UBS Worry Barometer 2025

Geopolitics and financial markets

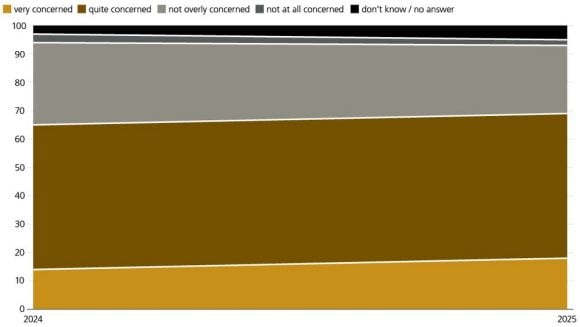

In the current geopolitical situation, global uncertainties and their impact occupy an important place in the latest UBS Worry Barometer. UBS offers solutions that ensure stability and future security, even in turbulent times.

Trend: comparison between the Swiss economy and foreign economies

in % of voters

The area chart shows how the Swiss population assesses the development of the Swiss and foreign economies from 2004 to 2025. The columns are divided into the categories “very good”, “rather good”, “rather bad”, “very bad”, and “don't know / no answer”. This reveals changes and trends in public opinion over the years.