Macro Monthly The case for emerging markets

Coronavirus will likely be negative for first-quarter global growth, but we do not expect it to derail the ongoing global manufacturing rebound.

Highlights

Highlights

- Amid considerable uncertainty about the risks it poses, investors are understandably concerned about the potential impact of the coronavirus on global growth

- While the virus should negatively impact Chinese and global growth this quarter, we do not expect it to derail the healing in global manufacturing that began in Q4 and should carry on well into 2020

- Even if the impact is bigger than we currently expect, the Chinese authorities have the full policy mix at their disposal to provide additional stimulus should it prove necessary

- Assuming the impact of the virus is not protracted, we see global growth continuing to trend higher as last year's monetary policy easing feeds through developing and emerging market economies and as the de-escalation of US/China trade tensions boosts corporate confidence

- As the most geared to this late cycle bounce, we remain positive on the outlook for all emerging market assets classes

At the time of writing, Lunar New Year celebrations in China have been curtailed by the spread of the deadly coronavirus. With full details about the global spread of the virus, its symptoms, incubation period and mortality rates unclear, investors are behaving entirely rationally in the face of uncertainty by selling risk assets and buying safe havens. We cannot say with confidence how or how quickly things are likely to progress. But human tragedy aside, history would suggest that such epidemics have a limited short-term impact on the wider economy that is often followed by a sharp rebound, as pent-up demand is unleashed. We suspect this particular geopolitical risk will end up an opportunity to accumulate emerging market assets at more attractive valuations.

That positive view begins with our conviction that global growth is experiencing a cyclical rebound after the sharp manufacturing slowdown of 2018-2019. Over recent months, global growth leading indicators have clearly bounced. High frequency macroeconomic data across both developed and emerging universes further supports the view that overall manufacturing demand momentum is reaccelerating. While the coronavirus is likely to impact that momentum in the short term, we do not believe it will derail it.

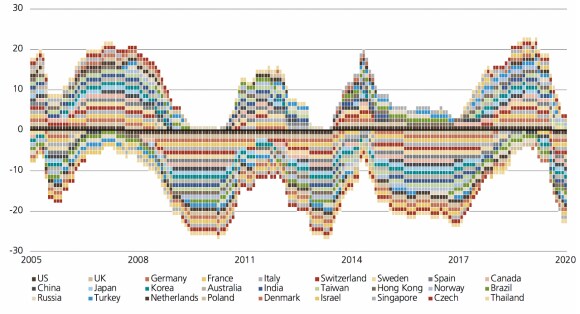

In our view, there is more to come from this rebound than markets are currently discounting. We see global demand growth supported by the lagged impact of aggressive monetary policy easing across developed and emerging markets in 2019. This kind of sharp move in accommodation has historically eased credit conditions, setting the stage for a V-shaped economic recovery. Central banks are set to remain accommodative in 2020 and we have already seen further easing in Türkiye, South Africa and Malaysia in early 2020. In our view, there is scope for EM monetary policy in aggregate to provide further stimulus should it prove necessary.

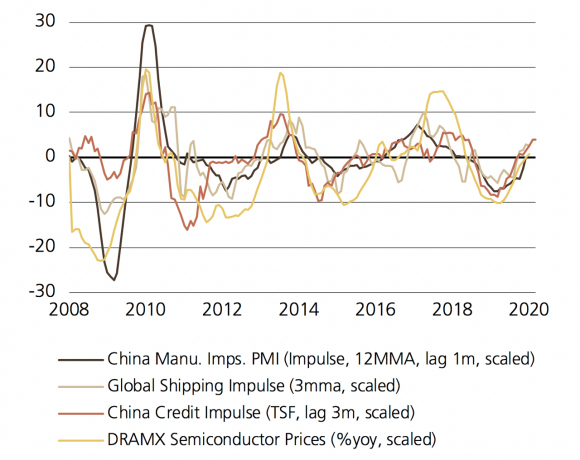

Exhibit 1: Leading indicators for emerging markets' profits growth are turning

Of course, the outlook for China and for global trade is of particular relevance to emerging markets. China's central position in the global manufacturing, commodities and the investment cycle leaves emerging markets growth and profits heavily reliant on the region's largest economy. The reduction in tariffs (and tensions) under the US and China's 'Phase 1' trade deal therefore represents a welcome moderation of geopolitical risk.

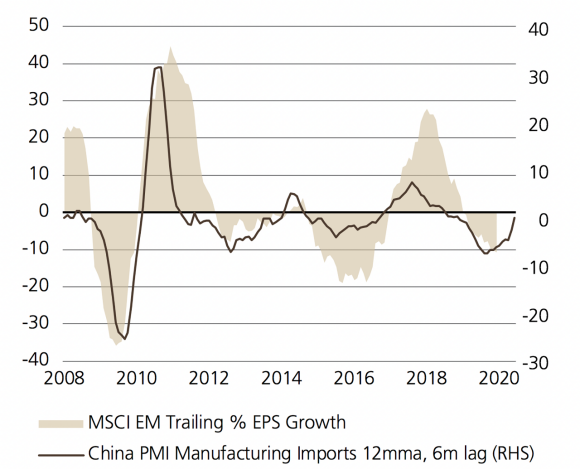

Exhibit 2: Emerging market profits have been closely connected to Chinese manufacturing growth

In our view, there is an understandable degree of market skepticism about whether the US/China trade truce will hold. More specifically, investors are questioning the viability and enforcement mechanisms for the Phase 1 deal's agreements on China's purchase of US agricultural commodities, the new rules on intellectual property and technology, and improved market access for US companies in China. But while both short-term and structural questions remain, we believe that there is little appetite in the White House in a US election year to threaten global risk assets by renewing trade hostilities. Given the uncertainties of 2019, we believe the absence of any renewed trade tensions is sufficient in itself to bolster business confidence across EM as the year progresses. Our positive view on EM equities therefore assumes neither de-escalation nor reescalation in the US/China trade talks in 2020. We would also emphasize that the risks to the US-China relationship are balanced. Investors should not discount the possibility of further tariff reduction should China show early compliance. Like the Fed, President Trump now owns the ability to 'cut rates,' providing stimulus via tariff reduction in an effort to ease financial conditions.

Exhibit 3: Easier monetary policy globally

Balance of markets with an easing (-1) versus hiking (+1) bias over past 12-18m

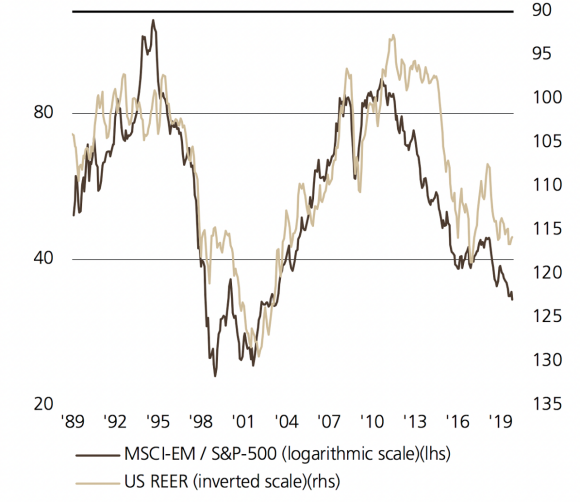

Exhibit 4: The historical relationship between the USD and EM v DM equity performance is well established

MSCI EM v S&P 500 (LHS), USD (RHS, inverted)

Meanwhile, China's targeted support for its manufacturing sector and broader policy stimulus appears to be working. There is compelling evidence that the slowdown is now stabilizing. This suggests that despite its ongoing focus on structural deleveraging, China is willing and able to provide the necessary stimulus to cushion its economy against cyclical domestic and international headwinds.

But does any of this matter in light of the coronavirus? The coronavirus is a wildcard and its impact is hard to quantify. Our current base case is that the virus meaningfully impacts Chinese consumption growth in Q1 and then subsequently fades, setting the stage for a sharp rebound. Importantly, the Chinese authorities have the full policy mix at their disposal to mitigate any more protracted negative impact should it prove necessary: further moderate easing through cuts in benchmark interest rates, and on the fiscal side through increasing government spending on infrastructure investment and other high multiplier spending initiatives. Crucially, we do not currently see the virus derailing the pick up in Chinese manufacturing momentum that began late last year.

The importance of USD

For many investors, it is hard to separate the outlook for emerging market equities from the outlook for emerging market currencies. We see both reacting positively to the improvement in manufacturing and the broader healing of the global economy. We currently favor a number of Latin America currencies including the Brazilian real and Chilean peso, where we see particularly attractive valuations.

Of course, the USD plays a central role in developing economies both as the most popular 'hard' currency for debt and as the pricing currency for key export commodities. Reduced demand for US Treasuries after the recent fall in real yields and the likelihood that monetary policy remains accommodative for the foreseeable future are all likely to limit the upside for the USD. Concerns about this year's presidential election race and the possibility of a significant change in US policy may well disadvantage the USD and US risk assets on a relative basis as 2020 progresses. With explicit penalties for devaluing against the USD embedded in recent trade deals with China, and with Canada and Mexico, the US also appears to be pursuing a quasi-fixed exchange rate regime. To be clear, we do not believe that the USD is set for a material downward repricing. But a number of obvious supports to the USD are now less powerful than they were, and as the fiscal impulse in the US begins to fade and ex-US global growth stabilizes, the risks of a materially stronger USD are diminishing. For EM corporates whip-sawed by currency volatility in recent years, stabilization against the USD represents welcome and important progress in itself.

Exhibit 5: EM Forward EPS starting to turn relative to US

MSCI EM v MSCI USA FY1 EPS Rebased

We see this improving demand and profits backdrop benefiting EM credit too, and expect continued flows towards both local and hard currency EM debt in a world where attractive real yields remain scarce. Within EM credit we believe that Asian bonds offer one of the most attractive risk/reward trade-offs, with Asian corporates benefiting from the lagged impact of recent Chinese monetary policy loosening. Spreads for Asian bonds over US Treasuries are only about average for this stage of the Chinese demand cycle, but this compares favorably to the stretched valuations elsewhere in global credit.

EM equity valuations also stand broadly in line with their long-term average on most major valuation metrics, including P/E. In the developed world, equity valuations vary markedly, but with the heavyweight US in particular standing out as stretched on traditional earnings measures, EM equities compare favorably to DM overall. Yes, there is scope for relative multiple expansion for EM equities. But this is not our base case. Our positive view is based predominantly on improving fundamentals for EM demand and corporate profitability rather than being driven by relative valuation. We simply ascribe a greater likelihood of earnings upgrades in EM as we see the region's corporates benefitting from a more stable currency backdrop and from a manufacturing and trade-led global demand bounce.

Is 2020 going to be the year the EM asset classes return to the spotlight? We think so. While the coronavirus has the potential to impact demand significantly, our base case is that the virus has only a short-term impact on demand that does not extend into the second half of the year. Emerging market economies were hardest hit by the downturn in manufacturing and trade in 2018 and 2019. Simply put, we believe that they are the most leveraged to the rebound.

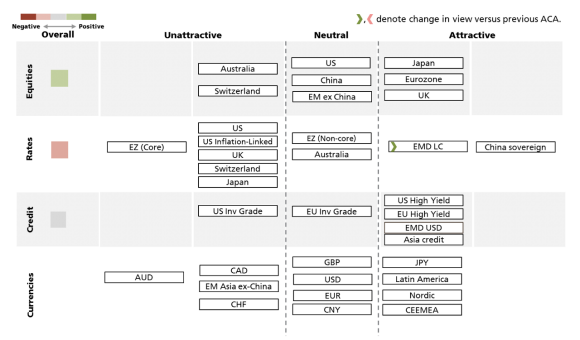

Asset class attractiveness

The chart below shows the views of our Macro Asset Allocation Strategy team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 28 January 2020.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.