Research & Insights

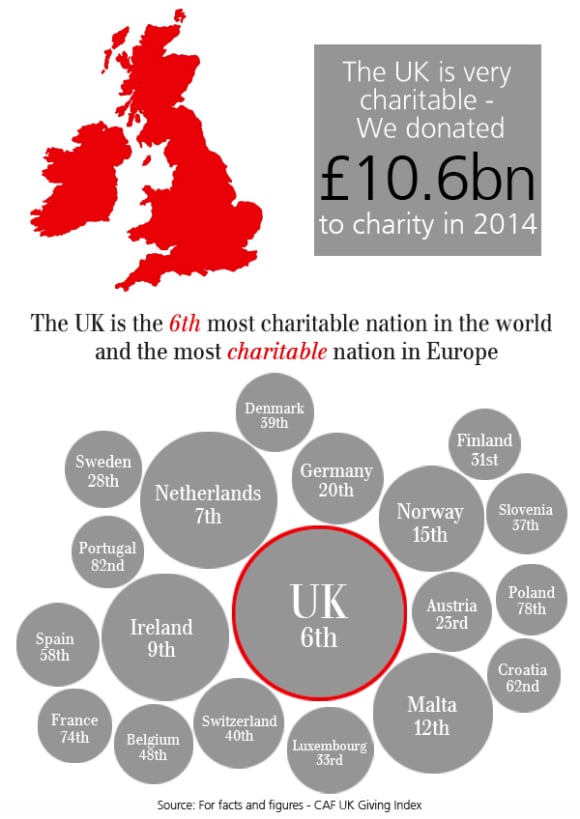

How generous are we?

How generous are we?

The price and value of investments and income derived from them can go down as well as up. Capital held in this account is therefore at risk. Tax treatment depends on individual circumstances and may be subject to change in future. UBS does not provide tax advice.

A client's experience

Did you know?

Did you know?

You can give to exempt charities

As well as UK registered charities you can also instruct grants to exempt charities, such as:

- Higher Education foundations and universities

- Community Societies

- Museums and Galleries

- Academy Trusts

Visit the Charity Commission website for more information about exempt charities.

You can donate the investment income

You can make donations with the income from the underlying investment portfolio – allowing you to have a separate giving plan of giving for the capital.

Do you still have questions?

Do you still have questions?

If you still have questions, we would be pleased to help answer them for you.