In today’s credit markets, yields remain attractive, there are signs of further market growth and investors continue to seek income. Yet behind these familiar themes, the lines between syndicated loans, high yield, illiquid credit and CLOs are increasingly blurred. Issuers and investors alike are moving fluidly across these segments, reshaping the structure of global corporate credit markets.

This evolution prompts a key question for allocators: If issuers now operate across a continuum of markets, shouldn’t portfolios be constructed to reflect the same? However, before reaching any conclusions for investors, we need to look at the macro backdrop and issuer behavior.

Supportive macro backdrop

Supportive macro backdrop

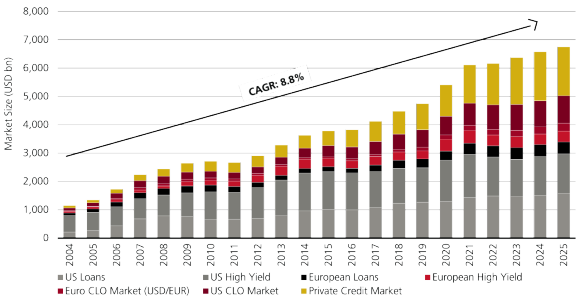

As Figure 1 clearly shows, non-investment grade credit markets continue to see growth, with issuers needing financing and investors seeking yield.

Figure 1: Growth of non-investment grade credit markets

Despite this strong investor demand, yields in non-investment grade credit remain attractive, and sustained tailwinds remain in place.

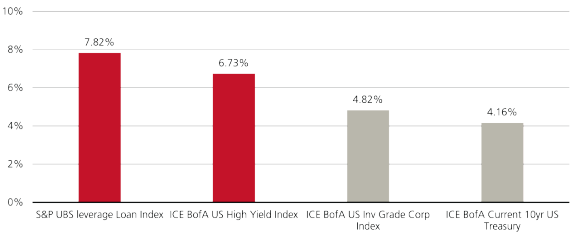

Figure 2: Yields in non-investment grade credit (US)

Yield (in %) : US (in USD)

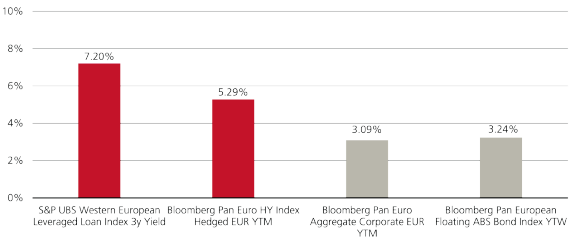

Figure 3: Yields in non-investment grade credit (Europe)

Yield (in %) : Europe (in EUR)

Looking ahead, monetary easing and the prospect of rate cuts are also strengthening fundamentals and improving refinancing conditions. As a result, we expect net new issuance to increase into 2026 as M&A activity has the potential to return.

Dynamic issuer behavior

Dynamic issuer behavior

Corporate issuers are no longer bound by traditional financing silos. Large corporates are arbitraging funding costs and liquidity access across public and private markets, and even across regions. They decide when and where to raise capital, balancing considerations of cost, tenor, structure, terms and investor appetite. In both the US and Europe, there is a rising preference for flexible, opportunistic issuance, whether through syndicated loans, high yield bonds or illiquid credit.

While there may be a natural tendency for larger public names to issue high yield bonds, and sponsors to tap the loan market, there is increased convergence with issuers using multiple markets over the life of the credit. This convergence reflects sophisticated deal syndication strategies, cross-market participation and the continued growth of investment vehicles like collateralized loan obligations (CLOs). While not an asset class issuers access directly for financing, the CLO market has continued to grow (at an 11% CAGR for the past decade1), thus supporting demand for loan issuance.

Essentially, the increased sophistication of issuers has reshaped credit markets into a lattice-like ecosystem where multiple debt instruments interlock.

Corporate issuers are no longer bound by traditional financing silos.

Harnessing the ecosystem

Harnessing the ecosystem

To answer our initial question: Yes, portfolios should now operate across the full continuum of credit markets, just as issuers do. Indeed, traditional single-sector strategies are giving way to multi-sector approaches that can reallocate dynamically as opportunities shift alongside issuer borrowing optimization. Agile investors can tactically rotate capital, exploiting temporary mismatches in liquidity and relative value between these various asset classes. They can take advantage of technically driven sell-offs, or shift when markets signal compression. This blending of syndicated loans, high yield bonds, less liquid loans and CLOs into a diversified portfolio means multi-asset credit strategies can offer attractive risk-adjusted returns without necessarily increasing credit risk.

Adaptability allows investors to respond effectively to evolving market conditions and capitalize on emerging opportunities. Diverse yield sources and dampened volatility compared to single-sector strategies can be obtained as a result.

Portfolios should now operate across the full continuum of credit markets.

The need for active management

The need for active management

There is a clear need for investment acumen in these specific asset classes, as well as structural expertise to manage the access vehicles.

Given the nature of non-investment grade credit, fundamental credit analysis is key. Investors allocating to these markets require a deep knowledge of the borrowers they are lending to. This includes understanding deal structure, the quality of the underlying borrower and the economic drivers and competitive positioning in the relevant sector.

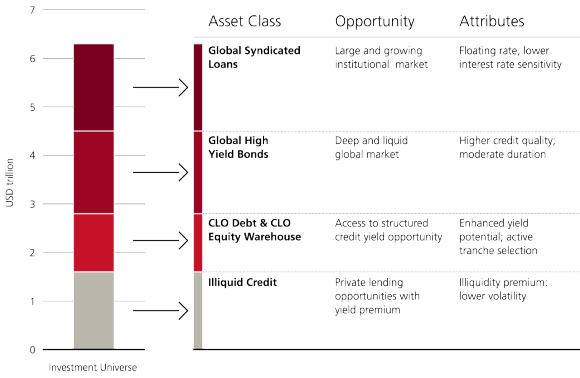

Having a team with the relevant expertise, as well as the scale to cover issuers across the capital structure in all sectors and geographies of this USD 6 trillion2 opportunity set, is crucial. The active part of management is not only the fundamental analysis, but also the ability to adapt and actively trade as relative value shifts between asset classes. Strategic rebalancing – rotating capital across the liquidity spectrum in response to market and issuer signals – can optimize outcomes while managing risks. Active management becomes essential, not only to identify mispriced credit opportunities across segments, but also to dynamically manage exposures, aligning with a client’s broader risk-return framework.

Separately managed accounts, interval funds, hybrid wrappers, private vehicles and co-investment sleeves are all access points for investors to consider when seeking the right manager. Desired risk/return, liquidity and fees will influence investors in terms of structure and how they access credit. Managers should continue to evaluate how to best provide optimal structures to minimize certain asset class inefficiencies.

Fundamental credit analysis is key.

A dynamic response

A dynamic response

Multi-asset credit (MAC) strategies exemplify this shift in action by combining syndicated loans, high yield, less liquid loans and collateralized loan obligations (CLOs) into a single portfolio.

This approach offers attractive risk-adjusted returns by capturing diversified sources of yield and reducing volatility relative to single-sector strategies. It also provides tactical flexibility, as actively managed portfolios can rotate between credit segments in response to evolving market dynamics. With credit risk converging across asset classes, a MAC strategy broadens the opportunity set, expanding the range of investment possibilities without increasing overall credit risk. Additionally, MAC strategies offer liquidity and accessibility, giving institutional investors diversified exposure while maintaining periodic liquidity through commingled or separately managed account (SMA) structures.

Together, these characteristics make MAC a natural fit for investors seeking both resilience and responsiveness – qualities that are increasingly essential in today’s converging market environment.

Actively managed portfolios can rotate between credit segments in response to evolving market dynamics.

Figure 4: Multi-asset credit: A USD >6 trillion2 global market

A broad and flexible approach across the credit spectrum

Investing where markets are going

Investing where markets are going

The convergence of liquid and illiquid credit is reshaping how supply and demand meet. Borrowers effectively arbitrage their financing needs between syndicated loans, high yield, private credit and by extension CLOs3, blurring long-standing boundaries.

The future of credit relies on understanding the ecosystem of fixed, floating, liquid, illiquid and structured asset classes.Investors who align their approach with this new reality through multi-asset credit strategies can position portfolios to capture opportunity wherever it emerges along the continuum of global credit.

The future of credit relies on understanding the ecosystem of fixed, floating, liquid, illiquid and structured asset classes.

The Red Thread

Alternative alpha

Alternative alpha