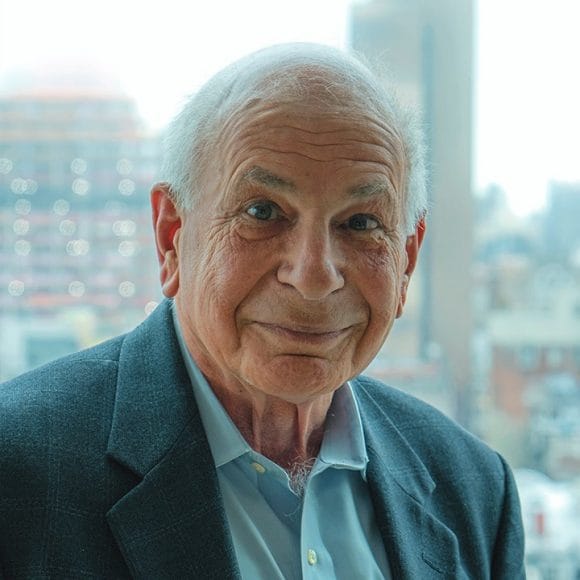

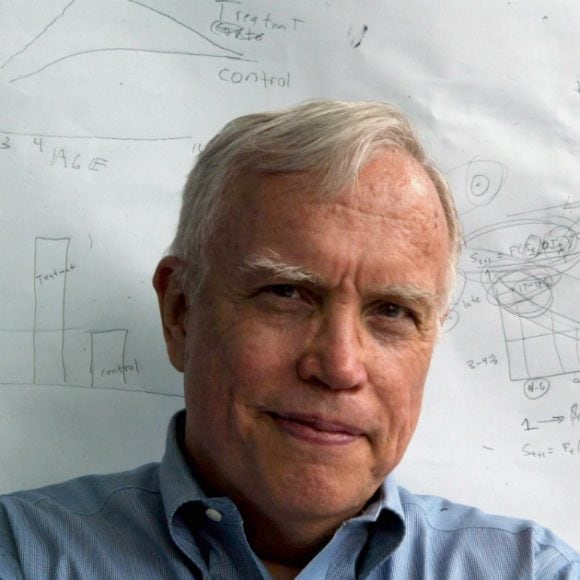

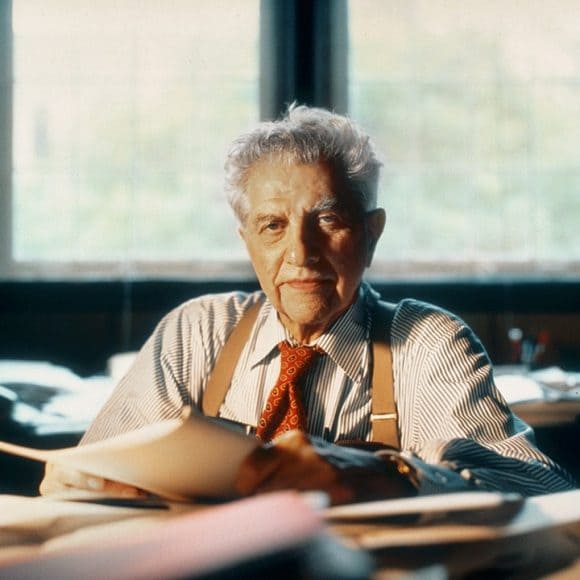

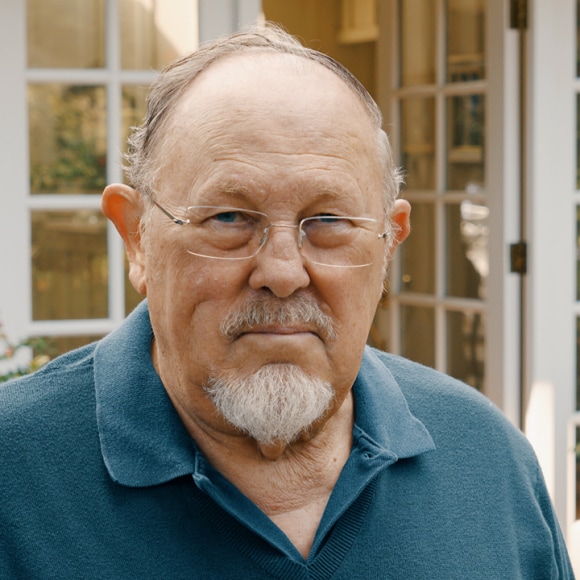

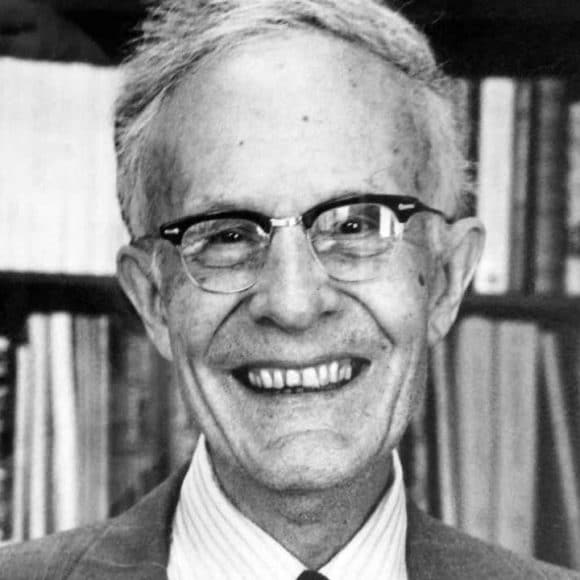

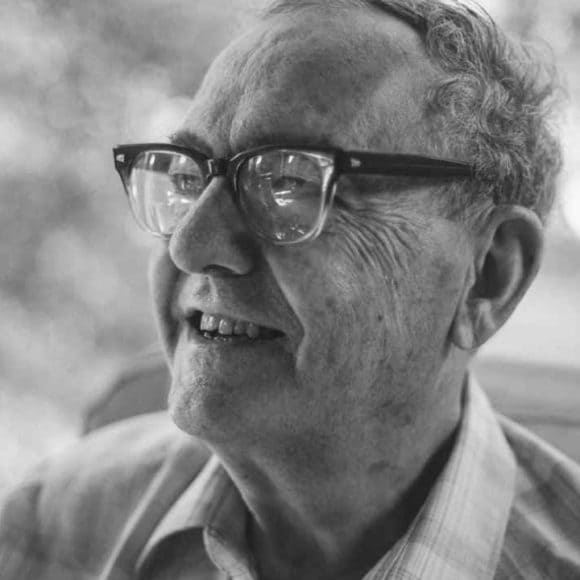

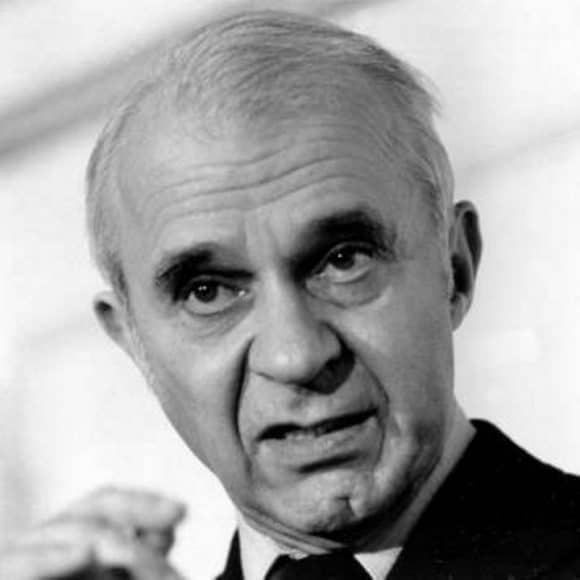

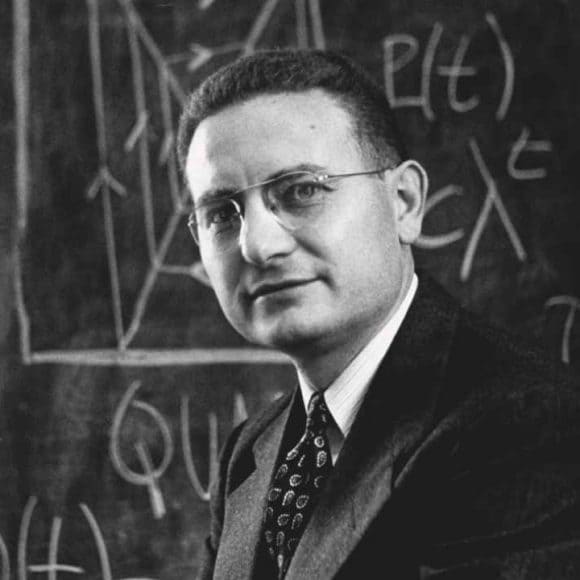

Check out all Nobel Laureates to find out more about their groundbreaking ideas and personal stories.

Check out all Nobel Laureates to find out more about their groundbreaking ideas and personal stories.

About us

Discover who we are

Investment research

Curated just for you

Contact information

Find services in your region