Over the past two decades, hedge funds have been declared dead, reborn, disrupted and reinvented more times than most investors can count. Yet in 2025, the debate continues: are hedge funds still worth their complexity and cost?

This question cuts to the core of how allocators think about risk, liquidity and the boundaries between traditional and alternative allocations. Multi-strategy platforms continue to expand, becoming more and more like global asset managers, while specialized single-strategy funds fight to prove their worth in an environment where alpha is scarce and investor patience short. Meanwhile, fund-of-funds (FoHFs), once the default gateway into hedge funds, must justify their relevance in a price-conscious world that prizes direct access, as well as operational and cash efficiency.

What emerges is a more sophisticated industry that is simultaneously consolidating and fragmenting, becoming both larger and more niche.

Industry’s bifurcation

Industry’s bifurcation

If the previous decade was one of survival, the current one is about divergence. Hedge funds are essentially polarizing into two archetypes:

- Mega multi-strats: complex platforms managing tens of billions across numerous teams and integrating risk management, liquidity provision and data infrastructure at scale.

- High-conviction boutiques: single-strategy funds with tightly defined specialisms in macro, credit or relative value, often capacity-constrained but nimble and opportunistic.

Scale has become both a moat and a mandate. Regulatory costs, compliance demands, competition for talent and the operational expectations of institutional investors have raised the barriers to entry for new launches. To attract serious institutional capital a hedge fund needs institutional infrastructure: top tier investment analytics, data pipelines including standardization and cleaning processes, cyber-security protocols, robust risk frameworks that are integrated into trading systems, and CFO-grade reporting.

This favors multi-strategy giants. Their economies of scale allow for sophisticated analytics, cross-strategy capital allocation, competitive talent recruitment and deep operational resources. However, their size can also come at a cost, making it harder to remain agile or foster genuine innovation.

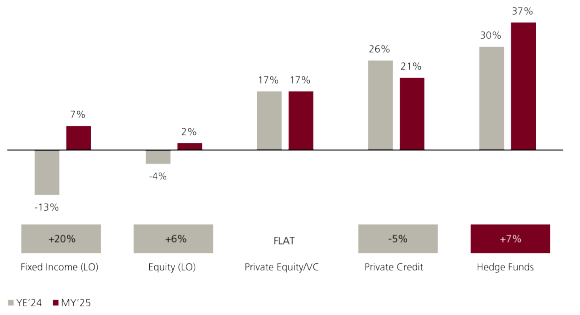

Figure 1: Allocators continue to allocate to hedge funds

Net investor allocations plans (2H25 vs. 1H25), % of respondents

The rise and strain of the multi-strategy model

The rise and strain of the multi-strategy model

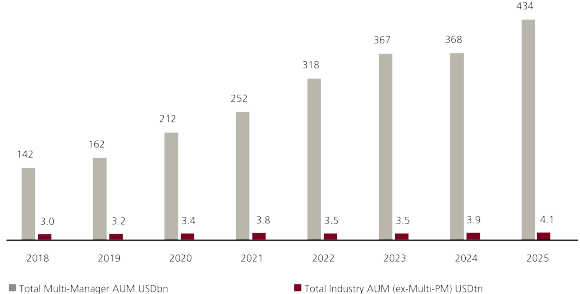

Multi-strategy platforms have been the main driver of hedge fund AuM growth. Today, the largest of these firms increasingly resemble diversified asset managers – operating through multiple internal and external trading teams – rather than traditional hedge funds.

Their model offers clear advantages: stable infrastructure, diversified earnings and disciplined risk budgeting. The ’pod’ structure gives talented portfolio managers a home where they can focus on alpha generation without the distraction of running a business.

Figure 2: Multi-managers are growíng strongly again after a muted 2024

Yet success breeds new challenges. As multi-strats have grown, so have the demands of their investors. Fee pressure is intensifying; pass-through cost models are becoming the norm, and competition for talent is fierce. Multi-strat managers must continuously recalibrate how much autonomy to grant their PMs while maintaining firm-wide risk coherence. Too much freedom risks correlation spikes in stress regimes; too little and the best traders migrate away to start their own funds or join more flexible platforms.

Moreover, as these firms expand into new asset classes – commodities, credit, quant and even private markets – the complexity of managing cross-strategy risk multiplies. Integrating a credit relative-value sleeve or a systematic macro book requires not only capital but deep domain expertise and a culture of shared discipline.

The question for allocators is no longer whether multi-strats work; they do. But which ones justify their rising cost structures, lengthening liquidity terms and limited capacity. It's the allocator's job to make sure these critical distinctions, more so than ever.

Single-strategy funds: Adapt or perish

Single-strategy funds: Adapt or perish

At the other end of the spectrum, single-strategy hedge funds face an identity crisis. The pure-play macro or event-driven fund that once thrived on volatility now contends with an uneven opportunity set and investors with shorter time horizons.

Delivering alpha in today’s environment requires two things: differentiation and adaptability. The best single-strategy managers are leaning into specialization (distressed credit in niche geographies, energy transition trades or complex merger spreads) and embracing technology to enhance execution and research depth.

But survival depends equally on flexibility. The volatility of the 2020s has not rewarded static mandates. Managers must be able to toggle exposures dynamically depending on where the opportunities lie in the prevailing market environment.

For allocators, the attraction often lies in their purity. A single-strategy fund can provide uncorrelated exposure to a specific risk premium that even the largest multi-strategy funds can’t replicate internally. These can be sized up or down into specific opportunities or market cycles, allowing allocators to add more tactical value to their core portfolios. The trade-off can be higher volatility, limited capacity, and occasionally, headline risk.

The reinvention of fund-of-funds

The reinvention of fund-of-funds

For many investors, fund-of-hedge-funds were the original entry point into alternatives. Today, they are being forced to redefine their core purpose. Simply offering diversification is no longer enough when investors can access top managers directly or through managed accounts.

The leaders have evolved into multi-alternative allocators, offering strategic access and early-stage exposure that even large institutions struggle to source. Their value proposition is shifting from aggregation to curation.

They can access closed funds, negotiate bespoke terms, and implement overlays like tail-risk protection or dynamic rebalancing that smooth volatility across portfolios. Their global networks and institutional relationships allow them to spot emerging talent before the crowd does, and to structure investments with favorable liquidity or fee terms.

At the same time, FoHFs increasingly serve as strategic partners to multi-strats. One way is to provide seed or ’spin-out’ capital for PM teams after a period of exclusivity with a multi-strategy firm; another is to co-develop strategy-specific funds (’spin-ins’) that remain within broader multi-strategy frameworks. This hybridization blurs the traditional lines between allocator and multi-strategy hedge fund manager – a theme increasingly common within alternatives.

Quant strategies and the new frontier

Quant strategies and the new frontier

Quantitative strategies, whether based on statistical arbitrage, machine learning or systematic macro approaches, now account for a large share of industry flows. Their advantage lies not only in data science but also in behavioral neutrality, as quantitative models exploit inefficiencies that discretionary managers may overlook.

The quant factor effect of the early 2010s has matured into an infrastructure advantage. Large firms with scalable data pipelines and advanced analytics enjoy compounding benefits that smaller players can’t replicate. In volatile markets, these systematic processes provide a form of risk control that complements discretionary insight rather than replaces it.

The challenge is one of governance: aligning liquidity terms with underlying exposures, managing valuation transparency and avoiding style drift. While some alternative strategies impose liquidity constraints due to genuinely illiquid holdings, others do so primarily because demand for their fund exceeds its capacity, thus finding themselves able to secure a longer-term capital base. But for investors willing to accept some illiquidity, the potential for return is compelling.

Opportunities here tend to be found at the intersection of multi-strats/platforms and FoHFs, given the cost, complexity and business acumen that is needed for a successful launch. These exclusive relationships can be structured between a standalone quant fund, with multi-strats that allow for direct monetization of the earlier stage alpha developments and higher Sharpe strategies. But there is a catch, as these earlier launches can be subject to higher cost burdens, early team building challenges and sub-scale alpha origination relative to steady state, fully established capabilities.

This is where FoHFs can leverage relationships with multi-strats and become the preferred capital provider to these quant spin-outs who have derisked the business and built a more mature alpha and risk proposition. This is a core area of focus within the FoHF community today.

Structural shifts reshaping the opportunity set

Structural shifts reshaping the opportunity set

Several secular forces are redefining what hedge funds are and how they fit in institutional portfolios:

Talent mobility: Portfolio managers move fluidly between pod shops, single-strats and allocators. Career risk is lower, but competition for expertise is relentless.

Institutionalization of cost pass-throughs: What began as an experiment has become industry standard, shifting operational transparency to investors but also compressing net returns.

Hybrid business models: Multi-PM firms expanding into discretionary macro; quant firms hiring human traders in strategies such as fundamental, intrinsic, relative and valuation (FIRV) or commodities; traditional credit shops launching systematic overlays.

Technology as alpha infrastructure: Data analytics, alternative data sets and risk visualization tools now define competitive edge more than directional conviction alone.

Client expectations: Investors want customization, liquidity optionality, improved cash efficiency and lower correlation, while consistently delivering a few percentage points of alpha over cash. Hedge funds must meet these needs or risk commoditization.

In short, the hedge fund ecosystem is evolving from a collection of independent boutiques to an integrated layer within the broader asset-management landscape.

Where do hedge funds fit now?

Where do hedge funds fit now?

In terms of portfolio construction it is critical to distinguish between diversification within hedge funds and diversification via a portfolio of hedge funds. A well-constructed multi-strategy allocation can dampen volatility but may also cap upside. Single-strategy exposures can offer sharper risk-reward payoffs but require active oversight and tolerance for dispersion.

Hedge funds’ role in many portfolios is shifting from ’return enhancer’ to ’risk moderator.’ In a world where both equities and bonds can suffer simultaneous drawdowns, the ability to generate idiosyncratic returns, whether through relative-value trades, volatility arbitrage or opportunistic credit, is increasingly valuable.

The path forward

The path forward

The next generation of hedge fund investing will not be defined by labels but by integration of data, disciplines and structures. Multi-strategy platforms will likely continue to absorb top talent and expand their asset base, while specialized funds may thrive in pockets of inefficiency. FoHFs will likely pivot toward partnership and early-stage seeding. Also, multi-strategy and FoHF convergence is expected to continue, as investors demand more transparency, customization and liquidity precision.

For allocators, success will depend on understanding precisely what they are paying for and which risks they wish to own. Put another way, hedge funds are no longer a monolithic asset class but a toolkit for potentially heightening portfolio resilience and flexibility. The juice still appears to be there. But in an industry increasingly defined by scale, technology and alignment, only those who know how to press it thoughtfully will taste its rewards.

The Red Thread

Alternative alpha

Alternative alpha