How can women best protect and grow their wealth?

Explore the factors that affect women's wealth compared to men's, and how events in their lives and attitudes toward investing can shape their finances.

How much of a gap do gender differences create in women's finances? Can this gap be mitigated by making the right investment decisions?

How much of a gap do gender differences create in women's finances? Can this gap be mitigated by making the right investment decisions?

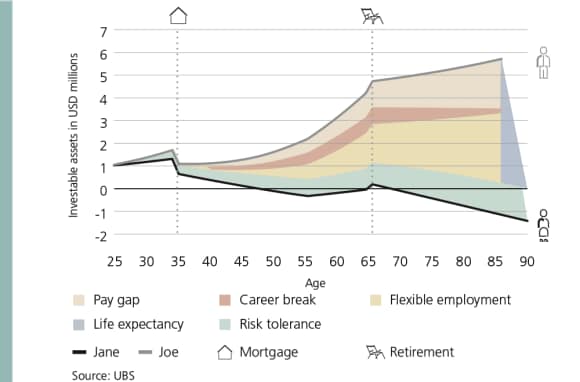

Factors like pay discrepancy, career break, work flexibility, longer life expectancy, and attitude towards risk - all can add up to women having less money to invest and grow, losing their wealth over time and, ultimately, not meeting their financial goals.

The good news is, women are generally more disciplined investors than men, and if they were to invest with an appropriate strategy it could help them bridge the gap and meet their objectives.

We use a representative "Jane" to explain our analysis.

Illustrating the female wealth gap through a representative Jane

Illustrating the female wealth gap through a representative Jane

We consider an illustrative "Jane" and "Joe" and model their financial outcomes based on some common male and female circumstances.* The example shows that compared to Joe, Jane's circumstances, financial confidence, and attitude to investing can actually make it harder for her to achieve her financial goals. In our model, Jane and Joe are each 25, single, have recently started work and want to:

- preserve and grow their inheritance of USD 1 million for the next generation

- buy a house at the age of 35

- enjoy a decent lifestyle during retirement

Assumptions for illustrative Jane and Joe

Assumptions for illustrative Jane and Joe

The actual amounts assumed in our analysis are only illustrative. However, they enable us to compare how Joe's and Jane's wealth develops throughout their lives. Jane and Joe are treated as individuals, each with their own independent wealth journey.

*Readers should not rely on the assumptions and outcomes detailed above to determine any investment strategy or draw any investment conclusions.

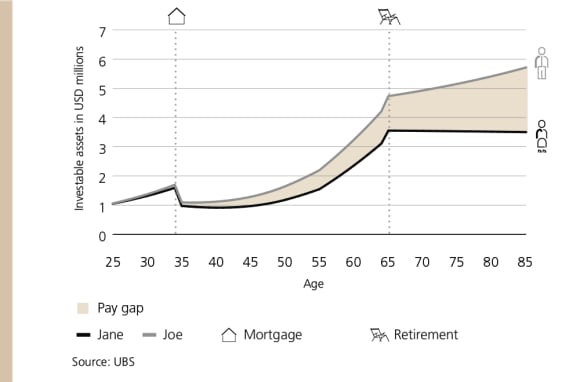

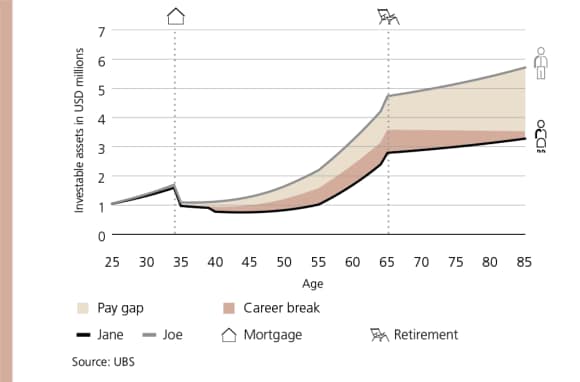

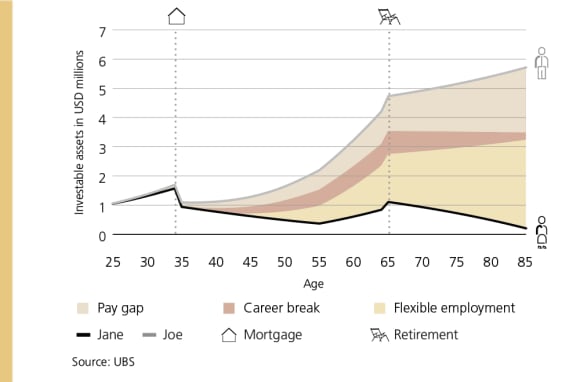

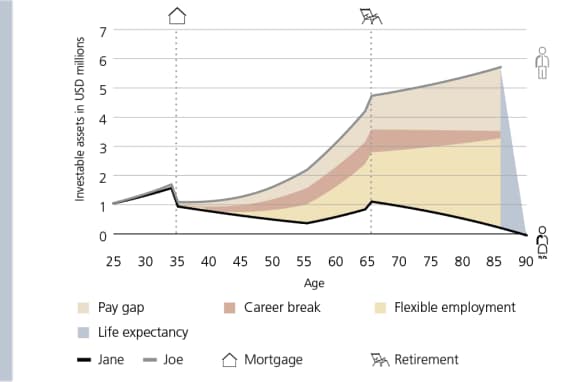

Explore how different factors throughout Jane's journey may affect her wealth and retirement savings. Each factor is labeled with a different color. The graphs show how each factor contributes to widening Jane's gap.

The result of pay gap discrepancy

The result of pay gap discrepancy

- In the US, women working full-time earn around 21% less on average compared with men on an annual basis. Various factors contribute to the gender pay gap, including being penalized for flexible work. Pay discrepancy occurs even when a woman and a man do the same job, and have the same experience and skills.

- In our model, Jane will earn around USD 800,000 less than Joe over her working life and will therefore have 38% less wealth by age 85 than Joe.

Source: Blau, Kahn 2016; Goldin, 2014.

The result of Jane taking a short career break

The result of Jane taking a short career break

- Women tend to be the main caregivers of children and aging parents. Taking career breaks to care for others can harm their career prospects over the long term.

- When we integrate the impact of lower earnings and a stalled career progression into the model, Jane's wealth at age 85 becomes 43% less compared to Joe.

Source: "The relationship between income and time off is highly non-linear for those in our sample. Any career interruption – a period of six months or more out of work – is costly in terms of future earnings, and at ten years out women are 22 percentage points more likely than men to have had at least one career interruption. Deviations from the male norm of high hours and continuous labor market attachment are greatly penalized in the corporate and financial sectors." Bertrand, Goldin, Katz 2010.

Lower net income diminishes Jane's wealth dramatically

Lower net income diminishes Jane's wealth dramatically

- Women engage more often in part- time work. In the US, women are nearly twice as likely as men to work part-time. Part-time work can have a lasting effect on women’s pay, for example, because they are less likely to be promoted. Women also receive fewer benefits and smaller allocations to their pension funds.

- In our model, the impact of flexible work results in a 96% decrease in the value of Jane's wealth.

Source: U.S. Bureau of Labor Statistics, 2015.

Impact of Jane's longer life expectancy

Impact of Jane's longer life expectancy

- In the US, women’s life expectancy is 6.7 years longer than men’s, whereas in the UK, the difference is 5.3 years. – Differences in life expectancy vary by country and seem to be narrowing. On average, the gap has gradually declined to 2.8 years today from 3.8 years in 2011, 4.6 years in 2001, and 6.3 years in 1971. Even a few years difference can have an impact on women's wealth.

- In our model, Jane's additional living years result in her not being able to achieve her goal of passing wealth to the next generation. She also struggles to maintain her lifestyle.

Source: Scientific American (https://www.scientificamerican.com/article/why-is-life-expectancy-lo/); V.Kontis, 2017 Study by Imperial College London and the World Health Organisation.

Investing in a lower volatility investment could be risky

Investing in a lower volatility investment could be risky

- While women are more likely than men to invest in a disciplined way , numerous surveys and studies also highlight women's relative lack of financial confidence when deciding on investments. This lack of confidence supports observed differences in women’s appetite for risk. Not taking enough risk can result in women not receiving the returns they require to achieve their ambitions or pay for the things they need.

- Our Jane's illustrative situation becomes even worse if she invests too conservatively. She faces an even bigger gap if her investment portfolio delivers returns of 1% a year rather than the previously assumed 3%. Because Jane chose an investment that is less "risky" (lower volatility), she cannot achieve her goals and is unable to support herself in retirement.

Source: Croson, 2009.

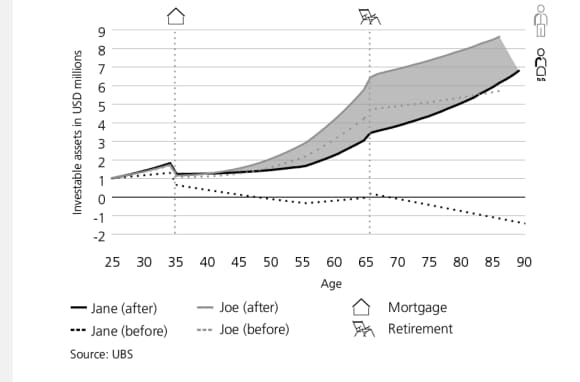

There is a solution

There is a solution

- If Jane wants to maximize the likelihood of achieving her goals, she must invest all her funds strategically. We conclude that investing in a disciplined way using an appropriate strategy can help women bridge the gap to men’s wealth journey and help them meet their objectives.

- In our model we show how with the right portfolio Jane and Joe can both meet their objectives.

Source: UBS

For more detail, download the full report

Download

Gender-Lens Wealth

Gender-Lens Wealth

Achieving gender equality and female empowerment is one of the United Nations' Sustainable Development goals (SDGs) for 2030. Yet, according to a recent World Economic Forum report, basic global gender gaps could take 83 years to close. What can investors do?