2021’s 5 #trending topics

We came into 2021 with a broadly positive outlook for the global economy as we progress towards a more durable reopening. What does this mean for the procyclical positions across asset classes that served us well this year?

Evan Brown

Head of Multi-Asset Strategy, Investment Solutions

Ryan Primmer

Head of Investment Solutions

We expect a choppier environment for equities at the headline level, which tends to happen in the second year of a new bull market. The equity risk premium is near the floor of the previous cycle, which may cap near-term upside in stocks as policy risks start to become more two-sided. The recent hawkish turn by the Federal Reserve threatens to undo some of the weakness in the US dollar year-to-date, though there may still be areas of outperformance in emerging market currencies of countries where central banks have already been aggressively raising rates and are poised to continue doing so. This development may foster more volatility in relative value procyclical positions across asset classes. Robust activity and lingering upside inflation risks should lead to higher yields over time.

Against this backdrop, we pose five key questions that could dictate absolute and relative performance across asset classes in the second half of the year, and look at how this informs our current positioning.

We expect a choppier environment for equities at the headline level, which tends to happen in the second year of a new bull market.

1. Should investors embrace equity market beta, or the relative equity positions that worked in the first half of the year?

1. Should investors embrace equity market beta, or the relative equity positions that worked in the first half of the year?

The common thread running through equities markets in the first half of the year saw stocks levered to strength in real economic activity outperform, while more defensive or secular growth stocks struggled. This theme is likely to experience more challenges and two-way moves, particularly in the near term, but ultimately remain intact in the back half of 2021. What is also different is that we have a more rangebound outlook for equities at the index level after robust gains during the first six months of the year.

There are times to run higher levels of risk, and times to run lower levels. In the near term, we believe the latter is more appropriate. We prefer procyclical relative value positions compared to a significant overweight stance on equity beta. Inflection points in growth are not expected to be synchronous, so we believe investors should migrate towards earlier-cycle environments, such as Europe, Japan, or specific emerging market countries. Global growth is poised to peak, but we expect the expansion to remain robust thereafter. Near-term volatility may provide windows of opportunities to selectively add to some early-cycle positions.

Inflection points in growth are not expected to be synchronous, so we believe investors should migrate towards earlier-cycle environments, such as Europe, Japan, or specific emerging market countries.

After strong value outperformance, cyclically-oriented regions may have more room to run

After strong value outperformance, cyclically-oriented regions may have more room to run

2. How does a hawkish pivot from the Federal Reserve change the outlook for the second half?

2. How does a hawkish pivot from the Federal Reserve change the outlook for the second half?

At its June meeting, Fed officials signaled that it may be appropriate to raise rates twice in 2023 – up from expectations that rates would stay at zero through that year. This glide path was more hawkish than anticipated. We believe this marks a transformation from the Federal Reserve acting primarily to suppress market volatility, as was the case throughout the COVID-19 crisis, to being more of a source of market volatility.

Monetary support has been critical in underpinning equity valuations. Now, investors may have to grapple with the prospect of a withdrawal of accommodation sooner than had previously been anticipated. Going forward, the underlying moves in the bond market will be crucial to setting the tone for other asset classes. Continued upward pressure on real yields, with breakevens moving lower, is not a constructive combination for risk assets like equities, credit spreads, and commodities.

However, it is important to appreciate the context in which monetary stimulus might start to be removed. The US central bank has more faith in the economic recovery – which is ultimately what will be needed to deliver continued earnings growth. In addition, the central bank is looking to curtail the kind of right-tail inflation risks that could prove disruptive to the expansion, risk assets, and common portfolio structures. So too must this shift by the Federal Reserve be balanced against other underlying economic trends, chiefly the upward convergence of global activity with that of the US.

In the short term, the Federal Reserve’s decision may elicit a meaningful reversal in particularly buoyant and vulnerable pockets of reflation trades. But over time, particularly if US inflationary pressures begin to subside, the strong, broadening global economic recovery should emerge as the dominant driver of absolute and relative performance across asset classes. And if US inflationary pressures begin to subside in the second half, as we anticipate, this likely reduces the likelihood that additional hawkish Fed surprises will be in the offing.

3. How will recently discussed and upcoming legislation from the US Congress affect markets?

3. How will recently discussed and upcoming legislation from the US Congress affect markets?

The US is likely to pass additional fiscal stimulus in 2021 that includes both physical and social infrastructure – but also tax hikes. This is the crucial implication for financial markets: fiscal policy risks stateside are now two-sided.

There is a tentative bipartisan agreement in the Senate to boost spending on physical infrastructure by USD 579 billion, without any new taxes. If passed, the bill is likely to be signed by the White House in the third quarter.

Congressional Democrat leaders have made statements indicating that they are planning on advancing a separate bill through the reconciliation process on a parallel track. Their aim, in our view, is to make sure that policy priorities such as social and green infrastructure are more fully addressed ahead of the midterm elections in 2022. This second bill is unlikely to be passed until the fourth quarter.

A lesson from earlier rounds of stimulus passed in 2021 is to not underestimate the eventual size of the total spending and revenue-raising measures in a second bill that has only Democratic support. Constraints on the size of this spending, as well as tax increases, will be set by more centrist senators from the Democratic Party as opposed to Republicans. However, some of the potential line items are more controversial than spending on physical infrastructure. This may result in the cumulative spending in the two bills rather than under an alternative scenario in which only one infrastructure bill is passed with only Democratic support. If the bipartisan deal falls apart, we would expect Democrats to quickly pivot to doing one big package through reconciliation.

Attempts to raise revenues are likely to face much stiffer opposition than any of the expenditures. If there ends up being two bills, we would expect the second to include approximately USD 2 trillion in additional spending somewhat offset by up to USD 1.5 trillion in corporate, personal income, and capital gains taxes. This spending will be spread out over a period of many years, so the more timely consideration for markets are the tax changes. In our view, investors have not displayed much concern about the prospect of higher taxes, and this should change.

The corporate tax rate is likely to increase to at least 25%, but will remain well below levels that prevailed prior to the 2017 Trump tax cuts. The key point is that the net effect of this package will be a reduction in the after-tax earnings power of US companies. This supports our preference for ex-US developed market equities.

In addition, Democrats are likely to include some revenue-raising measures that have a negative impact on multinational firms and mega-cap technology companies. All else equal, this should be a headwind for US growth stocks.

4. Can Europe avoid repeating the policy mistakes of last cycle?

4. Can Europe avoid repeating the policy mistakes of last cycle?

We expect to see Europe clear this very low bar with ease: in our view, there will be no abrupt lurch towards fiscal austerity, and the European Central Bank is not expected to hike rates amid a temporary bout of inflation.

The Eurozone is relatively unique in that growth is not likely to decelerate from 2021 to 2022. This is partially attributable to the delayed services recovery, but also a testament to the anticipated capital spending resurgence as well as enhanced support from the EU recovery fund – and the high likelihood that restrictions on government deficits will once again be suspended. Plans from European governments indicate that fiscal consolidation will be modest thereafter.

The German election in late September looms large as a catalyst for European assets. In the near term, political risks in Europe (and in particular Germany) are two-sided but asymmetrically skewed towards a more permissive stance regarding government deficits, higher public investment, and more economic integration.

As such, the persistent valuation headwinds for European assets during the pre-COVID cycle are well-positioned to turn to tailwinds during this expansion, in our view. Right now, earnings for European companies are poised to grow faster than those of their US counterparts despite slower economic growth in Europe vs the US.

We are closely watching the results of the German election and the longevity of the bounce back in business investment to judge whether both the public and private sector outlooks continue to support the outperformance of European assets.

5. Does the deceleration in Chinese credit growth jeopardize procyclical positions?

5. Does the deceleration in Chinese credit growth jeopardize procyclical positions?

The moderation in Chinese credit growth is the chief identifiable risk on the macro horizon. Based on investors’ muscle memory from the pre-pandemic expansion, this threatens to introduce volatility that challenges procyclical positioning, particularly in emerging market assets. Ultimately, we believe this risk will be overcome by the broader suite of tailwinds for global activity and the relatively modest nature of Chinese policy tightening.

Nominal GDP growth in China is strengthening even as total social financing softens. Reopening is allowing for a steady pick-up in consumer spending, the rebound in industrial profits supports capital expenditures, and the robust backdrop for external demand buoys Chinese exports.

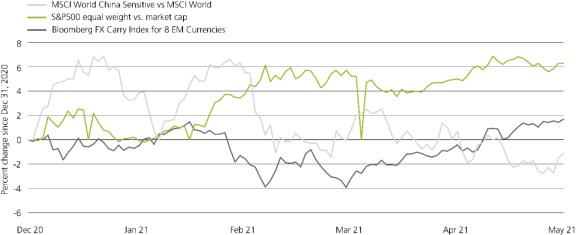

Markets are already expressing a more nuanced view on the ramifications of fading Chinese growth leadership. Global companies with exposure to China peaked in January. Other procyclical trades like emerging market currencies and the S&P 500 equal weight vs market cap have proceeded to fresh cycle highs.

What is different this time: the large stock of global fiscal stimulus that underpins global trade, the supply chain struggles that should prolong early-cycle dynamics in goods sectors, EM central banks are turning more hawkish, and years of underinvestment is fostering shortages across many commodity markets. These factors create a more supportive outlook for procyclical positions, including EM currencies, though such trades face an additional headwind in the near term due to the Fed’s more hawkish tilt.

Other procyclical trades like emerging market currencies and the S&P 500 equal weight versus market cap have proceeded to fresh cycle highs.

China concerns not weighing on broad procyclical positioning

China concerns not weighing on broad procyclical positioning

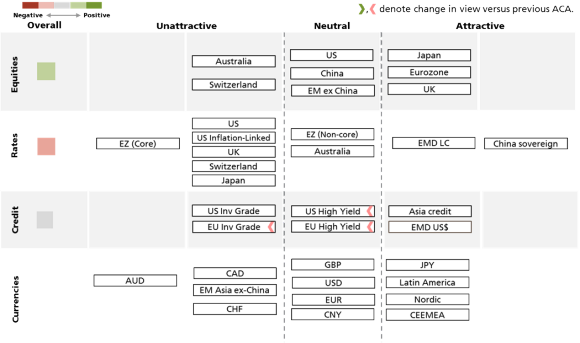

Asset Class Attractiveness

Asset Class Attractiveness