Hedge Funds: Why, and why now?

A wide-ranging fireside chat where Bruce Amlicke, CIO at UBS Hedge Fund Solutions and Kevin Russell, CIO at UBS O’Connor, make the case for hedge fund investing and identify where they see opportunities in 2021.

Moderator

Barry Gill

UBS-AM Head of Investments

Bruce Amlicke

UBS Hedge Fund Solutions

Chief Investment Officer

Kevin Russell

UBS O’Connor

Chief Investment Officer

Barry Gill: Hedge funds have largely sat out the tidal wave of reallocations to alternative investments in the last decade, but I think we have the perfect set of ingredients for a change in that stance.With equities in the 12th year of a bull market and bonds no longer providing attractive yields or adequate diversification benefits, we could finally be at the point in the cycle where alpha in public markets is going to be far more important than beta.

UBS Asset Management has two distinct businesses in the hedge fund space, both with deep experience going back over 20 years. UBS O'Connor, our single manager hedge fund has approximately USD 9 billion1 invested in multi-strategy and standalone capabilities. UBS Hedge Fund Solutions is the second largest global hedge fund multi-manager2, with nearly USD 40 billion1 in assets and invested in a rich network of third-party managers on behalf of both institutional and wealth clients.

Bruce Amlicke: From a macro perspective, we feel that we've had an important regime change with respect to consensus growth and inflation. Growth is booming and the European economy is beginning to do well. We’re seeing inflation, which in our view is more permanent than transitory, with input prices increasing and wages potentially increasing. Going forward, we believe we’re in for higher interest rates, which we expect to have a meaningful impact on equity hedged and commodity strategies—two opportunities that I'm most excited about right now.

When you have periods like we've had over the past year, with heightened volatility, macro-driven markets and excessive factor volatility, it creates a lot of inefficiencies in the market. When volatility starts to subside, investors focus on fundamentals again and pick winners and losers to monetize on those inefficiencies. We also see several tradable catalysts in the market today, such as an increase in mergers and acquisitions, changing regulations and tax policy, and an increasing focus on ESG, which may all provide an event rich backdrop.

The old playbook of buying the dips on high-flying growth stocks is going to be a bit more challenging. We think that having a value-bias approach to stock picking will be successful in the latter half of 2021.

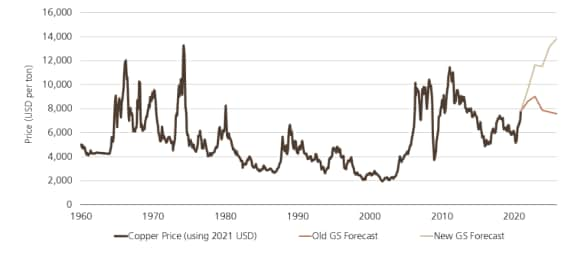

Historical (inflation-adjusted) and forecasted copper prices using 2021 USD

Historical (inflation-adjusted) and forecasted copper prices using 2021 USD

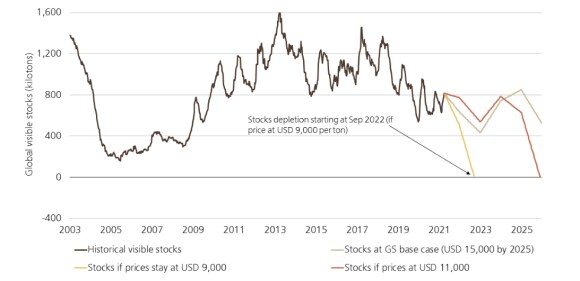

Historical and forecasted copper global visible stocks

Historical and forecasted copper global visible stocks

As for commodities, this is by far the best trading environment that I've seen since post Enron collapse—a perfect combination of high volatility and fundamentally driven commodity markets. On the demand side, you're seeing explosive cyclical recovery, but it's being supercharged by the fact that there’s a massive shift towards renewables and electric vehicles that is driving demand for copper, nickel and cobalt, for example. We believe that's going to drive up capex in the commodity cycle relative to GDP over the coming years.

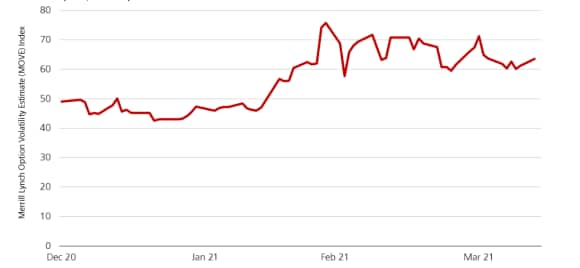

Kevin Russell: In many ways, we see a more conducive macro environment today than in 2020. We see massive changes in the market right now, with a tremendous amount of uncertainty, and the global economy reopening in fits and starts. We have ongoing accommodative monetary policy, and fiscal spending here in the US. We are seeing a significant spike in interest rate volatility, which we consider the best indicator for risk appetite. It is creating a lot of rotations and overcorrections within the equity markets, generating tremendous relative value opportunities.

Rising interest rate volatility suggests reduced investor confidence

Rising interest rate volatility suggests reduced investor confidence

We’ve also been focused on six mega trends that we believe create structural alpha opportunities. The first is the dynamics at play between banks and broker dealers in the credit markets. The corporate credit markets have exploded in size, and banks and broker dealers who carry inventory are just too small relative to that notional amount of corporate debt, creating tremendous opportunities for accredited investors like ourselves.

The second is the undeniable growth of special purpose acquisition companies (SPACs), at USD 91 billion3, they have become a very important mechanism for emerging growth companies to come public. There's enough inefficiency in that structure to create really compelling relative value opportunities for investors like us.

The third is the environmental space. Climate change is real, and it’s causing changes in consumer preferences, the regulatory landscape and significant shifts in capex. Those are the raw materials for dispersion of returns and we're seeking to capitalize on that.

The fourth is bank disintermediation from private credit—banks are just not efficient lenders, and regulatory limits on banks’ structured lending leads to growth for private credit.

The fifth is trade finance, also known as working capital. We're seeing compelling opportunities relative to investment grade and high yield bonds. Trade finance has shorter duration, higher yield, lower default probabilities and higher recovery, so we believe they are better than corporate bonds in every way.

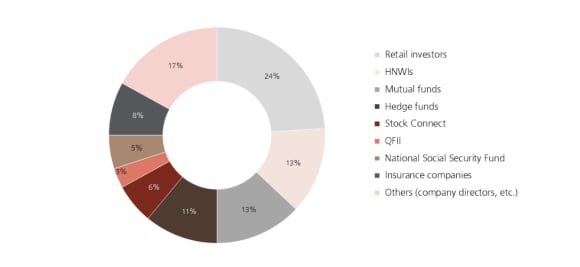

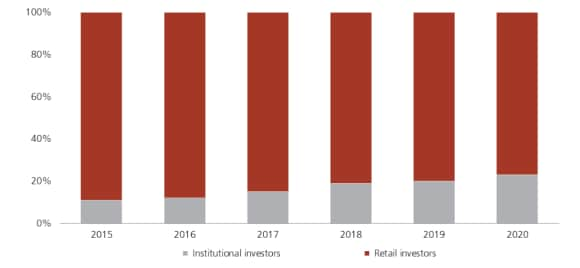

The sixth is China, which has become a ‘table pounder’ of an opportunity. At 17% of global GDP4, China has been working hard to make their markets more accessible and more efficient. Late last year China, eased foreign access to its capital markets through a reform of its Qualified Foreign Institutional Investor (QFII) program that will allow investors to trade directly with Chinese banks and broker-dealers. That's really exciting because they have a very robust capital market that we're seeking to capitalize on, unique pools of liquidity and quite frankly the corporate access provided in the onshore market is better. Another dynamic, which is arguably more impactful, is the impending ability to borrow and short stocks in the onshore markets. Lastly, the investor composition is a lot less competitive from a hedge fund perspective, contrasted against the enormous participation of retail investors. Retail investors generally trade with a heavy momentum quality creating an alpha opportunity for relative value investing.

China A-shares: free-float market cap by investor type

China A-shares: free-float market cap by investor type

That's really exciting because they have a very robust capital market that we're able to capitalize on, unique pools of liquidity and quite frankly the corporate access provided in the onshore market is better. Another dynamic, which is arguably more impactful, is the impending ability to borrow and short stocks in the onshore markets.

Lastly, the investor composition is a lot less competitive from a hedge fund perspective, contrasted against the enormous participation of retail investors. Retail investors generally trade with a heavy momentum quality creating an alpha opportunity for relative value investing.

Shenzhen investor composition

Shenzhen investor composition

Source: SZSE, UBS, as of June 2020

Bruce: While we’re on the topic of Asia, another idea that we find compelling is the Japan event theme. The underlying fundamentals have never been better. We see a lot of corporate activity going on right now. The government continues to double down on corporate management. Most recently was a government edict that corporate boards must have greater than one-third independent directors. This is spurring some beneficial governance changes that we think will pay dividends.

We're already starting to see corporate activity increase, tender offers rise year on year, merger and acquisition activity taking off and an increase in private equity taking public companies private.

A fund of hedge funds approach gives us capital allocation fluidity and the ability to invest across asset classes, geographies and opportunities.

Q&A

Q&A