Macro Quarterly Losing momentum, staying strong

After pricing in an economic recovery from the pandemic, investors are facing more difficult questions.

Evan Brown

Head of Macro Asset Allocation Strategy

Ryan Primmer

Head of Investment Solutions

Lucas Kawa

Asset Allocation Strategist

Highlights

Highlights

- Investors are navigating an environment in which economic momentum is slowing to one where the rate of growth stabilizes well above trend.

- Historically, these inflection points can be a source of market volatility. The stage of the cycle and Treasury market regime also contribute to our tactically cautious stance on equity beta.

- We maintain our conviction in procyclical relative value trades in ex-US developed market equities, which have relatively attractive earnings outlooks and valuations.

- In our view, the Federal Reserve’s responsiveness to inflation risks should leave the US dollar in a more rangebound environment, but select emerging market currencies can still outperform.

- We believe that some asset classes, like global sovereign bonds, trade at levels that imply too much pessimism about the likely strength of the global expansion, providing opportunities for investors.

After pricing in an economic recovery from the pandemic, investors are facing more difficult questions: What’s next? What kind of expansion will this be? And how will inflation and growth outcomes be similar or different to previous cycles?

From a market perspective, in answering these questions it is important to differentiate between the rate of change and momentum. We expect the former, the rate of growth, will remain strong, in part because monetary and fiscal policy will remain accommodative. However, we believe that momentum will slow, because monetary and fiscal policy will soon be less supportive of growth than they are right now. In addition, pent-up demand following economic reopening should normalize to a more sustainable level.

Markets are forward-looking and in the process of navigating this change from an accelerating to decelerating growth environment. Historically, these inflection points can cause market volatility as investors try to assess the extent of the loss of momentum and the future equilibrium for the growth rate of activity. Typically, asset prices over-react to the underlying negative changes in the fundamentals during this period.

Outside of equities at the headline level, and particularly US stocks, there are indications that prices reflect this reassessment of the growth backdrop across various asset classes, though to widely different degrees. In our view, these cross-asset signals need to be taken seriously, which leaves us tactically cautious on equity beta. However, we suspect it will soon be time to fade these growth fears and increase equity exposure once cross-asset warning signals wane. In the meantime, we maintain our core, relative value procyclical equity positions in anticipation that ex-US developed market stocks have already more than discounted the extent of the loss in growth momentum and will meaningfully outperform once this transition phase runs its course.

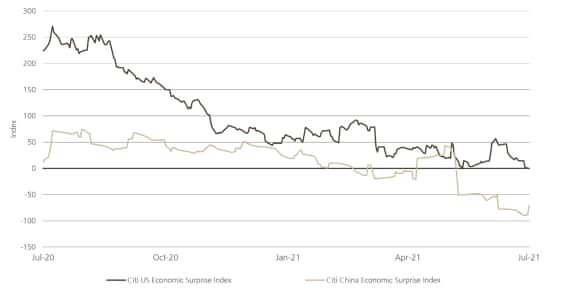

Exhibit 1: Economic data no longer surprising to the upside in China and US

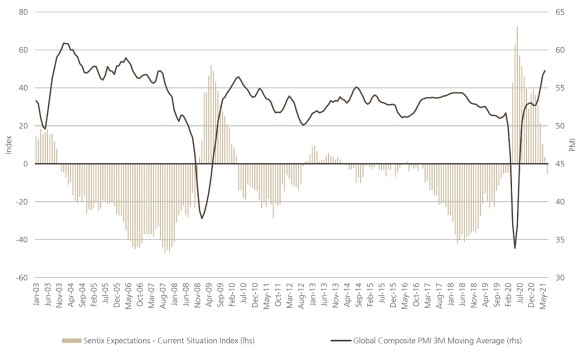

Exhibit 2: Change in confidence surveys suggests global momentum peaking

Approaching the peak

Approaching the peak

The world’s two largest economies, China and the US, led the surprisingly strong global recovery from the virus-induced recession. But in these nations, economic data is now failing to beat analysts’ estimates – and in the case of China, falling far short of them. For this reason, as well as their more attractive coupons, Chinese bonds are our most preferred among sovereigns.

Pessimism turning into over-optimism is a common feature of the progression from recession to recovery. It is a sign that these economies have exited the early-cycle environment and expectations – and asset prices – need to be recalibrated.

These two economies are driving the loss of momentum at the global level. Confidence surveys show a significant narrowing of the gap between assessments of current conditions compared to economic expectations. On the one hand, this development is a testament to the strength of the global recovery. But historically this is also associated with a peak in global purchasing managers’ indexes and waning economic momentum thereafter.

Tactically cautious

Tactically cautious

Many asset prices – such as copper and the US dollar – have adjusted in a manner consistent with a looming shift from accelerating to decelerating activity.

Global equities, and in particular US equities, are among the outliers in this regard. The stage of the cycle and Treasury market regime are suggesting that investors should be cautious on equities at the index level.

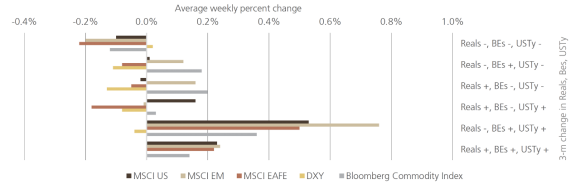

Exhibit 3: The worst Treasury market backdrop for equities

Nominals, reals, and breakevens all down over past three months

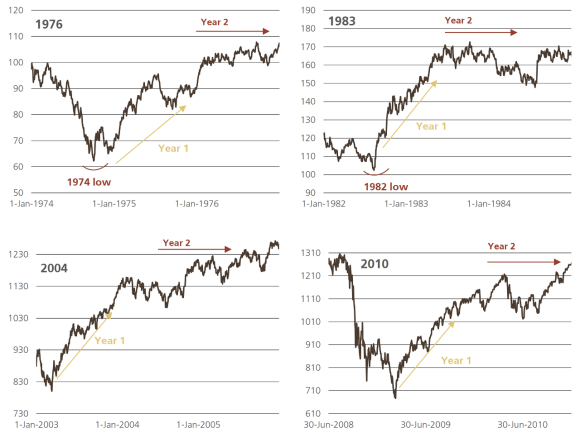

Exhibit 4: Year two of a bull market is often choppy

Major S&P 500 bottoms have been followed by a one-year resurgence and subsequent consolidation

The second year following a major market bottom and start of a bull market – which we believe this is – tends to include a period of consolidation in US equities. Investors, having weathered a negative shock, reach a point at which enthusiasm about the rally gives way to a reappraisal of the likely trajectory of earnings growth required to justify those equity valuations.

Moreover, the three-month rates of change for US 10-year Treasury yields, breakevens, and nominals have all recently turned negative. Of all the different permutations of these variables, this particular mix has historically been the worst regime for performance in equities and the highest for volatility (see Exhibit 3).

Soon time to fade the growth fears

Soon time to fade the growth fears

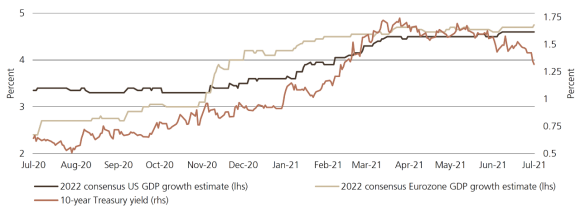

Estimates for 2022 GDP growth in the US and Eurozone have remained firm even as US Treasury yields retraced a significant portion of their year-to-date advance. These forecasts, if realized, would mark the strongest annual growth for either region in the 21st century (excluding 2021).

The amount of fiscal stimulus to date is larger than it was in the aftermath of the 2007-2009 financial crisis, and the ensuing retrenchment will likely be neither as sudden nor severe. Household balance sheets are in a healthier position, and buoyed by excess savings. The outlook for capital spending is also robust given the magnitude of the growth in corporate profits.

In our view, sovereign bond yields stand out as an asset class that may have overshot to the downside in light of the vigor this economic recovery is likely to retain. However, we have to consider the implications for our broad multi-asset positioning if the warning being sent by bonds is indeed accurate, and have reduced risk at the margin accordingly.

Part of the rally in longer-term yields is attributable to the Federal Reserve’s heightened sensitivity to price pressures. This has seemingly reduced right-tail outcomes for both inflation and growth in the eyes of market participants, and we believe only the former is justified. Given our positive macro outlook, we are examining opportunities to go more underweight global duration. Looking to the cross-asset backdrop for broad signs of stability across asset classes – the dollar no longer going up, and copper and bond yields no longer going down – will guide us as to when it may be appropriate to add equity risk more aggressively at the headline level.

Exhibit 5: Growth looks to stay strong in 2022

10-year Treasury yield tracked against 2022 consensus GDP growth estimates

Asset allocation

Asset allocation

Investors are adjusting to a new phase of the expansion. We can’t say with certainty how long this transition period will last. While it is ongoing, different assets will over or under-react to the change of global economic momentum.

Global equities at the headline level have yet to register a meaningfully negative reaction to this inflection point. Therefore, we do not believe it is a prudent time to increase equity risk until other cyclically sensitive assets, such as copper and developed market sovereign bond yields, show more concrete signs of stabilization.

However, we retain our core relative value positions in procyclical equities such as Europe and Japan. Unlike global equities at the headline level, these positions have lagged recently. In our view, any future underperformance would be modest even in the event that investors remain preoccupied with peak growth and peak stimulus. Ultimately, we have confidence that global growth will stabilize above trend in the coming quarters, and that these are the regions that will

outperform as we emerge from this transition period and investors’ focus shifts to the robust run rate for economic activity. We believe that their recent underperformance is not a function of a deterioration in their underlying earnings outlooks relative to US equities. This fortifies our preference for these regions on a going forward basis.

We are actively looking for opportunities in other asset classes, like global sovereign bonds, where we believe that yields now embed too much pessimism about the shape and strength of the expansion.

In our view, the US dollar should be more rangebound, especially against G10 currencies, due to the Fed’s responsiveness to inflation risks. Since Asia is leading the loss of economic momentum, we stay short cyclical Asian currencies, as well as select G10 commodity exporters. Some emerging market currencies, such as the Russian ruble and Brazilian real, are well-supported by monetary tightening and retain the capacity to perform even in a trendless USD environment.

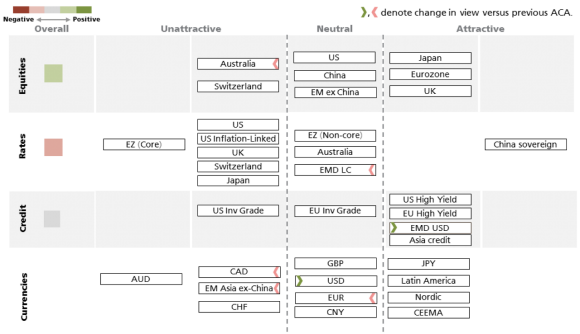

Asset class attractiveness (ACA)

Asset class attractiveness (ACA)

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 12 July 2021.

Asset Class | Asset Class | Overall signal | Overall signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | US Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed market Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets (EM) Equities(ex. China) | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | China Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Global Duration | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Bonds | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed-market Bonds | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Investment Grade (IG) Corporate Debt | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US High Yield Bonds | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Debt - US dollar / Local currency | Overall signal | Neutral / Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Chinese Bonds | Overall signal | Dark green | UBS Asset Management’s viewpoint |

|

Asset Class | Currency | Overall signal |

| UBS Asset Management’s viewpoint |

|

A comprehensive solutions provider

A comprehensive solutions provider

UBS Asset Management Investment Solutions manages USD 149.1 billion (as of 31 March 2021). Our 100+ Investment Solutions professionals leverage the depth and breadth of UBS's global investment resources across regions and asset classes to develop solutions that are designed to meet client investment challenges. Investment Solutions' macro-economic and asset allocation views are developed with input from portfolio managers globally and across asset classes.

For more information, contact your UBS Asset Management representative or your financial advisor.