Some real assets are already playing a role in addressing investors’ ESG concerns, so will the initiatives underway be an important value driver when thinking about the valuation and performance of real asset portfolios?

What factors have driven the positive shift in real assets?

What factors have driven the positive shift in real assets?

The increased emphasis on topics related to climate change and the factors which can impact an asset’s operations and affect the environment, whether this be in its direct operations or across its supply chains, are just some of the key drivers.

Firms are being faced with these realities and the importance and need to implement strategies to identify and mitigate risks associated with climate change into their asset and fund policies and practices.

Data and performance measurement also has an important role to play. For example, we recently signed an agreement with Four Twenty Seven, provider of data and market intelligence, to provide forward looking climate risk measurement data (floods, sea level rise, wind, heat) for all our strategies globally.

From a social perspective, the impacts to health and well-being of for example, building occupants, employees, or indoor environmental quality are also factors now higher on investors’ minds. Increasing tenant engagement is providing more transparent reports on an asset's progress as a whole.

And in the area of food & agriculture, for example, consumers are not just concerned with the environmental sustainability of their food products, they are also interested in the social implications of product origins, such as the well-being of the farmer who grew their food. Third-party certifications such as the Leading Harvest Farmland Management Standard can address economic, environmental, social and governance issues in agriculture. Consumer pressure adds weight to this element too and can be seen in the growing demand for fresh food and online deliveries, which is increasing the need for cold storage, to ultimately reduce food waste.

ESG issues are being driven by recent legislative and reporting developments, such as the EU Sustainable Finance Disclosure Regulation (SFDR), Task Force on Climate-Related Financial Disclosures (TCFD), 2015 Paris Agreement on climate change and third-party industry benchmarks such as UN PRI and GRESB.

These developments reflect the urgency to measure, mitigate and report environmental risks related to climate change. ESG is no longer born from a sense of doing good but is becoming a key part of a business’s strategy.

Does sustainable investing mean giving up on performance opportunities?

Does sustainable investing mean giving up on performance opportunities?

There is a monumental shift in expectations and how private and public companies conduct themselves.

This behavioral shift is creating investment growth opportunities as businesses adapt. For example, investing in a new office building means thinking about creating an environmentally sound building. This potentially attracts higher paying tenants and ultimately creates higher economic value for the building.

Encouraging economic investment in historically underinvested areas promotes long-term growth while at the same time has a positive impact on the community. And finally, better governance will encourage firms to incorporate environmental and social consequences into their business objectives, which ultimately can have a positive impact on their valuations.

Industry benchmarks such as GRESB and UN PRI are examples which can allow investors to examine their performance and gain valuable insight into how to better integrate ESG into investments, strategy, and overall performance.

Related

Real estate

Real estate

Global scale, breadth and depth

What are the main areas of focus for investors in the next 10 years?

What are the main areas of focus for investors in the next 10 years?

The options for investors to gain exposure to ESG have never been greater.

This has risen in parallel with the tremendous growth in the amount of investment capital moving into climate change, environmental issues and sustainable investing.

Costs are likely to rise as climate risk is priced into clean energy, supply chains and sustainable goods but innovations in technology will likely increase in importance as part of this transition.

This represents more than a third of the USD 140.5 trillion in projected total assets under management.

The International Energy Agency (IEA), the UK’s prime minister and leading economists are among those calling for a green recovery that aims to ‘build back better’ by reducing emissions and putting people and the planet first.

This means implementing strategies (energy efficiency, increased production of clean energy such as solar, and directly purchasing clean energy) to reduce the carbon footprint of our assets and portfolios.

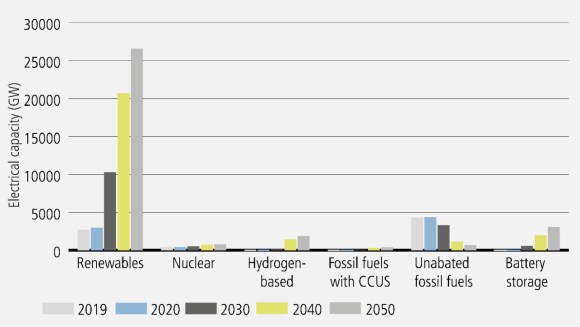

Recent IEA data, which shows the current pathway to net zero, summarizes how global capacity needs to change: more renewables and storage, less coal and gas, unless more carbon capture storage (CCS) technology is used.

Energy scenario projections

Energy scenario projections

Finally, firms and individual investors are likely to face risk in the form of more regulation and changes in investor behavior as a result of changing strategies, policies or investments as society and industry work to reduce its reliance on carbon and impact on the climate. Costs are likely to rise as climate risk is priced into clean energy, supply chains and sustainable goods, but innovations in technology will likely increase in importance as part of this transition.

Related

Real Estate outlook

Real Estate outlook

Insights on real estate investing in a post-COVID world

PDF

Investment outlook 2022

Investment outlook 2022

As we work towards building a more sustainable future and continue to face global supply chain and inflation challenges, what role will asset managers play, and how will this reshape the economy?

Was this article helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.

About the authors

Darren Rabenou

Head of ESG Investment Strategies and Head of Food & Agriculture

Darren Rabenou is the Head of Food & Agriculture at UBS-AM Real Estate & Private Markert's Division. He oversees the UBS Farmland business and other food-related investment strategies. Darren serves on the investment committee for UBS’s food cold storage development strategy and represents REPM on the Sustainable Finance Committee. He has over 30 years of investment experience and before joining UBS, Darren was a partner at Fabbri Group, Managing large-scale farmland operations in California and Portugal.

Darren Rabenou

Head of ESG Investment Strategies e Head of Food & Agriculture

Darren Rabenou è Head of Food & Agriculture della divisione UBS AM Real Estate & Private Market. Supervisiona le attività UBS Farmland e altre strategie legate al settore alimentare. Fa parte del comitato d'investimento per la strategia di sviluppo delle celle frigorifere alimentari di UBS e rappresenta REPM nel Sustainable Finance Committee. Ha oltre 30 anni di esperienza negli investimenti e prima di entrare in UBS è stato partner del Gruppo Fabbri, gestendo operazioni agricole su larga scala in California e Portogallo.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.