Unsere Expertise

Gehen Sie eine Partnerschaft mit einem der weltweit wachstumsstärksten ETF-Manager ein, der Ihnen dank seiner Expertise viele verschiedene Lösungen anbieten kann, die genau auf Ihre Bedürfnisse zugeschnitten sind und der über wertvolle Erfahrungen aus mehr als 30 Jahren erfolgreicher Arbeit verfügt.

Was uns von Mitbewerbern unterscheidet

Auswahl

Mit nur einer Transaktion haben Anleger dank unserer breiten Palette an ETFs aus den Anlageklassen Aktien, Anleihen, Rohstoffe, Edelmetalle und Immobilien Zugang zu zahlreichen Märkten.

Expertise

Profitieren Sie von unserem Status als einer der erfahrensten europäischen ETF-Anbieter. Wir bieten hochwertige Indexreplikationsstrategien an – unterstützt durch ein erfahrenes und kompetentes Portfoliomanagementteam.

Anerkennung

Unsere Auszeichnung als Passive Manager of the Year 2021 bei den Insurance Asset Risk EMEA Awards war die jüngste in einer ganzen Reihe von Auszeichnungen, die wir in den vergangenen Jahren für unsere ETF-Kompetenzen erhalten haben.

Unsere ETF-Kompetenzen

Aktien

Mit nur einer einzigen Transaktion erhalten Sie mit unseren UBS Aktien-ETFs Zugang zu den wichtigsten Aktienmärkten der Welt.

Festverzinsliche Anlagen

Investieren Sie in liquide und gut diversifizierte Segmente des Anleihenmarkts, beispielsweise Unternehmens-, Staats- oder Schwellenländeranleihen.

Nachhaltige Anlagen (SI)

Unsere nachhaltige Reise begann 2011 mit der Auflegung unserer vier ersten SRI ETFs. Als Pionier in diesem Bereich bieten wir Ihnen eine breite Palette an Lösungen an, mit denen Sie Ihre ESG-Ziele erreichen können.

Währungsabsicherung

Mit unserem großen Angebot an währungsabgesicherten UBS ETFs können Sie Ihr Portfolio gegen Wechselkursschwankungen absichern.

Rohstoffe

Diversifizieren Sie Ihr Portfolio mit unseren kostengünstigen und liquiden Rohstoff-ETFs.

Alternatives Beta

Konzentrieren Sie sich auf systematische faktorbasierte Indizes, um Märkte intelligenter abzubilden als nur anhand der Marktkapitalisierung, während Sie gleichzeitig Diversifizierungsvorteile anstreben.

Klimalösungen

Verringern Sie mit unseren kostengünstigen, regelbasierten MSCI Climate Paris-Aligned- und Climate Aware ETF-Lösungen Ihr Engagement in kohlenstoffintensiven Branchen und richten Sie Ihr Portfolio auf eine Netto-Null-Zukunft aus.

UBS ETF Capital Markets Weekly

UBS ETF Capital Markets Weekly

Werfen Sie einen Blick auf unseren ETF Capital Markets Weekly. Das Dokument beleuchtet die für UBS ETFs relevanten Primärmarktaktivitäten, die größten Sekundärmarktgeschäfte, einen Marktüberblick sowie einen Ausblick auf die kommende Woche. Viel Spaß beim Lesen.

ETF-Handel

UBS ETF Capital Markets

Das ETF Capital Markets Team hilft Kunden, den ETF-Handel zu verstehen, und erklärt ihnen, warum Wettbewerb eine zentrale Voraussetzung für bestmögliche Ausführung ist. Eine mangelhafte Ausführung beim ETF-Handel kann kostspielig sein und die Vorteile, die die ETF-Mantelstruktur im Hinblick auf Transparenz, Liquidität und Ausführungssicherheit mit sich bringt, wieder zunichtemachen.

Wissenswertes über den ETF-Handel

Das UBS ETFs Team hält sich immer über die aktuellsten Entwicklungen auf dem Laufenden und präsentiert proaktiv neue passive Lösungen, die sich für viele verschiedene Präferenzen moderner Anleger eignen.

Clemens Reuter, Global Head of ETF & Index Fund Client Coverage

Häufig gestellte Fragen zu ETFs

Häufig gestellte Fragen

Ein börsengehandelter Fonds (ETF) («Exchange Traded Fund», ETF) ist ein Anlagefonds, der die Wertentwicklung des ihm zugrunde liegenden Index abbildet und der an der Börse ge- und verkauft werden kann. Genau wie ein klassischer Fonds ist auch ein ETF ein Anlagefonds und damit nicht von einer Zahlungsunfähigkeit des ETF-Anbieters betroffen. Er bietet die Vorteile eines Fonds für gemeinsame Anlagen, wird aber wie eine Aktie gehandelt.

ETFs können zu jeder Tageszeit an der Börse oder außerbörslich gehandelt werden. Da ETFs an einen zugrunde liegenden Index gekoppelt sind, sind sie passive Anlageinstrumente, die lediglich die Wertentwicklung ihres Basiswerts nachvollziehen. Anders ausgedrückt: Steigt der Wert des zugrunde liegenden Index, steigt auch der Wert des ETF.

In den USA kamen die ersten ETFs 1993 an die Börse, Europa folgte dann 1999. Seitdem ist die Zahl der verfügbaren ETFs konstant gestiegen. Üblicherweise sind ETFs passive Indexfonds, aber seit 2008 sind auch aktiv verwaltete ETFs zugelassen, die eine Portfoliomanagement-Strategie erfordern.

UBS ETFs sind auf eine Vielzahl von Basiswerten in einer Reihe von unterschiedlichen zugrunde liegenden Anlageklassen (z. B. Aktien, Anleihen, Rohstoffe, Edelmetalle und Immobilien) verfügbar. So erhalten Anleger mit nur einer einzigen Transaktion Zugang zu zahlreichen Märkten. Anleger können auch die von ihnen bevorzugte Replikationsmethode wählen, denn UBS bietet ein breites Spektrum an physisch und synthetisch replizierten ETFs an.

Diversifikation

Mithilfe von ETFs können Sie Ihr Portfolio auf besonders kostengünstige und effiziente Weise diversifizieren, indem Sie Risiken auf mehrere Risikoträger verteilen und so das Risikoprofil Ihrer Anlage optimieren. Da ETFs einen Index abbilden, können Sie mit nur einer einzigen Transaktion einen ganzen Markt abdecken.

Flexibilität

ETFs können ganz einfach gekauft und wieder verkauft werden – auch innerhalb eines Tages. Anleger können innerhalb von Sekunden eine Marktmeinung umsetzen. Aufgrund dieser Eigenschaften können ETFs in vielfältiger Weise als Teil einer Anlagestrategie eingesetzt werden: für langfristiges Wachstum, kurzfristige Handelsmöglichkeiten oder zur teilweisen Absicherung eines Portfolios.

Transparenz

ETFs sind besonders transparente Anlageinstrumente, denn sie erzielen die Wertentwicklung des ihnen zugrunde liegenden Index abzüglich der Gebühren. Alle wichtigen Handels- und anderen Informationen können auf Tagesbasis oder in Echtzeit eingesehen werden. Bei UBS ETFs wird der indikative Nettoinventarwert während der üblichen Handelszeiten alle 15 Sekunden berechnet.

Kosteneffizienz

Bei ETFs fallen keine Ausgabe- oder Rücknahmeaufschläge an, sondern lediglich die Transaktionskosten für Kauf oder Verkauf eines ETF. Darüber hinaus fällt lediglich eine geringe Verwaltungsgebühr an.

Sicherheit

Ebenso wie herkömmliche Fonds stellen ETFs ein Sondervermögen dar. Sie sind von einer eventuellen Insolvenz des ETF-Anbieters oder der Depotbank nicht betroffen, da das Fondsvermögen nicht in die Konkursmasse einbezogen wird.

Das Ziel eines börsengehandelten Fonds («Exchange Traded Fund», ETF) ist es, den Index, auf den sich der ETF bezieht, möglichst exakt abzubilden und Anlegern in den ETF so die gleiche Wertentwicklung zur Verfügung zu stellen wie der dem Index zugrunde liegende Markt.

Indizes beruhen jedoch auf theoretischen Berechnungen. Das bedeutet, dass Kosten, die beispielsweise für den Kauf oder Verkauf von im Index enthaltenen Titeln in der Praxis entstehen, in die Berechnung des Index keinen Eingang finden. Sollen ein Index und seine Wertentwicklung für ein Investment nachgebildet, d.h., repliziert werden, fallen diese Kosten jedoch an.

Daher ist es besonders wichtig, wie genau ein ETF der Wertentwicklung des ihm zugrunde liegenden Index folgt. Im Idealfall unterscheidet sich die Wertentwicklung des ETF einzig durch die anfallenden Kosten und Gebühren von der des Index. Da Indizes, die beispielsweise nur den Aktienmarkt eines einzigen Landes abbilden, andere Anforderung an die Indexreplikation stellen als ein Index, der Titel aus mehreren Ländern enthält, unterscheiden sich die Anforderungen an eine exakte Indexreplikation von Index zu Index. Daher setzen UBS ETFs unterschiedliche Methoden der Indexreplikation ein.

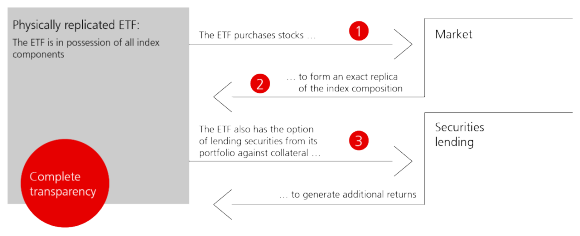

Vollständige physische Replikation

Der ETF investiert in die im Index enthaltenen Titel in dem gleichen Verhältnis, wie sie im Index enthalten sind.

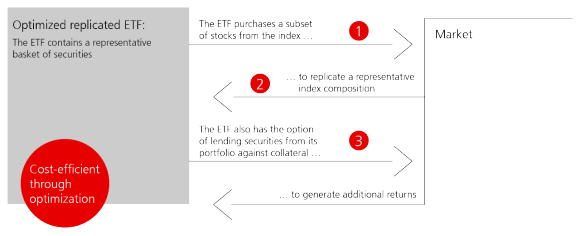

Optimierte physische Replikation

Der ETF investiert nur in diejenigen Titel im Index, die benötigt werden, um eine sehr ähnliche Wertentwicklung wie der Index zu erzielen.

Synthetische Replikation

Der ETF investiert in ein Wertpapier-Portfolio und tauscht dessen Wertentwicklung gegen die des Index.

Der Kaufprozess ist bei allen Replikationsmethoden prinzipiell identisch – eine physische Lieferung der Wertpapiere erfolgt jedoch nur bei physisch replizierten ETFs.

- Der Anleger kauft ETF-Anteile über die Börse oder direkt bei einem Market Maker oder einem autorisierten Partner (OTC-Handel)

- Der Market Maker bzw. der autorisierte Partner zahlt Barmittel (bei physisch und synthetisch replizierten ETFs) an den ETF oder liefert diesem die benötigten Wertpapiere (nur bei physisch replizierten ETFs)

Bei der vollständigen physischen Indexreplikation erwirbt der ETF alle im zugrunde liegenden Index enthaltenen Wertpapiere entsprechend ihren Indexgewichtungen. Der ETF befindet sich dadurch im physischen Besitz der Indexkomponenten und ist so ein genaues Abbild des Index. Kommt es im Index zu Änderungen, etwa durch Indexanpassungen oder Kapitalmaßnahmen der enthaltenen Wertpapiere, vollzieht der ETF diese nach, was regelmäßige Transaktionen notwendig macht. Der ETF schüttet Erträge – beispielsweise Dividenden oder Zinscoupons – regelmäßig aus.

Die vollständige physische Replikationsmethode zeichnet sich durch Einfachheit und einen minimalen Tracking Error aus.

Wertpapierleihe

Um zusätzliche Erträge zu erzielen und die Nettokosten für die Anleger zu senken, führen einige ausgewählte physisch replizierte ETFs Wertpapierleihgeschäfte durch. Dabei werden Wertpapiere des ETF gegen Gebühr verliehen. Wertpapierleihgeschäfte von UBS ETFs sind zu mindestens 105 Prozent überbesichert.

Bei der optimierten physischen Replikationsmethode ist der ETF im Besitz eines Teils der im zugrunde liegenden Index enthaltenen Wertpapiere. Mithilfe von Analysetools und mathematischen Optimierungsverfahren wird eine Teilmenge der Indexkonstituenten festgelegt, die eine ähnliche Rendite wie die ursprünglich im Index vertretenen Aktien erzielt. Mit der optimierten physischen Replikation kann die Liquidität erhöht und der Tracking Error minimiert werden.

Die optimierte physische Replikationsmethode ist besonders für sehr breit angelegte Indizes geeignet. So umfasst beispielsweise der MSCI World Index ca. 1600 Aktien aus unterschiedlichen Märkten, Rechts- und Währungsräumen. Daher wäre eine vollständige physische Replikation des Index mit hohen Transaktionskosten verbunden. Einige dieser Werte sind nur wenig liquide bzw. haben aufgrund ihrer geringen Gewichtung nur wenig Einfluss auf die Wertentwicklung des Index. Durch den Verzicht auf diese Werte können die Transaktionskosten gesenkt werden.

Verschiedene Faktoren fließen in die Preisbildung für ETFs ein und haben Einfluss auf die Kosten der einzelnen ETFs. Die Gesamtkosten eines ETF hängen in hohem Maße von der von Ihnen gewählten Portfoliostrategie sowie der Anlageklasse ab, in die der Fonds investiert. ETF-Gebühren sind niedriger als die Gebühren traditioneller Anlagefonds, allerdings gibt es viele verschiedene Preisbedingungen. Auch die ETF-Spreads variieren in Abhängigkeit von der ETF-Aktivität.

Die Tracking-Differenz ist die Differenz zwischen der Wertentwicklung des Fonds und der Wertentwicklung des Index. Die Wertentwicklung des Fonds gibt alle Kosten des Fonds und alle Ertragsströme in den Fonds an. Sowohl die Total Expense Ratio des ETF als auch die Tracking-Differenz werden im Halbjahres- und Jahresbericht des Fonds veröffentlicht.

Die Total Expense Ratio (TER) ist das Verhältnis zwischen den Gesamtkosten und der durchschnittlichen Größe eines Fonds während eines Geschäftsjahres. Als Kosten gelten dabei alle Aufwendungen gemäß Erfolgsrechnung, einschließlich Management-, Verwaltungs-, Depot-, Revisions-, Rechts- und Beratungsgebühren (Betriebsaufwand). Die Total Expense Ratio des ETFs wird rückwirkend als Prozentsatz des Durchschnitts-Fondsvermögens ausgedrückt und nach den Richtlinien zur Berechnung und Offenlegung der TER von kollektiven Kapitalanlagen berechnet.

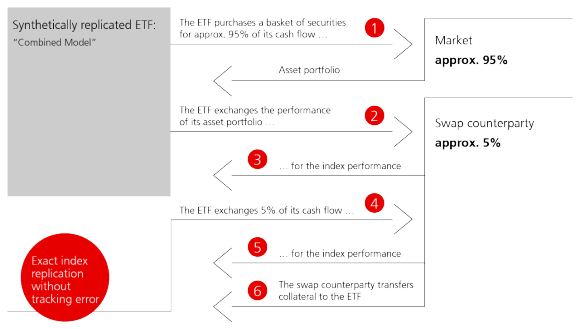

Bei der synthetischen Indexreplikation wird die Wertentwicklung des dem ETF zugrunde liegenden Index durch ein Tauschgeschäft (engl. «Swap») erzielt. Der ETF geht mit einer Investmentbank, der Swap-Gegenpartei, eine Vereinbarung ein («Swap-Vereinbarung»). Gegenstand dieser Vereinbarung ist die Übertragung von Geldflüssen des ETF auf die Swap-Gegenpartei, die dem ETF im Gegenzug die Wertentwicklung des abgebildeten Index garantiert. Das Risiko einer präzisen Indexabbildung wird vom ETF auf die Swap-Gegenpartei übertragen. Weil das physische Eigentum der im Index enthaltenen Werte nicht mehr Voraussetzung für die Partizipation an der Wertentwicklung des Index ist, können beispielsweise Märkte, die aufgrund von Handelsrestriktionen nicht oder nur schwer zugänglich sind, effizient abgebildet werden.

UBS setzt bei der synthetischen Replikation zwei verschiedene synthetische Swap-Strukturen ein: den vollständig abgesicherten Swap (Fully Funded Swap) und ein kombiniertes Modell (Fully Funded Swap/Total Return Swap und Asset-Portfolio).

- Der ETF erwirbt einen Korb von Wertpapieren mit ca. 95% seiner liquiden Mittel.

- Der ETF verpflichtet sich gegenüber der Swap-Gegenpartei zur Zahlung der Performance des Korbs.

- Die Swap-Gegenpartei verpflichtet sich ihrerseits zur Zahlung der exakten Indexperformance (abzüglich einer Gebühr).

- Der ETF schließt eine Vereinbarung über einen Fully Funded Swap mit der Swap-Gegenpartei über ca. 5% seiner liquiden Mittel.

- Die Swap-Gegenpartei schuldet die exakte Indexperformance (abzüglich einer Gebühr).

- Die Swap-Gegenpartei überträgt dem ETF Sicherheiten in Form von G10-Staatsanleihen, supranationalen Anleihen und liquiden Mitteln. Der Betrag der übertragenen Sicherheiten unterliegt Abschlägen (Haircuts).

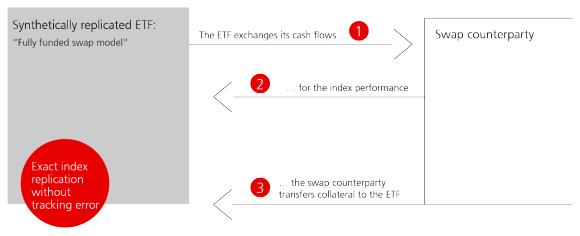

Fully Funded Swap-Modell

Mit dieser Replikationsmethode überträgt der ETF liquide Mittel an die Swap-Gegenpartei und erhält seinerseits die Indexperformance über eine Swap-Vereinbarung. Um den ETF vor dem Risiko einer Nichterfüllung der Verpflichtungen durch die Swap-Gegenpartei zu schützen, überträgt die Swap-Gegenpartei dem ETF Sicherheiten in Form von G10-Staatsanleihen, supranationalen Anleihen und liquiden Mitteln. Der Betrag der übertragenen Sicherheiten unterliegt Abschlägen (Haircuts), und die Sicherheitswerte werden in einem separaten Depot bei einer externen Depotbank im Namen des ETF gehalten (Eigentumsübertragung). Der ETF hat unmittelbaren Zugang zu den Sicherheiten für den Fall, dass die Swap-Gegenpartei ihre Verpflichtungen nicht erfüllt.

- Der ETF schließt mit der Swap-Gegenpartei eine Vereinbarung über einen Fully Funded Swap.

- Die Swap-Gegenpartei schuldet die exakte Indexperformance (abzüglich einer Gebühr).

- Die Swap-Gegenpartei überträgt dem ETF Sicherheiten in Form von G10-Staatsanleihen, supranationalen Anleihen und liquiden Mitteln. Der Betrag der übertragenen Sicherheiten unterliegt Abschlägen (Haircuts).

Bei allen synthetischen UBS ETFs ist die UBS Investment Bank die ausschließliche Gegenpartei für alle OTC-Swap-Transaktionen. Allerdings überwacht der UBS ETF regelmäßig die Kreditwürdigkeit der Gegenpartei. Die Überwachung wird von den Mitgliedern des Verwaltungsrats bei den vierteljährlichen Sitzungen durchgeführt. Die Überprüfung kann auch auf Ad-hoc-Basis erfolgen, falls die Marktumstände dies erfordern. Die UBS Investment Bank ist zwar die einzige Gegenpartei für die Swap-Vereinbarungen von UBS ETFs, doch die Preisstellung wird mindestens jährlich anhand einer Reihe externer Panel-Banken überprüft. Wenn eine Panel-Bank günstigere Bedingungen anbietet, dann kann die UBS Investment Bank mit der Panel-Bank eine Back-to-Back-Swap-Vereinbarung eingehen, um wettbewerbsfähige Preise für die ETFs zu erhalten. Sofern zulässig und betrieblich möglich, nutzen wir mehrere FX-Gegenparteien, um unsere FX-Transaktionen zu erleichtern.

Bei der ETF-Wertpapierleihe überlässt der Verleiher (UBS ETFs) einem Dritten (dem Entleiher) für einen bestimmten Zeitraum gegen Gebühr eine gewisse Anzahl von Wertpapieren aus dem ETF-Portfolio.

- UBS ETFs setzen Wertpapierleihe nur bei einigen ausgewählten physisch replizierten ETFs mit Domizil in der Schweiz, Irland und Luxemburg ein.

- Ziel ist es, durch Zusatzerträge die Nettokosten für den Anleger zu reduzieren.

- Wertpapierleihgeschäfte von UBS ETFs sind zu mindestens 105 Prozent überbesichert.

- Bei in der Schweiz domizilierten ETFs kommt der jeweilige Haircut hinzu.

- Die sorgfältige Auswahl der Entleiher und die tägliche Mark-to-Market-Bewertung der Sicherheiten dienen der Risikominimierung.

Hohe Transparenz durch tägliche Publikation der Sicherheiten jedes Teilfonds.

Ja, einige physisch replizierte UBS ETFs mit Domizil in Luxemburg, Irland und der Schweiz betreiben Wertpapierleihe. Bei den Anleihen-, ESG/SRI- und Edelmetall-ETFs von UBS geht die Fondsverwaltungsgesellschaft jedoch keine Leihgeschäfte ein.

Mit der Wertpapierleihe erzielt der Fonds zusätzliche Einnahmen (in der Regel 1 bis 20 Basispunkte, je nach Index). Einnahmen aus Wertpapierleihe spiegeln sich im Nettoinventarwert wider und senken direkt die Nettokosten für die Anleger.

Während der Dauer der Wertpapierleihe zahlt der Entleiher dem ETF eine Gebühr. Überdies werden alle während der Leihe auf die Wertpapiere gezahlten Ansprüche wie etwa Coupons oder Dividenden in Form einer Ersatzleistung an den ETF weitergegeben. Durch die Wertpapierleihe kann der Fonds somit zusätzliche Einnahmen erzielen, die sich im Nettoinventarwert (NAV) widerspiegeln und so direkt die Nettokosten für die Anleger senken.

Gemäß der europäischen OGAW-Richtlinie und dem Schweizer KAG darf die Höhe der verliehenen Wertpapiere bis zu 100% betragen. In der Praxis war die tatsächliche Ausleihquote bei UBS ETFs bislang deutlich geringer. Für UBS ETFs gilt daher für die Ausleihe von Wertpapieren eine Obergrenze bei 50% des Nettoinventarwerts eines ETF. Bei bestimmten ETFs liegt die Grenze bei 25%, um Marktanforderungen zu erfüllen.

Um das Risiko der Wertpapierleihe für UBS ETFs zu minimieren, werden die Entleiher sorgfältig ausgewählt und täglich überwacht. Bevor der Entleiher die Wertpapiere erhält, muss er dem Verleiher, dem ETF, dafür Sicherheiten zur Verfügung stellen. Diese Sicherheiten dienen dazu, die Verpflichtungen des Entleihers gegenüber dem Verleiher abzusichern. Die Sicherheiten werden auf ein von der Bilanz des Verleihers vollständig getrenntes separates Depot oder Sicherheitenkonto übertragen.

Die Wertpapierleihe kann täglich auf Verlangen des Verleihers gekündigt werden. Durch die tägliche Neubewertung von Darlehen und Sicherheiten zu Marktpreisen wird zudem sichergestellt, dass der Wert der vom Entleiher gestellten Sicherheiten stets korrekt angepasst wird. Darüber hinaus sind Wertpapierleihgeschäfte mit UBS ETFs immer zu mindestens 105% überbesichert. Bei in der Schweiz ansässigen ETFs kommt zusätzlich ein Abschlag bei der Bewertung der hinterlegten Sicherheiten hinzu, der sogenannte «Haircut». Die Wertpapierleihe endet, wenn der ETF die Wertpapierleihe kündigt oder der Bedarf des Entleihers gedeckt ist. Erst nach Rückgabe der Wertpapiere an den ETF werden die verwahrten Sicherheiten an den Entleiher zurückgegeben.

Vermittler bei der Wertpapierleihe für die in Luxemburg ansässigen ETFs sind State Street Bank International GmbH, Niederlassung München, Deutschland, und State Street Bank and Trust Company. Bei den Schweizer UBS ETFs fungiert UBS Switzerland AG als einziger Entleiher (Eigenhändler) der Wertpapierleihe.

State Street fungiert als Vermittler. Die Entleiherliste des Vermittlers wird von Vertretern von UBS genehmigt. Zudem stimmt sie mit der Gegenparteiliste von UBS überein. Das Gegenparteirisiko wird vom Vermittler, State Street, täglich überwacht. State Street gewährt zudem eine Ausfallentschädigung, falls ein Entleiher Wertpapiere nicht zurückgeben kann. Die Wertpapierleihgeschäfte der UBS ETFs sind vollständig besichert.

UBS Switzerland AG tritt gegenüber dem ETF als einziger Entleiher (Eigenhändler) auf und garantiert dabei die Erfüllung aller vertraglichen Verpflichtungen. Zum Schutz des ETF vor dem UBS-Gegenparteirisiko stellt UBS Switzerland AG Sicherheiten gemäß den strengen Bestimmungen der KKV-FINMA (Kollektivanlagenverordnung-FINMA).

- Die Bedingungen der Transaktion werden zwischen Vermittler und Entleiher vereinbart, und die Sicherheiten werden geliefert.

- Nachdem der Vermittler die Sicherheiten erhalten hat, werden die geliehenen/entliehenen Wertpapiere an den Entleiher übertragen.

- Der Verleiher (d.h. der ETF) bleibt wirtschaftlicher Eigentümer des verliehenen Wertpapiers. Daher zieht der Vermittler alle während der Leihe auf das Wertpapier gezahlten Ansprüche ein und leitet diese als Ersatzleistung an den Verleiher weiter. Der Verleiher ist wirtschaftlich genauso gestellt, als wenn das Wertpapier nicht verliehen worden wäre.

- Der Entleiher zahlt dem Vermittler die vorab vereinbarte Leihgebühr. Zahlungen werden monatlich vereinbart und geleistet.

- Der Entleiher gibt die Wertpapiere zurück,wenn der Bedarf gedeckt ist, oder früher, sofern der Verleiher eine Position glattstellt. Alle Transaktionen können täglich auf Verlangen gekündigt werden, und es werden keine befristeten Transaktionen eingegangen.

- Nach der Rückgabe des Wertpapiers an das Depot des Verleihers gibt der Vermittler die verwahrten Sicherheiten an den Entleiher zurück.

- UBS ETFs haben UBS Switzerland AG das Mandat für die Wertpapierleihe übertragen, sie fungiert als zentraler Anbieter für die Wertpapierleihe.

- UBS Switzerland AG verwendet die entliehenen Wertpapiere entsprechend der Nachfrage von Street-Side-Entleihern und von UBS-internen Quellen. UBS handelt mit externen und internen Entleihern zu marktüblichen Konditionen.

- UBS ETFs haben ein Kreditrisiko nur gegenüber UBS Switzerland AG, nicht jedoch gegenüber Street-Side-Entleihern.

- Die vom Entleiher am Markt erhaltenen Gebühren werden entsprechend dem vereinbarten Gebührenteilungsvertrag zwischen UBS ETF und UBS Switzerland AG aufgeteilt.

- Falls ein Wertpapier über einen Stichtag hinaus verliehen ist, leitet UBS Switzerland AG etwaige Kapitalmaßnahmen an den ETF weiter. Coupons und Dividenden werden in Form einer Ersatzleistung an den ETF gezahlt, wodurch gewährleistet wird, dass der ETF wirtschaftlich mindestens genauso gestellt ist, als wenn die Wertpapiere nicht über den Stichtag hinaus verliehen worden wären.

- UBS Switzerland AG gibt die Wertpapiere nach Ablauf der Leihzeit, oder wenn der ETF die Wertpapiere zurückfordert, z. B. bei einem Verkauf, an den ETF zurück. Der Portfoliomanager des ETF kann Wertpapiere jederzeit verkaufen, auch wenn diese verliehen sind. Somit hat die Wertpapierleihe keinen Einfluss auf den grundlegenden Anlageprozess.

Wertpapierleihgeschäfte sind bei den in Luxemburg errichteten UBS ETFs vollständig besichert. Die luxemburgische Aufsichtsbehörde schreibt eine Mindestbesicherung von 90% vor; UBS ETFs nehmen jedoch eine Überbesicherung von 105% vor.

Die Sicherheiten werden in einem Depot gehalten, das von der Bilanz des Vermittlers völlig getrennt ist. Weitere Maßnahmen zur Risikominderung sind eine sorgfältige Auswahl der Entleiher und die tägliche Neubewertung der Darlehen und Sicherheiten.

Wertpapierleihe bei in Luxemburg und Irland domizilierten ETFs

Für UBS ETFs, die in Luxemburg und in Irland domiziliert sind und Wertpapierleihe betreiben, werden gegenwärtig die folgenden Sicherheiten akzeptiert:

- Aktien aus folgenden Indizes werden akzeptiert: AS30, ATX, BEL20, SPTSX, KFX, HEX25, CAC, DAX, HSI, FTSE, MIB, NKY, AEX, OBX, STI, IBEX, OMX, SMI, SPX, INDU, NYA, CCMP, RAY, UKX, SX5P, N100 und E100

- Staatsanleihen aus folgenden Ländern werden akzeptiert: Australien, Österreich, Belgien, Kanada, Dänemark, Finnland, Frankreich, Deutschland, Japan, Niederlande, Neuseeland, Norwegen, Schweden, SNB Bills, Großbritannien und USA (einschließlich Agency-Papieren)

Quelle: State Street, 4. Februar 2022

Art und Höhe der Besicherung, die für in Luxemburg und Irland domizilierte ETFs erforderlich ist*

| Art der Sicherheit |

| |||

Art der entliehenen Wertpapiere | Staatsanleihen | Internationale Aktien | |||

Internationale Aktien | 105% | 105% | |||

US-Aktien | 105% | 105% |

Wertpapierleihgeschäfte sind bei den in der Schweiz ansässigen UBS ETFs vollständig besichert. UBS Switzerland AG verfügt über einen sehr robusten Besicherungsprozess, der im Einklang mit den Bestimmungen der KKV-FINMA (Kollektivanlagenverordnung-FINMA) steht.

UBS ETFs erhalten Sicherheiten mit einem Sicherheitenwert von mindestens 105% der entliehenen Wertpapiere. Als Sicherheiten dienen liquide Mittel, darunter Staatsanleihen, liquide Aktien und Anleihen, die von einer von der FINMA anerkannten Ratingagentur mit einem festgelegten Mindest-Rating bewertet wurden. Bei der Ermittlung des Sicherheitenwerts eines Wertpapiers kommt ein Haircut von bis zu 8% zur Anwendung.

Verschiedene Konzentrationsgrenzen sorgen für eine gute Diversifikation des Besicherungsportfolios.

Durch eine tägliche Neubewertung zu Marktpreisen wird sichergestellt, dass der Wert der Sicherheiten an den entsprechenden Beleihungswert angepasst wird.

Die Sicherheiten werden im Namen des Verleihers auf ein gesondertes Sicherheitenkonto übertragen, das von der Konkursmasse von UBS Switzerland AG getrennt ist.

Wertpapierleihe für in der Schweiz domizilierte ETFs

Für UBS ETFs mit Domizil in der Schweiz, die Wertpapierleihe betreiben, werden gegenwärtig die folgenden Wertpapiere als Sicherheit akzeptiert (unter Ausschluss von Wertpapieren der entleihenden Gegenpartei):

- Staatsanleihen von G10-Ländern.

Staatsanleihen, die nicht von den USA, Japan, Großbritannien, Deutschland oder der Schweiz begeben werden, müssen mindestens mit «A» oder einem gleichwertigen Rating bewertet sein. - Unternehmensanleihen, die mindestens mit «A» oder einem gleichwertigen Rating bewertet sind.

- Aktien von Unternehmen, die in den folgenden Indizes vertreten sind: AEX, ATX, BEL20, CAC, DAX, INDU, UKX, HEX25, KFX, OMX, OBX, SMI, SPI, SPX, SX5E

Quelle: UBS Switzerland AG, 20. September 2021

Haircuts und Sicherheitsleistung (Margin)*

Um den Bedarf an Sicherheiten zu ermitteln, wird der Marktwert der verliehenen Wertpapiere um eine Sicherheitsleistung von 5% erhöht. Der Beleihungswert eines Wertpapiers entspricht seinem Marktwert abzüglich eines Haircuts gemäß folgender Tabelle:

Internationale Aktien | 8% | ||

Staatsanleihen von US, JP, UK, DE, CH | 0% | ||

Staatsanleihen mit einem Mindestrating von «A» (unter Ausschluss von US, UK, DE, CH) | 2% | ||

Unternehmensanleihen mit einem Mindestrating von «A» | 4% |

UBS hat die Ausleihquote jedes UBS ETF auf 50% seines verwalteten Vermögens begrenzt. In der Praxis ist die tatsächliche Ausleihquote in der Regel deutlich niedriger