UBS Worry Barometer 2025

Environment and climate protection

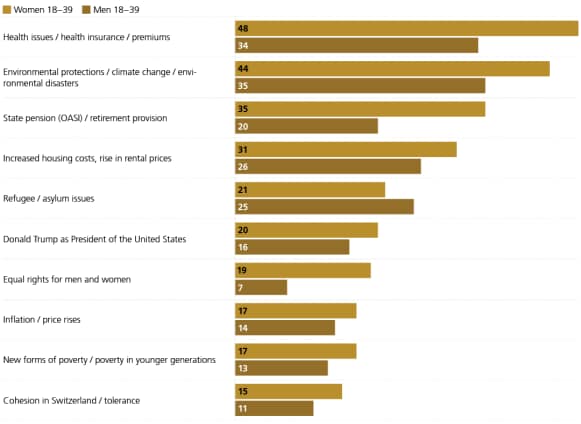

Protecting our environment remains a fundamental issue, especially for younger generations. Sustainable financial solutions help combine environmental awareness with financial goals and contribute to climate protection.