With major economies embarking on a pathway to increased use of renewable energy, how can we identify the winners and losers that will emerge as the world shifts toward a more sustainable, low carbon economy?

As the energy transition continues to unfold, the challenges of evolving away from traditional fossil fuel energy sources are becoming increasingly apparent, and it is clear that the transition to a lower carbon future will not be a smooth glide path, but one with uncertainty and unintended consequences.

A coordinated effective global policy solution facilitating this herculean effort must satisfy a range of constituents with varying levels of commitment and abilities to contribute. We continue to expect that ongoing dislocations in capital flows, investment cycles and commodity prices will provide a steady stream of alpha opportunities going forward across sectors, themes and geographies with many structural winners and losers.

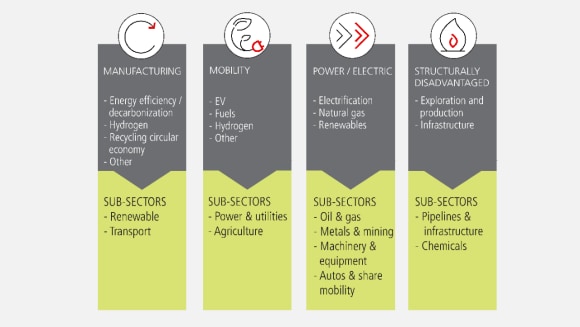

Energy themes and sub-themes span sectors

Energy themes and sub-themes span sectors

The challenge ahead

The challenge ahead

Over the next several decades, historic levels of capex will be required to transform the energy supply mix from fossil fuels to renewable power to support the goals set forth in the Paris Agreement.

This monumental challenge will require many trillions of dollars of investment and call on many traditional and new supply chains that will also need substantial investments to keep up with renewable energy growth. We believe the supply chains into renewable energy provide a robust opportunity set for investment.

The global capital markets will play an instrumental role in determining the direction and pace of the energy transition. We believe this process already has begun, with many solution providers and facilitators commanding higher valuations and lower costs of capital.

In contrast, structurally disadvantaged industries are facing a shrinking investor base and more limited access to capital markets. Capital flows, oftentimes influenced by policy directives, will serve as a self-reinforcing mechanism that will drive the pace of the transition.

Decarbonization drive

Decarbonization drive

The market will likely reward the providers of new technologies that advance decarbonization and those who are executing on well-positioned business models, and on the flipside, punish those that are not able to pivot or have constraints around access to capital.

Sectors that had been sleepy now have dynamic growth profiles, and some historically cyclical sectors likely have multi-decade secular tailwinds.

The utility sector is a prime example. Utilities contribute over 40% of energy-related CO2 emissions globally, while at the same time holding the key to decarbonizing other sectors of the economy through electrification.

The precipitous decline in the cost of renewable generation has opened the door to large scale, commercial decarbonization more quickly than many anticipated. Despite continued improvement in energy efficiency, we expect the demand for electricity to increase materially as large swaths of the economy transition from conventional fuel sources to electricity.

Due to their low cost of capital and considerable ability to control their own destinies by decarbonizing their production portfolios to drive “green” electrification, we believe that policymakers will be motivated to continue to provide support to utilities to achieve stated decarbonization goals.

The decarbonization of the power generation sector is an indispensable component of the energy transition. With utilities entering into a long-term growth phase, as they transition their generation fleets away from fossil fuels and towards renewables, an argument can be made that traditional valuation metrics may no longer apply and utilities should be valued through more of a “growth” lens.

As policy makers continue to provide these benefits with increasing clarity on the longevity of renewable generation assets, the market is likely to discount projections further out, pulling that value forward for investors.

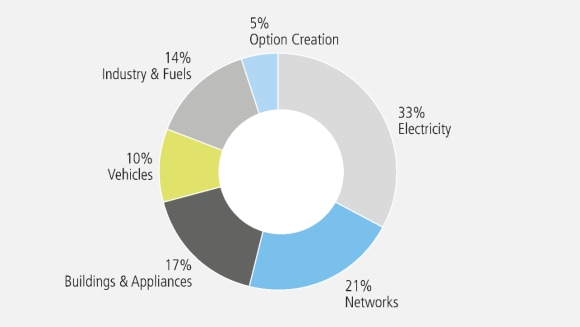

EUR 7tn investment required by 2050

EUR 7tn investment required by 2050

USD 2.5tn investment required 2021-2030

USD 2.5tn investment required 2021-2030

Many disrupted companies and industries that are not well positioned to adapt could face increasing earnings pressure and multiple compression. As corporations look to reposition to better align with decarbonization, excess invested capital may pressure returns and create mini-cycles. We believe companies with largely protected business models or markets can thrive, while those looking to compete only with low-cost capital will struggle.

We see strong tailwinds behind the energy transition themes that drive investment opportunities. Climate friendly government policies and rapidly improving technologies should continue to push the world’s major economies toward decarbonization. We continue to believe the energy transition will present unprecedented investment opportunities, both long and short, with a decade or more of visibility on key structural themes.

PDF

Investment outlook 2022

Investment outlook 2022

As we work towards building a more sustainable future and continue to face global supply chain and inflation challenges, what role will asset managers play, and how will this reshape the economy?

Was this article helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.

About the authors

Julie Trent

Head of Partner Relations and Communication, UBS O'Connor

Ken Geren

Portfolio Manager UBS O‘Connor

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.