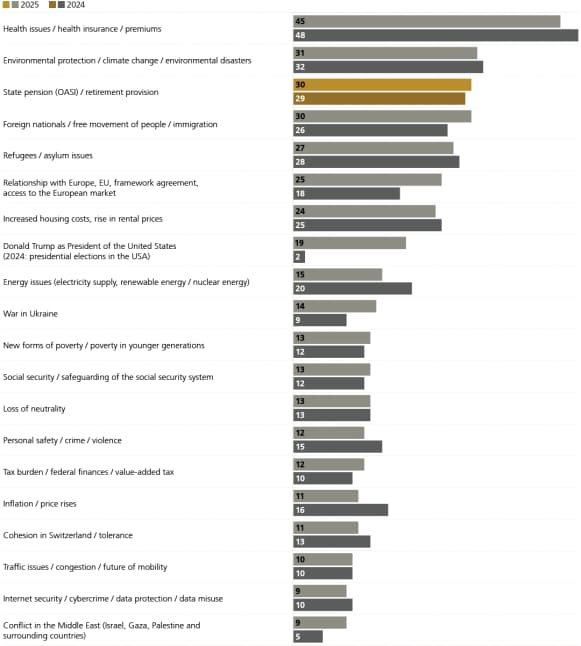

UBS Worry Barometer 2025

Retirement provision and OASI

What is the current situation regarding the OASI pension scheme and what does its future look like? The UBS Worry Barometer 2025 provides important insights to help organize your retirement planning and protect your finances.