Retiring old clichés

Bucking convention, retirees find happiness and seek growth

Age 65.

Age 65.

It used to be the trigger for retirement. And for many investors, age is still important. But most wealthy investors are focused on achieving financial well-being before they retire.

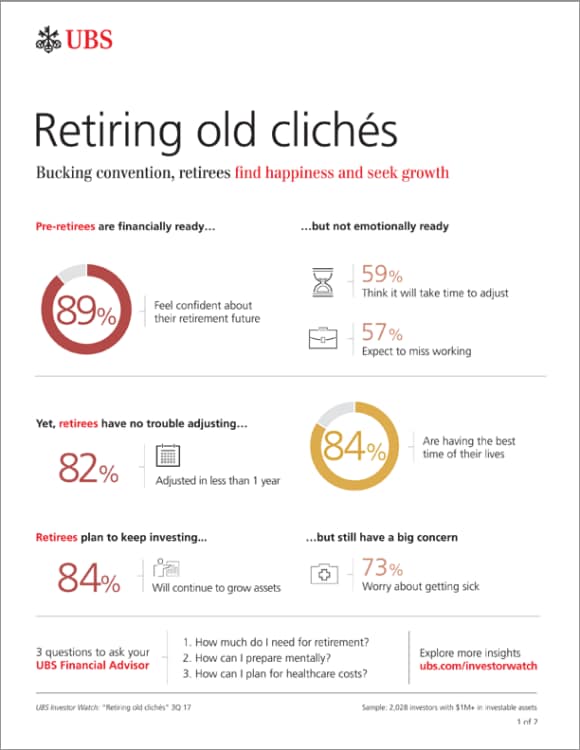

Wealthy investors on the cusp of retirement are set on reaching a specific savings goal. Whatever their individual target may be, the vast majority of these wealthy Baby Boomers are highly confident they will have enough saved for retirement.

After they retire, however, many wealthy investors don’t take a conservative approach with their portfolios. They often have Social Security, pension and dividend income to cover everyday liquidity needs, freeing them to focus on longevity and legacy goals.

In fact, 84% of wealthy retirees plan to grow their assets regardless of age. For this reason, they are comfortable maintaining, and in some cases increasing, their equity exposure in retirement.

Interestingly, financial security is only part of the retirement calculus for wealthy investors. Even with money in the bank, the prospect of leaving colleagues, filling the hours and losing purpose keeps many wealthy Boomers working. Based on the experience of retirees, however, their anxiety is unfounded. The vast majority of wealthy investors are happier in retirement than they have ever been.

If Boomers pondering retirement can make the leap, they may be happier for it.

Wealthy pre-retirees base retirement readiness on assets…

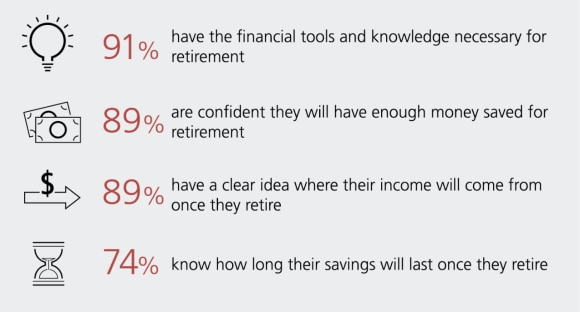

In assessing their retirement readiness, wealthy pre-retirees differ from other investors in two key respects. First, the majority of wealthy pre-retirees (66%) are focused on hitting a certain asset level before retiring, citing financial security as the main trigger for walking away from work. In contrast, investors with fewer assets believe reaching a specific age is the main reason to retire.

Second, wealthy pre-retirees do not worry about having enough money to last. Nine in ten are confident they are well prepared financially for retirement compared to two-thirds of investors with fewer assets.

Wealthy pre-retirees are confident about their retirement future

Percentage who agree with each statement

I have been saving money for more than 40 years. I have homes and other property. I have life insurance. I have everything I need.

I am more financially prepared than mentally based on my calculations. I could retire in the next 5 years.

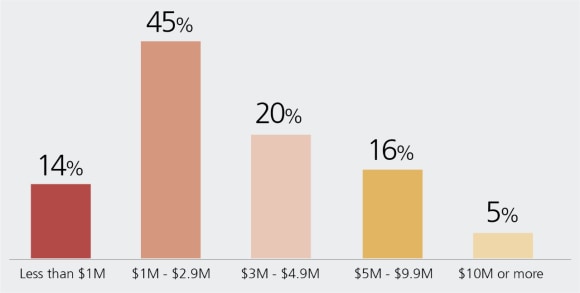

…and they have a specific savings target in mind

Wealthy pre-retirees want to reach a specific savings level before they retire. The ideal number ranges across a wide spectrum and depends on a variety of factors, such as goals, expected income and spending.

The vast majority of wealthy pre-retirees indicate that their retirement savings are in liquid assets, primarily held in traditional retirement accounts such as IRAs and 401(k) plans. They also hold taxable investments, banking accounts and, to a lesser extent, real estate.

Wealthy pre-retirees know their retirement number

Distribution of retirement savings goals

I have over $1 million in my 401(k). I will use that to supplement my pension until I take Social Security.

I have been investing for over 35 years. Assets are 100% in place where I can retire any time I want and never change my lifestyle.

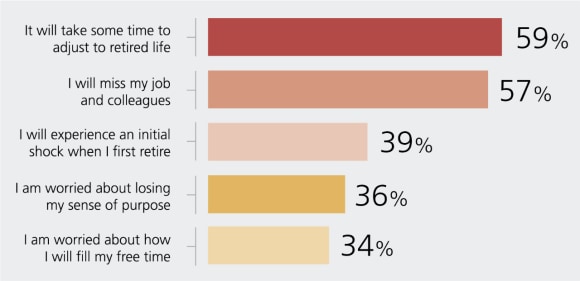

Emotional anxiety keeps wealthy pre-retirees from making the leap…

Wealthy pre-retirees are more concerned with being emotionally ready for retirement than being financially ready. Many worry about leaving colleagues behind, filling their free time and finding purpose. In fact, many believe not having a schedule in retirement will be harder than not collecting a paycheck.

Wealthy pre-retirees will miss their schedule more than their salary

Which one will you find harder to adjust to in retirement?

Percentage who agree with each statement

Psychological preparation is critical. I think it’s important to want to retire, or at least be content with the idea.

I’m not sure how bored I will be if I do not to go to work every day.

…but wealthy retirees have no trouble adjusting to their new life

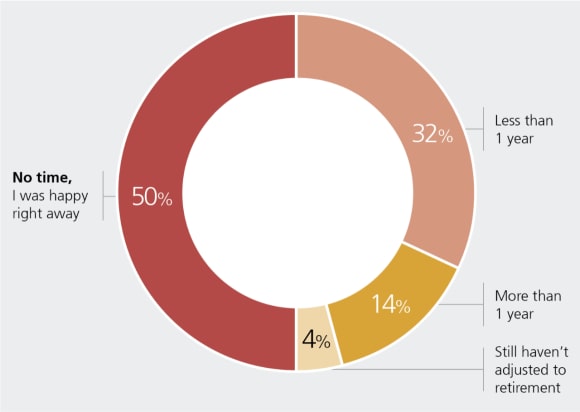

In stark contrast to the fears of pre-retirees, most retired investors adjusted quickly and easily to retired life. Half took no time at all to adjust. Another third took less than a year. In fact, if today’s retirees had to do it over again, only 19% would have delayed their retirement.

Retirement a quicker adjustment than expected

Time needed to adjust to retirement

Lots of us worry that we never developed interests because we were so busy working, but somehow my days are filled to the extent I wish.

I am totally enjoying retirement. Less pressure, fewer responsibilities, no deadlines. This has been the best time of my life by far.

Wealthy investors reach peak happiness in retirement…

A full 84% of wealthy retirees say they are happier than at any point in their lives. Still healthy and on solid financial footing, 90% are most satisfied with life in their 60s and 70s - higher than investors in any other age group.

Health and wealth are the primary reasons, but many retirees cite free time, self-confidence and less stress as major factors as well.

Wealthy investors are most satisfied in their 60s and 70s

Percentage very satisfied with their life today by age group

If I could have done anything differently it’s that I wish I had retired earlier. I’d have more time with my wife.

Retirement is like being a kid again, but with money and no curfew.

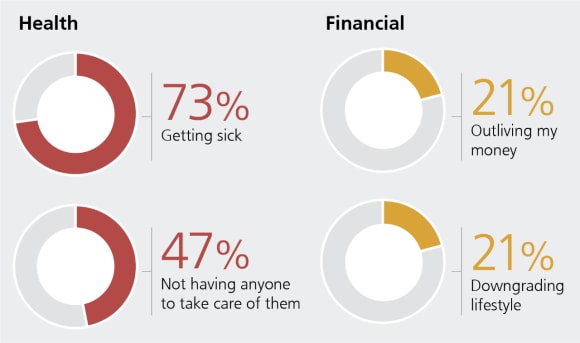

…but health fears outweigh financial concerns

With a high degree of confidence in their financial stability, wealthy retirees worry far more about potential health issues. For example, few fear that they will outlive their money, but nearly three quarters worry about getting sick.

However, it appears that wealthy retirees have not fully integrated potential healthcare costs into their retirement plans. For example, 88% say they are prepared for retirement, but less than half feel secure about their health and long-term care planning.

Health is the top concern for wealthy retirees

Percentage worried about each

My biggest worry is one or both of us having a serious health issue that will impact our independence.

I am not worried about outliving my assets. I have more assets than I can possibly spend in my remaining lifetime.

Wealthy retirees plan to continue growing assets…

In addition to retirement savings, wealthy retirees also rely on Social Security, dividends and pensions for income. With funds set aside to cover their liquidity needs, the majority are investing more aggressively for a retirement that may last decades. Many wealthy retirees are also investing to build a legacy for future generations.

Wealthy retirees are seeking portfolio growth

Percentage who agree with each statement

Our spending is covered by our Social Security, my husband’s pension and interest earned every month. The rest is in investment accounts and that will be passed on to our children.

It can help in future planning to have money organized into short, mid and long-range buckets.

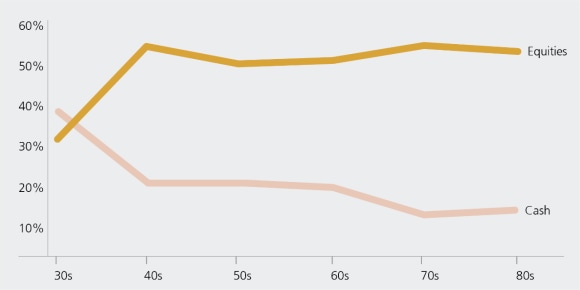

…by maintaining their equity exposure in retirement

The old rule of thumb to hold equities equal to 100 minus one’s age does not resonate with wealthy retirees anymore. In fact, 60% disagree with this guideline. After retirement, the majority of wealthy investors actually maintain or increase their equity exposure for long-term growth.

Wealthy retirees maintain equity levels

Cash & equity allocations by age group

I never followed the traditional rule of investing nor believed in it. I feel holding cash and or bonds just reduces your return over time.

I would have missed a lot of capital gains if I had invested less in stocks, especially since the downturn.

Connect with your UBS Financial Advisor today

About the survey

About the survey

UBS Wealth Management Americas surveys U.S. investors on a quarterly basis to keep a pulse on their needs, goals and concerns. After identifying several emerging trends in the survey data, UBS decided in 2012 to create the UBS Investor Watch to track, analyze and report the sentiment of affluent and high net worth investors.

UBS Investor Watch surveys cover a variety of topics, including:

- Overall financial sentiment

- Economic outlook and concerns

- Personal goals and concerns

- Key topics, like aging and retirement

For this twentieth edition of UBS Investor Watch, we revisited the retirement concepts introduced in 2013 in the “80 is the new 60” Investor Watch report. This time, we surveyed 2,028 affluent and high net worth investors (with at least $1 million in investable assets) from June 8 – 13, 2017, including 475 with at least $5 million. With 94 survey respondents, we conducted qualitative follow-up interviews.