances this might dampen global growth which leads to a further slowdown, or even worse, a global recession.

Turning to US/China trade issues. The revival of negotiations toward a 'phase 2' agreement might present risks, perhaps on the upside. We believe there is little appetite in the White House in a US election year to threaten global risk assets by renewing trade hostilities.

Additionally, there is scope for President Trump to pass further tariff cuts should coronavirus impact the US economy, which would be beneficial to China.

5. China Allocation Opportunity, your China multi-asset strategy, had a strong year in 2019, why was that?

5. China Allocation Opportunity, your China multi-asset strategy, had a strong year in 2019, why was that?

Our investment approach combines not only the expertise of our equity, fixed income and asset allocation portfolio management teams, but also top-down macro asset allocation with bottom-up security selection.

The strategy is actively managed on both asset allocation levels and the underlying securities.

For example, we gradually reduced our underweight on equities towards the end of 2018 and then went long equities from January 2019 until May 2019 to capture the pick-up in the Chinese equity market.

Also we increased our risk allocation to China A shares which contributed positively as they heavily outperformed the H share universe.

On the security selection level, both our stock picking and our bond selection had a strong positive contribution in 2019.

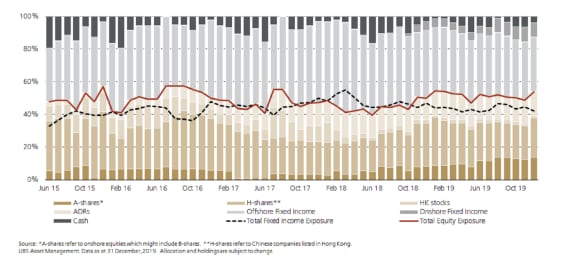

China multi-asset strategy: allocation over time

China multi-asset strategy: allocation over time

6. What are the benefits of a multi-asset China strategy compared to a China equity strategy?

6. What are the benefits of a multi-asset China strategy compared to a China equity strategy?

A multi-asset strategy like ours has historically been much less volatile than most pure equity strategies, which may make it suitable for investors who would like to capture China's growth story, but who would like an easier ride.

Additionally, allocating to China fixed income means exposure to the highest nominal yields among the 10 largest fixed income markets globally.

Finally, investors get flexibility with an actively-managed China multi-asset strategy.

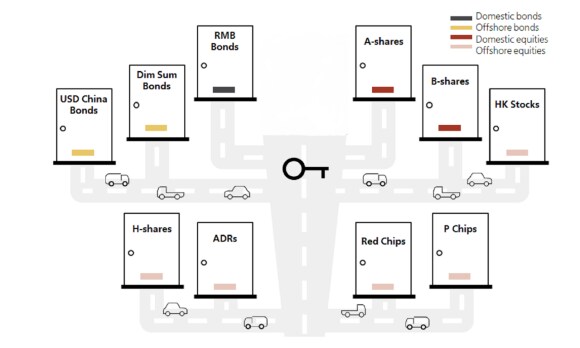

Instead of being focused on one asset class or market, multi-asset strategies offer a one-stop shop with access to both equity and fixed income (onshore and offshore) and the flexibility to allocate between them as market conditions change.

7. Wouldn't an investor get the same return by investing in both a China equity and a China high-yield fixed income strategy?

7. Wouldn't an investor get the same return by investing in both a China equity and a China high-yield fixed income strategy?

We allocate to a more broader bond universe than just high yield, including investment grade bonds and local government and policy bank bonds. This gives us better protection particularly in down markets.

On top of that, our active asset allocation added value beyond the bottom up security selection.

Given the distinctive characteristic of the Chinese markets, the diversification benefit is somewhat limited by investing in a passive strategy with fixed allocation to equity and bonds compared to a global multi asset portfolio.

It is especially true to a USD investor that the equities and fixed income are positively correlated in China. Cash and government bonds are key risk-off assets that we can utilize to position defensively, it has been one of the contributors to our strategy success.

Cash and government bonds are key risk-off assets that we can utilize to position defensively, it has been one of the contributors to the success of our strategy.

8. When managing a China multi-asset strategy, how do you reconcile your opinions with the views of equity and fixed income portfolio managers?

8. When managing a China multi-asset strategy, how do you reconcile your opinions with the views of equity and fixed income portfolio managers?

Different teams bring different elements to the strategy.

While Investment Solutions manages beta of the strategy and steers the overall asset allocation through a macro lens, underlying managers deliver alpha via their outstanding security selection skills.

That's what we mean by combining top-down macro strategy with bottom-up security selection.

While PMs within the firm may have strong conviction on particular companies or securities, short-term headwinds/tailwinds may impact particular markets or sectors.

By managing a multi-asset allocation, we can navigate smoothly by adjusting our asset allocations.

Read more

Fixed Income

Fixed Income

A globally oriented service for a globally integrated world

Asset Management services and solutions in your location

Asset Management services and solutions in your location

Please select your region

For further information on what we can offer you, please get in touch.

For further information on what we can offer you, please get in touch.