Macro Monthly It’s fiscal policy on the ballot

We ascribe 75% odds to Democratic nominee Joe Biden winning the presidency. Different election outcomes may introduce more uncertainties into the economic outlook, but are unlikely to change the fundamental realities.

Highlights

Highlights

- A full normalization of private sector activity will likely remain elusive well into 2021 due to COVID-19.

- The strength of the US and global economic recovery will depend on continued support from the public sector.

- We believe that investors should focus on which election outcomes deliver the greatest likelihood of necessary fiscal support — a 'Blue Wave' and to a lesser extent, the status quo.

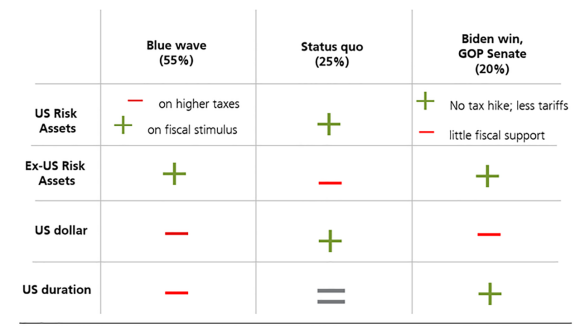

- In our view, a Blue Wave is the most likely election outcome. The resulting spending increase of that outcome could drive cyclicals and global equities ex-US higher and Treasuries and the dollar lower, with US stocks a relative underperformer due to higher taxes.

- We see the outcome that carries the most risk of premature withdrawal of fiscal support and a lower outlook for US growth is a Biden Presidency with a GOP Senate.

- An inconclusive election result is certainly not a market positive, but with post-election volatility already elevated we think the bar is high for major market disruption.

The marquee event of the 2020 schedule is around the corner. From a market perspective, the upcoming November 3 US election and aftermath are assuming increased importance. The persistence of the biggest unscheduled event of 2020 – the COVID-19 pandemic – means the varying election outcomes have implications for fiscal policy that will largely determine whether growth in 2021 is vigorous or downshifts rapidly, leaving lasting scars. The virus will likely continue to delay any full normalization of activity until there is broad inoculation by an effective and trusted vaccine. As such, the private sector will not be at full speed well into 2021, and in need of a crutch. That makes additional fiscal support necessary to continue assisting struggling segments of the economy bridge the gap to a broader recovery.

Risk assets, over time, can weather the prospect of higher taxes on profits. They will have much more difficulty grappling with an absence of fiscal support that puts the nascent earnings recovery in jeopardy and raises the risk of insolvencies among businesses and households whose income streams remain materially impaired due to pandemic.

We ascribe 75% odds to Democratic nominee Joe Biden winning the presidency. This is relatively in line with prominent models that aggregate polling data, supplemented by economic and demographic data (FiveThirtyEight). This outcome is likely to be associated with a weaker dollar and better relative performance for equities outside the US. Some, but not all, of the lingering US protectionism discount embedded in international risk assets and foreign exchange is poised to dissipate on a Biden victory.

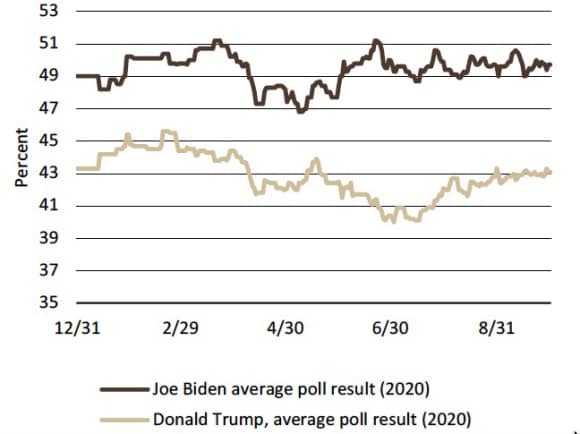

Exhibit 1: Biden has a bigger lead than Clinton and...

Exhibit 1: Biden has a bigger lead than Clinton and...

Exhibit 2: …national polls are more stable than in 2016.

Exhibit 2: …national polls are more stable than in 2016.

We favor pro-cyclical positions that stand to benefit from increased optimism on the global economic recovery and higher visibility in an eventual return to pre-COVID-19 patterns and levels of spending. We believe a Biden victory along with a Democratic Congress would accelerate the tailwinds for this trade set, and serve as a particularly potent catalyst for value to outperform growth. We remain diversified, and retain hedges that should be poised to provide meaningful offset if the result is different or inconclusive.

Different election outcomes may introduce more uncertainties into the economic outlook, but are unlikely to change the fundamental realities. After the dust settles, this will still be an early-cycle environment in which positions most closely tied to the healing of the global economy will continue to trend positively or have asymmetric catch-up potential.

Blue wave: 55%

We believe the most likely outcome is a Democratic clean sweep, and stress that the fiscal spending is more important to the macroeconomic and the global market outlook than tax policy changes.

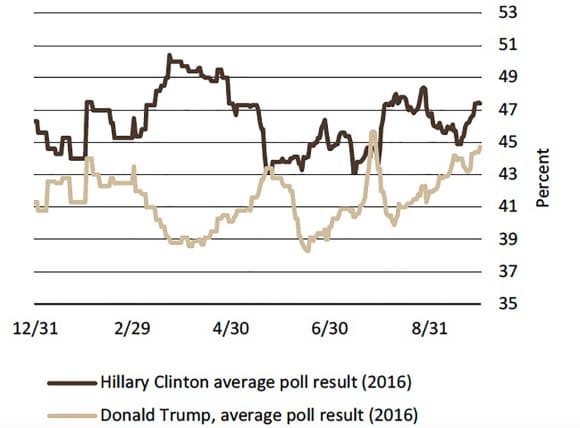

Exhibit 3: Election: Thoughts on initial market implications

Exhibit 3: Election: Thoughts on initial market implications

Ex-US outperforms US on Trump loss. Watch fiscal policy.

In this scenario, we think enhanced US fiscal spending is likely to disproportionately benefit cyclical areas of the global equity market. Cyclicals do not have a dominant weighting in the S&P 500 Index, particularly relative to other international indexes. Gains accruing to US cyclicals will likely be offset by a Biden tax policy that diminishes the after-tax earnings power and potential for buybacks among US corporations, particularly the health care, technology and communication sectors.

A looming capital gains tax increase, meanwhile, would provide a catalyst for a liquidation event in technology/growth stocks. The immense outperformance of these stocks in recent years, and especially 2020, provides further evidence to believe that selling ahead of a potential tax increase would be concentrated in this cohort. Technology and communication services are also two of the three sectors with the most adverse earnings impact from Biden’s proposed tax plan. The potential for more regulatory scrutiny or antitrust proceedings against Big Tech companies looms as an additional negative for the group under this scenario. Even in an economy that has not fully healed from the coronavirus, higher taxes are an integral ideological component of the Democratic agenda to reduce economic inequities.

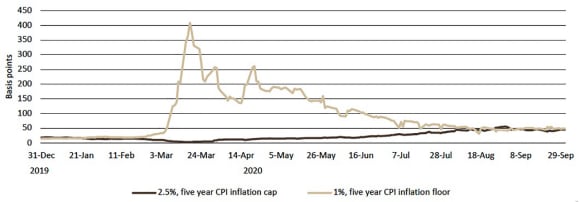

The Treasury market is able to quickly price in the key implication of a unified government: a stronger fiscal impulse. The about-face in yields on election night in 2016 and during the brief period of time in the 2018 midterm results when the Republican party had a fighting chance of retaining the House demonstrate this. We believe a Blue Wave would be unambiguously negative for US duration. Inflation-linked derivatives imply that investors ascribe similar odds to consumer price inflation averaging below 1% and above 2.5% over the next five years. We think the latter is much more likely than the former if a Blue Wave leads to sustained fiscal expansion. Treasury yields are vulnerable to a shock from this implication of a unified Democratic government.

Exhibit 4: Blue wave fiscal impulse would likely accelerate value catch-up

Exhibit 4: Blue wave fiscal impulse would likely accelerate value catch-up

While Biden will likely continue a policy of US decoupling from China, it is slated to be much more predictable. He is likely to seek a multilateral approach and look to establish consensus with other developed nations in dealings with China on issues such as climate change and human rights. The use of tariffs, whose effects were thoroughly incorporated into the USD/CNY cross during times when levies were threatened or enacted, will likely be de-emphasized over time.

Status quo: 25%

If a Biden victory does not come to pass, we would expect a continuation of market trends during recent years of the Trump presidency to persist in the short term. Emerging market assets would be most at risk. Conversely, US assets would be poised to outperform, with segments of the market most exposed to Biden tax changes benefitting from a relief rally.

We believe a Trump presidency and divided Congress would be able to provide additional fiscal support in 2020/2021,

though not nearly on the same scale as the Blue Wave. Overall, the limited scope for legislation advancing Trump’s priorities under a divided Congress could increase trade risks materially during a second term, as the president enjoys more unilateral authority in this domain.

A short position in cyclical Asian currencies would likely serve as an effective hedge to our more procyclical trade set in the event of this result.

Biden win, GOP Senate: 20%

This scenario has the most potential variance between the knee-jerk and medium-term market implications, as well as where our views are most out of consensus. On the surface, this outcome means a more predictable foreign and trade policy with minimal risk of tax increases. We expect that initially stocks would perform well and the dollar would weaken. Whether US assets outperform global equities would be a function of whether trade risks or higher taxes were more thoroughly embedded in prices.

Exhibit 5: Markets are not priced for a potential sustained fiscal expansion to propel inflation higher

Exhibit 5: Markets are not priced for a potential sustained fiscal expansion to propel inflation higher

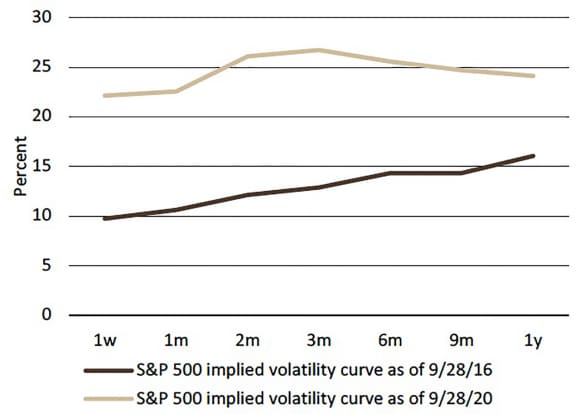

Exhibit 6: Unlike 2016, stocks appear to have priced in election risk well ahead of event

Exhibit 6: Unlike 2016, stocks appear to have priced in election risk well ahead of event

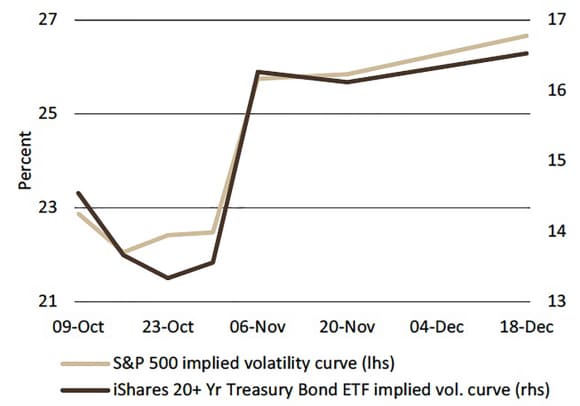

Exhibit 7: The US election looks to be priced as a persistent shock for equity, bond volatility

Exhibit 7: The US election looks to be priced as a persistent shock for equity, bond volatility

Because of the importance of fiscal support to keep macro momentum intact, we believe over the medium term this outcome would be the least constructive for risk assets. While we still expect some degree of fiscal support in this scenario, it is also the outcome with the greatest risk of no additional meaningful fiscal thrust to cushion the lingering pandemic-related blows to individuals, businesses, and other levels of government.

From a legislative perspective, we fear that this would be akin to a third term for former President Barack Obama, with Republican lawmakers displaying an increased commitment to fiscal hawkishness. A repeat of the fiscal consolidation that occurred through much of the Obama administration would dampen the speed of the economic recovery. The downshift to a sluggish recovery could raise the risks to our base case for a continued healing of the US and global economies, which we believe would be associated by higher risk premia in financial markets. As such, the impact a President Biden would have on the Treasury market is binary, and hinges upon which party controls the Senate.

We exercised discretion in modestly adjusting the odds for this outcome upwards relative to model-based projections in light of Republican Senate candidates’ tendency to outperform President Trump in close 2016 statewide races, a dynamic that is curiously absent from current polling.

Indecision day

The deluge of mail-in ballots due to the ongoing pandemic raise the prospect that the winner of the presidential election, as well as some Congressional seats, will not be known on the night of November 3/early morning of November 4. Based on current polling, the most obvious path to a conclusive result on the night of involves a decisive Biden victory in Florida, a state which begins tabulating mail-in ballots over three weeks prior to Election Day.

Other potential key tipping point states that either candidate would need to secure victory (Pennsylvania, Wisconsin, Michigan) will accept ballots that arrive after November 3. These states do not allow for mail-in ballots to be processed before Election Day. Based on the expected skew of the mail-in ballots, a Biden lead in some or all of those states on November 3 would strongly imply a victory.

The scenario for a prolonged inconclusive result, and ensuing potential legal battles, involves President Trump prevailing in Florida and having narrow leads in the other aforementioned states on November 3 that dissipate as more mail-in ballots are counted.

The pricing of equity and rates volatility is consistent with the election serving as the start of a moderately higher volatility regime. To markets, the election is not an event, but a persistent shock.

This dynamic could be driven by an inconclusive election outcome in the aftermath of the Nov. 3 vote, with narrow margins and mail-in ballots yet to be counted. Or, investors may perceive heightened policy risks during the transition period. We are wary of the prospect for additional trade or other actions against China to be taken in the intervening period between the election and the inauguration if Biden prevails. This would also push back the timing of any additional fiscal thrust into 2021.

Any lack of immediate clarity on the election outcomes would not be a positive for risk assets, but we are not convinced that this dynamic is a reason to substantially reduce such exposures. That this volatility already appears to be priced in raises the bar for any political disruption to meaningfully roil markets.

Recent history shows that the departure from political norms does not necessarily weigh on US equity valuations. We do not expect such a period would necessarily elicit downward revisions to earnings unless widespread civil unrest evolves into a broad, prolonged drag on commerce and significantly eroded credibility in US institutions and the power of the State. Long positions in the yen and gold relative to the US dollar should provide some degree of protection against these tail scenarios.

A contested election could become a sizable, persistent negative for markets if its ripple effects included a sharp decline in consumer confidence and irreparable damage to any possibility of more fiscal support in 2020 and 2021. Volatility fostered by lingering uncertainty over the election results is likely to create dislocations that become attractive investment opportunities.

Conclusion

Recency bias aside, most US elections do not catalyze a substantive turn in the macroeconomic environment that provides investable themes. We believe the 2020 election is different. The election is of tactical importance to the near-term outlook for growth because of its implications for still-needed fiscal support. And our modal scenario offers the possibility of bringing about a regime change of persistent fiscal expansion in the US, with potentially immense cross-asset ramifications. This outcome would likely hasten and increase the magnitude of outperformance for our preferred relative value opportunities.

But perspective is necessary. The global economic recovery is not on the ballot in 2020. Under the two most probable scenarios, we expect adequate policy support going forward. And there is still a possibility of a fiscal breakthrough prior to the election that buttresses the economy through the first quarter of 2021, and reduces some of the near-term importance of this event from an investing lens. Whether Trump or Biden emerges victorious and no matter what the composition of Congress, we feel that global activity should continue to gain traction, aiding our procyclical, early-cycle trade set.

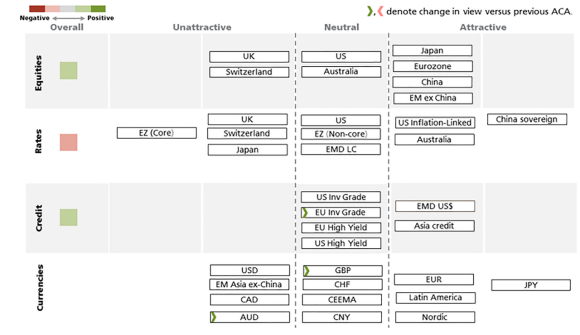

Asset class attractiveness

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 1 October 2020.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.