Dividends for yield-thirsty investors

For income-seekers, life has become an investment challenge. As yields on decent quality bonds languish, can defensive dividend strategies offer attractive alternative income sources?

24 Nov 2020

4 min read

Patrick Zimmermann

Head of Quantitative Investments

Urs Raebsamen

Head of Investment Specialists, Systematic & Index Investments

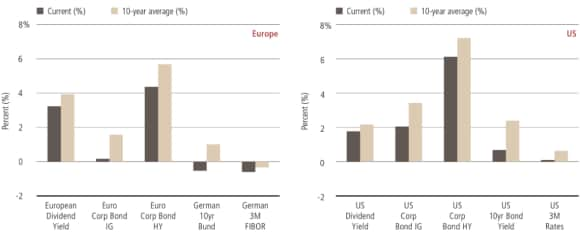

In a world of low interest rates and years of asset purchases by central banks that have led to ultra-low bond yields, many yield hunters have turned their attention to equities where dividend yields have remained broadly in line with their historical norms of 2% to 4%.

While equities offer the potential to participate in the market’s upside, there is also the risk of capital loss larger than what a typical high-grade fixed income investor might be willing to accept.

Nonetheless, there are three potential sources of equity income: dividends, share buybacks and call overlay strategies, and we assess their place in equity income portfolios.

The income investor’s toolkit

The income investor’s toolkit

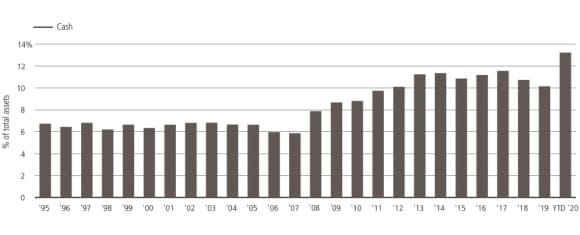

In the years following the Global Financial Crisis (GFC), many companies deleveraged and bolstered their balance sheets by building up significant cash reserves. The COVID-19 crisis led some of those companies, most prominently a number of UK-listed banks, to cut or even cancel their dividends. Many firms, however, have kept their dividends intact, and yields held up well when markets fell. As markets recovered strongly, yields have come down somewhat.

Equity dividend yield in line with historical average in Europe and US

To identify stocks with sustainable dividends, we favor a combination of high dividend and high quality stock selection criteria; the latter of which can be measured by looking at metrics such as high profitability, low financial leverage, strong corporate governance and human capital management, stock price stability and size, amongst others. We believe this combination of dividend and quality criteria can lead to better results over the long term.

Another means by which equities have delivered meaningful income returns in recent years has been through the use of share buybacks. By buying back shares, companies reduce the number of shares in circulation, distributing profits over a smaller pool of shares. This is reflected in higher earnings per share (EPS).

Unless there has been a dramatic (and coincidental) change in fundamentals, if the EPS rises, so should the share price – if the share price doesn’t rise, the P/E will fall. To preserve the company’s intrinsic valuation, the share price should rise to keep the P/E broadly in line with its pre-buyback level. This effect is otherwise known as ‘the buyback yield’ – the long-term price increase due to share buybacks.

Buyback volumes in the US peaked before the COVID-19 equity market correction, and have since dropped significantly. While earnings have also fallen, US companies have on average been cautious and many have raised capital in the bond market to enhance their liquidity position. With the economy as well as earnings recovering, cumulative cash balances are approaching peak levels again and we believe that this should allow companies to resume buyback programs.

US companies’ cash balance over time

Income from option overlays

Income from option overlays

Covered call overwriting strategies systematically sell short-dated call options on portfolio holdings. The call option seller earns an option premium, which itself adds an income stream to the portfolio, but with the added benefit that by selling call options on a stock, the portfolio’s market sensitivity, and therefore downside risk, contributes to a smoother return profile. In exchange for the income and the added layer of downside cushion, the call times of market distress, selling call options usually provides greater levels of income during turbulent bear markets.

During the COVID-19 market correction, option premia rose significantly, allowing us to achieve roughly double the normal income and at the same time setting the strike-levels much higher whereby upside participation in a rebound increases correspondingly.

Therefore, we believe equities offer yield hunters a multi-faceted investment approach – dividends, share buybacks and call overlay strategies – to generate income. Given that the three sources are complementary with respect to their behavior in different parts of the cycle, a combination of all three approaches could prove an effective means of navigating 2021 to achieve the income investors are seeking.