What to watch in the week ahead

Weekly Global

![]()

header.search.error

Weekly Global

What comes next in the conflict between the US and Iran?

The US and Israel began joint airstrikes across Iran on Saturday, 28 February, with Iran's supreme leader, Ayatollah Ali Khamenei, among those confirmed killed. US President Donald Trump called for regime change, and on social media warned the strikes "will continue, uninterrupted through the week or, as long as necessary." Investors reacted to the developments on Monday: Oil and gold prices have jumped, while equity markets have come under pressure.

In the weeks and months ahead, we will be closely monitoring several indicators. Will the flow of energy through the Straits of Hormuz continue? This is the world's most important oil route, accounting for more than onefifth of global oil demand and nearly one-third of seaborne shipments, moving about 21 million barrels per day to global markets from Iran, Iraq, Kuwait, Qatar, Saudi Arabia, and the United Arab Emirates. How will energy production be affected? So far, aside from a disruption to supplies in northern Iraq, oil production continues across the region. There were also reports of three tankers suffering damage, although one was a shadow fleet tanker used by Iran. OPEC+, a group of oil-exporting nations, also agreed on Sunday to increase their production quota by 206,000 barrels per day in April. Nonetheless, we will monitor whether Iranian retaliation damages the production and distribution capacity of other nations in the region.

How quickly will the US and Israel "declare victory" and how quickly will Iran's capacity to retaliate be degraded? Our base case view that there will not be a sustained disruption to oil supplies is predicated in part on the relative military success of the US-Israeli operation so far and the likely rapid degradation of Iranian military capacity. What would be the impact of a higher oil price on inflation and growth? The sensitivity of the global economy to moves in oil prices has been on a long-term downward trend for decades, as the energy intensity of growth has reduced. But a sustained rise in energy prices would nonetheless be an economic drag. How would central banks react to higher energy prices? A potential worry for investors would be that an oil price-driven increase in inflation could cause top central banks to move toward rate hikes. However, comments by top central banks over recent years have suggested an eagerness not to overreact to one-off increases in price levels, including most recently from higher US tariffs.

Historically, the impact of geopolitical shocks on markets has tended to be short-lived, unless they morph into economic shocks. Making snap decisions to de-risk portfolios amid geopolitical conflict has historically not been a profitable strategy. In line with our base case view that this conflict will not lead to sustained global economic disruption, we believe that investors should maintain a long-term focus, stay invested in broad equity indices, and use periods of volatility to build more diversified portfolios.

Has AI capital spending become too much of a good thing?

The skeptical reaction to NVIDIA’s earnings—which beat forecasts and showed 73% growth in revenue over the prior year—underlined again that investors have become more cautious about AI. The 5.5% share price fall in the session following the announcement was the worst after its quarterly earnings since this time last year.

With hyperscalers on track to divert nearly 100% of their free cash flow to capital expenditure this year—up from a 10-year average of around 40% —concerns are rising that capex is now growing too quickly and could present a threat to the bull market. The use of leverage—both public and private—to finance this expansion has the potential to amplify volatility. While such fears may be exaggerated, the uncertainty has been making some investors less willing to pay historically elevated multiples for tech stocks.

With this worry weighing on US stocks, investors will be looking to see if this narrative shifts this week, and beyond. We remain positive on the outlook for equity markets overall, underpinned by resilient economic growth, supportive fiscal and monetary policies, and robust earnings growth. And we will be looking for further evidence of this resilience in the coming week from the February jobs data, which is expected to show continued stabilization after a strong release for January. The ISM business activity surveys for February should also be encouraging.

That said, we expect uncertainties over the tech outlook to persist, and our assessment is the risk-reward profile in the sector has become more balanced. Against this backdrop, we recently downgraded US information technology and communication services from Attractive to Neutral. However, this is part of a broadening of the stock market rally, including a more positive outlook for industrials. We still expect the S&P 500 to reach 7,700 by the end of 2026—propelled by 12% earnings per share growth for the index.

What do AI disintermediation risks mean for credit markets?

AI disintermediation risk has emerged as an important market narrative in recent weeks. US software and IT services have been hit, with the S&P 500 software index down close to 30% from its fall 2025 high, as rapid advances in agentic AI inject new uncertainty over the terminal value of traditional software models. That volatility has also been felt in credit markets. Pressure is starting to show in high yield (HY), and sector dispersion has risen sharply.

We think AI disintermediation risks in credit are real. But while long-term risks exist for some business models, we see limited near-term impact on corporate credit quality. Credit impairment typically requires sustained deterioration in earnings and cash flow, which triggers downgrades or refinancing challenges. Most investment grade and large high yield issuers retain strong balance sheets and financial flexibility, making them resilient to near-term disruption. Highly leveraged HY issuers, where risks are more pronounced, represent only a small fraction of the market.

While software and services are more exposed to automation risks from agentic AI tools, companies with strong competitive moats, regulatory barriers, or entrenched B2B relationships are better positioned to adapt. Many large tech firms are actively investing in AI to defend and extend their franchises. More broadly, credit fundamentals and technicals look healthy. Balance sheets are strong, cash generation is healthy, and refinancing needs are manageable. The macro backdrop remains supportive, with solid economic growth, stable labor markets, and accommodative policy

So, we think credit markets are likely to remain resilient, with these AIrelated risks unlikely to spill over into sustained stress. Any wider bouts of AI-linked volatility in credit could be an opportunity for selective entry, in our view, particularly in high-quality issuers with robust fundamentals.

Chart of the week

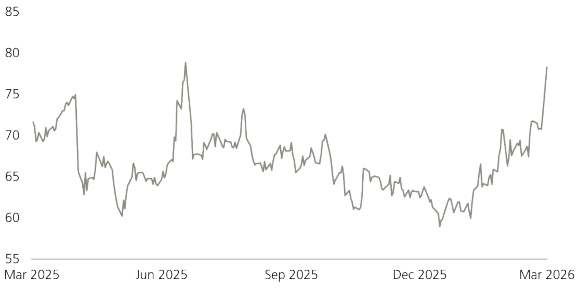

Our base case remains that there will be only a brief disruption to the global supply of energy. We expect any initial rise in the price of oil to reverse, at least partially, once it becomes clear that supply disruptions are temporary, critical oil infrastructure is not destroyed, and the need for continued military action fades. In this scenario, markets may be volatile over the coming weeks but would likely thereafter start to refocus on positive global economic fundamentals. This would be in line with the impact of most geopolitical shocks in recent history.

Brent crude oil, USD/bbl

Learn more about the outlook for geopolitics

Dig deeper into CIO's take on equities

Look here for more CIO views on fixed income