Macro Monthly Macro Monthly: Evidence of reacceleration

Financial assets have performed strongly to start the year, reflecting fading investor pessimism on the likelihood of a recession as decelerating inflation means central bank tightening cycles are winding down.

Evidence of reacceleration

Evidence of reacceleration

Highlights

- Financial assets have performed strongly to start the year, reflecting fading investor pessimism on the likelihood of a recession as decelerating inflation means central bank tightening cycles are winding down.

- We believe evidence of economic reacceleration from the US, China, and Europe is a more powerful catalyst for markets going forward.

- Cyclical areas of the equity market have more room to run to reflect this better-than-expected growth backdrop, in our view.

- Growth resilience raises the odds that inflation will remain sticky and elevated relative to the pre-pandemic cycle, which may challenge valuations for more expensive segments within global equities, like the US.

Financial markets have started the year with an ‘everything rally’ as fears over the potential for an imminent recession – concerns we argued were misplaced – have receded.

There are two key drivers of the price action, in our view. One is the deceleration of inflation, which has given investors more confidence that central banks’ tightening campaigns are winding down. Segments of the market like unprofitable, early-stage growth stocks and long-term government bonds have been among the biggest beneficiaries of this shift in views. Secondly, there is evidence of a reacceleration in economic activity. We believe this development is a more important market catalyst as we progress further into 2023.

We continue to favor emerging market equities relative to US stocks, as they have superior earnings revision momentum on the back of China’s reopening and are attractively valued on a relative basis. We are also positive on cyclical segments of the stock market, such as the energy and financial sectors, US small caps vs. large caps, and value vs. growth factor. We find the ample carry available in emerging market hard currency debt to be attractive and believe spreads have scope to compress.

US dollar weakness should continue to be in the offing, in our view, as the Federal Reserve’s tightening campaign nears its conclusion, China’s economic rebound lifts global growth, and the stress on Europe from high energy prices subsides.

There is a limit to how low longer-term US government bond yields can go given this resilient growth backdrop, and we believe this level has been reached. In addition, this sturdier-than-appreciated growth backdrop is not necessarily a good-news story for equities at the index level. Growth resilience raises the odds of inflation aftershocks and, in our view, is likely to contribute to a higher-for-longer interest rate environment. Solid nominal growth coupled with expensive valuations for global equities (driven in large part by a handful of US companies) informs our view that commodities should outperform global equities going forward.

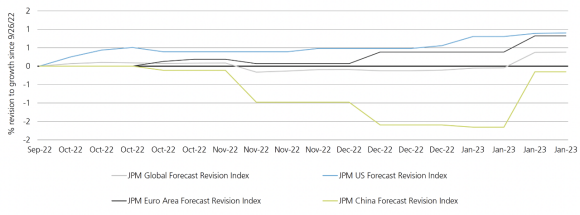

Exhibit 1: Global growth revisions are turning up

Headwinds to tailwinds

Headwinds to tailwinds

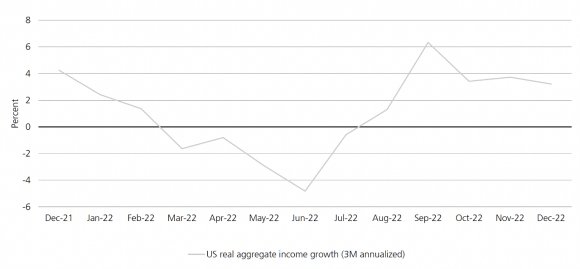

The US labor market continues to be seemingly indomitable, underscored by stunningly high job growth in January. Initial and continuing jobless claims are running at or below levels that prevailed at the end of 2019. While wage growth has moderated, indicators such as the private-sector quits rate imply that this is likely to remain above its pre-pandemic pace. Excess savings have clearly been drawn down, and are no longer putting a sturdy floor under US spending. But, for the US consumer, positive real aggregate income growth is now providing cause to expect continued strength. Since the start of August, US inflation-adjusted spending power has been increasing on a three-month annualized basis as the deceleration in price pressures exceeds that of wage and employment growth. After a concerning dip in December, the ISM Services purchasing managers’ index also surged to start the year. This suggests momentum in the most important component of the US economy, services, is intact.

Related

Macro updates

Macro updates

Keeping you up-to-date with markets

Exhibit 2: Real income growth provides more fuel for consumer spending

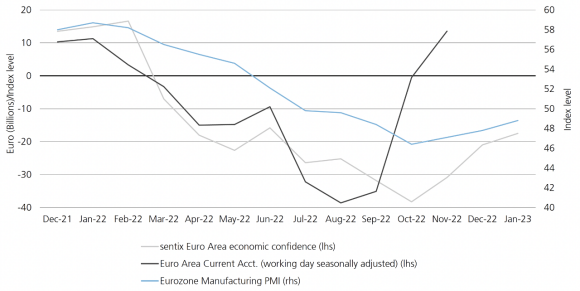

Exhibit 3:European activity is rounding a corner

Residential investment, a major negative for US GDP growth over the past three quarters and considered a leading indicator for the economy at large, is also likely to be less of a drag. The near-100 basis point drop in US 30-year fixed mortgage rates off their peak is reinvigorating domestic housing activity, with mortgage applications moving higher since the start of the year.

Meanwhile, China is set to reclaim its role as the engine of global economic growth. The spread of the COVID-19 virus as mobility restrictions were abandoned has been swift. Now, measures such as severe cases and patients in hospitals are now both more than 70% off their peaks. Service-sector spending is likely to receive the biggest boost from a durable, comprehensive economic reopening, but this process should also provide a broad-based lift for growth, in our view. We believe China’s manufacturing purchasing managers’ indexes will soon rebound into positive territory. If this occurs, history would suggest that this would have positive spillovers for global factory activity.

Investors have also gone from debating the severity of a potential European recession to wondering whether there will be a downturn at all. Fourth-quarter figures showing virtually flat activity (after adjusting for distortions relating to Irish tax policy) reinforces how left-tail outcomes during Europe’s winter have been avoided. Forward-looking indicators are evolving in a manner consistent with passing a trough and moving towards recovery. Importantly, the stress brought about by higher energy prices is shaping up to be much less severe than feared. Wholesale energy and natural gas prices are roughly half of what European Central Bank staff predicted for 2023 back in December. This development is an unambiguous positive for European industry as well as consumers.

Asset allocation implications

Asset allocation implications

We believe markets are entering a more nuanced environment that will be less favorable for beta but still surprisingly positive for economic activity relative to consensus.

The peak in inflation and central bank hawkishness have fueled a significant rebound in many of the speculative, expensive assets most damaged by tightening campaigns. In our view, there are limits to this “buy what the Fed broke” strategy. Growth resilience means that it will be difficult for central banks to get inflation rates all the way down to their targets. This also suggests that government bond yields have limited room to decline further. Under these conditions, we believe the valuation pressures that plagued more expensive acyclical/growth stocks in 2022 are likely to reemerge.

In our view the most attractive investment opportunities continue to be in cyclically-sensitive areas of the equity market, which are inexpensively valued on a relative basis and are more tightly levered to this re-acceleration in economic activity. Relative growth differentials are likely to move in favor of the rest of the world relative to the US, in our view, which should continue to put downward pressure on the US dollar. The Japanese yen, Mexican peso, and Australian dollar are our preferred currencies amid a sustained depreciation in the US dollar.

The overall resilience in nominal growth, particularly in China, coupled with tight supply is a recipe for higher commodity prices. Similarly, expensive equity valuations along with limited near-term recession risk makes the carry opportunity in emerging market hard currency debt very attractive on a relative basis.

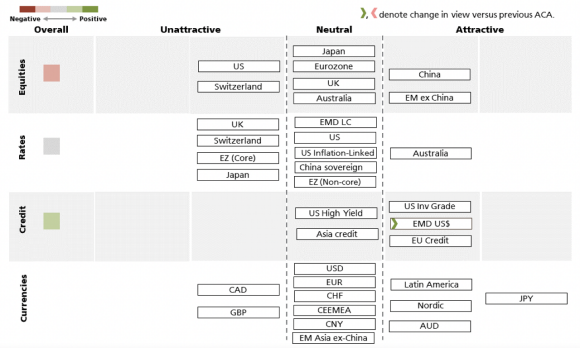

Asset class attractiveness (ACA)

Asset class attractiveness (ACA)

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness as of February 3, 2023. The colored squares on the left provide our overall signal for global equities, rates, and credit. The rest of the ratings pertain to the relative attractiveness of certain regions within the asset classes of equities, rates, credit and currencies. Because the ACA does not include all asset classes, the net overall signal may be somewhat negative or positive.

Asset Class | Asset Class | Overall/ relative signal | Overall/ relative signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities

| Overall/ relative signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Equities | Overall/ relative signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed market Equities | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets (EM) Equities | Overall/ relative signal | Light Green | UBS Asset Management’s viewpoint |

|

Asset Class | China Equities | Overall/ relative signal | Light Green | UBS Asset Management’s viewpoint |

|

Asset Class | Global Duration | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | US Bonds | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US | Overall/ relative signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Investment Grade (IG) | Overall/ relative signal | Light Green | UBS Asset Management’s viewpoint |

|

Asset Class | US HY Corporate Debt | Overall/ relative signal | Light Green | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Debt | Overall/ relative signal | Light Green Grey | UBS Asset Management’s viewpoint |

|

Asset Class | China Sovereign | Overall/ relative signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Currency | Overall/ relative signal |

| UBS Asset Management’s viewpoint |

|

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.