Defining credit dislocation

COVID-19 sent shockwaves through the credit markets exposing their fragility. Is now the time to invest? Our credit experts think so, learn more from our latest webinar.

The unprecedented economic shutdown resulting from the COVID-19 outbreak has exposed the fragility of the credit markets, resulting in dynamic volatility across the asset class. Repricing of credit assets may create opportunities for proactive investors to capitalize on dislocations in the market, but active management and asset selection are crucial to the investment process.

Key webinar takeaways

Key webinar takeaways

- March's indiscrimate selling in credit markets was followed by unprecedented policymaker support and technical challenges, leading to an uneven recovery and opportunities in dislocations.

- We believe the best opportunity set in the slowing economy is in levered loans, CLOs, energy credit MBS and single thematic idiosyncratic situations.

- Downgrades will likely lead to forced selling within CLOs, creating opportunities for rules-based investors to capitalize by purchasing loans of quality companies at steep discounts.

- The ability to select survivors in energy versus those likely to default will be critical as we see opportunity to step in at attractive prices.

- Deploying fresh capital has its advantages rather than investing in existing portfolios, alongside existing investors with different economic expectations and liquidity needs.

Bruce Amlicke, Chief Investment Officer, UBS Multi-Manager Solutions

Bruce Amlicke, Chief Investment Officer, UBS Multi-Manager Solutions

Pre-COVID credit market dynamics

Over the past several years we’ve been looking at the corporate credit bubble forming, knowing eventually it would pop, but it took a global pandemic to bring the existing credit cycle to an end. After years of monitoring the market, HFS had drastically reduced our corporate credit allocation to close to zero while maintaining exposure to mortgage credit, asset-backed securities and co-investments. Now we have the opportunity to redeploy capital into corporate credit at levels we consider to be attractive. The shutdown has caused carnage and defaults across retail, travel / leisure, energy and more interestingly some of the large high quality companies.

Corporate leverage has been trending higher and recently reached an all-time peak. The biggest enabler of this leverage increase has been the CLO market which has expanded the leverage loan universe to over USD 1.1trn as of February 2020. Investors have been accessing CLOs as a way to gain exposure to yield with relatively low risk. For example, CLO AAA paper was popular amongst risk-sensitive Japanese financial institutions as a way to deal with the challenges of negative yields.

Leveraged loan market size

The leveraged loan market has increased over the past 20 years reaching its highest levels at the start of 2020.

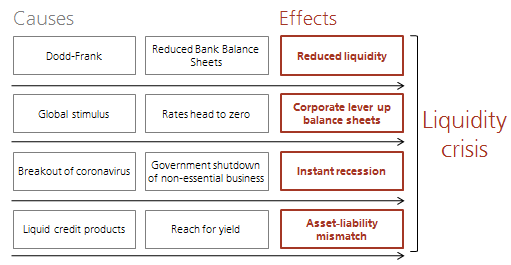

COVID-19 as a trigger point for credit

We feel that the economic shock of COVID-19 will lead to reduced corporate earnings and an increase in defaults and downgrades. These events will likely lead to forced selling across credit markets, whether it is fallen angels in the investment grade space or levered loan defaults. We have already seen a widening of spreads which has been exacerbated by low liquidity in the credit markets.

This recovery could be messier than the 2008 GFC due to consumer behavior changing, and ultimately we believe the carnage will be much broader and longer lasting in the corporate cycle.

The indiscriminate selling that was seen in March has been followed by unprecedented policymaker support, which only targeted certain parts of the credit spectrum causing an uneven recovery. We're also seeing technical challenges including forced sellers, limited buyers and liquidity gaps. This creates opportunities to target dislocated instruments with what we believe is limited downside risk.

Joe Sciortino, Head of Credit Investments, UBS Hedge Fund Solutions

Joe Sciortino, Head of Credit Investments, UBS Hedge Fund Solutions

We believe the best opportunity set in the slowing economy is around four targeted investment areas: levered loans, CLOs, energy credit and MBS.

Opportunities in levered loans

The opportunity in the loan space is the same theme that we have seen many times before in credit sectors that have experienced rapid growth. The expansion of these sectors is usually accompanied by higher leverage and lower quality of issuance, which is what we've seen in the levered loan space since the Global Financial Crisis (GFC). The levered loan market is dominated by CLOs which are rules-based investors. They are the largest holders of loans, having purchased 70% of the primary issuance of levered loans over the past 2 years. With high growth, falling quality and only one primary type of buyer, we had very little exposure to the space over the past few years, with the expectation that levered loans would be an area where any turn in the credit cycle would shine a light on weakness in this market.

The global pandemic has acted as a catalyst within this opportunity set as it is impacting corporate earnings across sectors, putting a clear timeline on accelerated ratings downgrades. These downgrades will likely lead to forced selling by CLO managers in the next few quarters as they rebalance portfolios. We look at this as an opportunity to step into the market from a thematic perspective and take advantage of these dislocations by purchasing loans of quality companies, which we don’t believe will default, at attractive prices.

Right now we feel the best opportunity is to stay in the higher quality performing paper.

Leveraged loan index prices

The S&P / LSTA Leveraged Loan Index price experienced a sharp decline at the beginning of 2020 reaching a trough in March, but has subsequently reflected a slight rebound as of 30 April 2020.

Opportunities in CLOs

Along the theme of corporate downgrades another investment opportunity we are targeting are CLOs themselves. As loans held by CLOs are downgraded, the CLOs that hold them will become stressed. The CLO space has seen tremendous growth from investors attempting to secure excess yield via a perceived complexity premium. Investors new to the space may not have the experience of investing through a full credit cycle and may not be willing to take on heightened downgrades, defaults and severity rates, resulting in increased volatility and credit risk.

While equity markets have rallied coming out of March, CLOs have seen very little trading outside of small bi-lateral deals. We have begun to see stressed investors seeking liquidity and selling indiscriminately, particularly mezzanine and equity tranches. In addition, significant CLO investors such as insurance companies cannot hold securities below a certain rating and also may become forced sellers if downgrades occur. As CLOs are difficult to model and require massive amounts of data to evaluate, analysis requires insight into the underlying structure of the loans in the portfolio as well as the sponsors and ownership of the CLOs. We believe with the correct selection expertise, there is the ability to take advantage of forced selling at steep discounts.

CLO index price discount

The three JP Morgan CLO Indices prices experienced a decline in the beginning of 2020 reaching troughs in late March. The indices have subsequently reflected a slight rebound as of 30 April 2020.

Opportunities in energy credit

We've been following the energy sector closely with the volatility in the oil complex since 2015. Prior to the recent crisis, we believed there was too much money chasing too few opportunities in the space, and we were unwilling to take on commodity risk without a certain amount of downside protection. Generally, we don’t like taking equity, commodity or housing price risk with our debt investments. However, the changing regulations around reserve based loans (RBLs) in 2019 caused us to increase our research in this area. The recent drop in oil prices has caused a significant amount of stress across the sector creating an opportunity to step in on both the asset side, through RBLs and via the high yield and levered loan markets.

We think that the opportunity here is unique. Unlike the past 10 years in the broad credit market where investors basically bought the market on dips, security selection is paramount to performance in the energy space. Looking forward, we believe that we will see high default and severity rates in energy. We see opportunity where we can step in at attractive prices with companies that may be downgraded or in a stressed sector but will ultimately survive, as the ability to select survivors versus those likely to default will be critical.

Energy index price discount

The ICE BofA High Yield Energy Index price experienced a sharp decline in the beginning of 2020 reaching a trough in March, but has subsequently reflected a slight rebound as of 30 April 2020.

Opportunities in MBS

The mortgage market is an interesting but more unpredictable opportunity set because in most of the sectors, particularly the residential side, the underlying collateral is fairly stable, but owners of the credit may be stressed. In March, structured credit hedge funds suffered poor performance and are now subject to significant redemptions at mid-year and will be forced to sell high-quality positions to meet liquidity needs. We believe there is an opportunity for an experienced mortgage investor with access to flow and strong anaylitical skills to step in as liquidity providers for both portfolios and LP interests at significant discounts.

Commercial real estate is the one area where we are most concerned. Without clarity on how the fundamentals really affect the underlying property, you can't underwrite future revenues.

Credit risk transfer prices

The JP Morgan Credit Risk Transfer RMBS prices experienced a decline in the beginning of 2020 reaching troughs in early April. The indices have subsequently reflected a slight rebound as of 30 April 2020.

Capitalizing on current market dynamics

Security selection: Strong fundamental research will be key to navigating the current market dynamics and to be able to identify quality assets at discounted terms with potentially limited downside risk.

Fresh capital: There is a significant advantage in being able to deploy fresh capital rather than investing in existing portfolios with legacy positions, alongside existing investors with different economic expectations and liquidity needs.

Active management: In the bull market in rates and credit of the last decade, it was difficult to derive alpha from corporate credit markets. The economic downturn has changed this dynamic to one of winners and losers, where active management will be key in order to dynamically take advantage of dislocations

Glenn Shapiro, Head of Special Situations and Fundamental Strategies, UBS Hedge Fund Solutions

The benefit we have from our seat is 2,500 points of contact annually with managers across the globe . We have a sense of where good ideas exist globally by asset class, sector and geography, as well as what types of attributes to look at from a perspective of single name or theme exposure.

With the experience of a team with strong underwriting and restructuring backgrounds, we have effectively put together a road map of how to navigate this credit cycle. We typically look for idiosyncratic risks where we are comfortable with potential convexity of an investment, the upside vs. downside and the pathway to getting paid. As the COVID-19 crisis has unfolded we have been able to expand the type of investments we look for given the new credit environment.

We have now expanded the type of investments we look for given the new credit environment.

Credit Co-investment opportunity road map:

- Stay close to government programs where support is provided: Agency mortgages (agency pools, AGNC: a mortgage REIT that is almost exclusively agency MBS); GSE-sponsored multi-family (Freddie Mac K and B programs); super senior exposures of national champions (e.g., airlines)

- Act as a liquidity-provider, leveraging the ability to get money on invested capital-type returns: Repo lines against illiquid structured credit pools with significant coverage (e.g., in Aircraft lending, write aircraft to zero, in Real Estate write CRE development to zero, etc.), MOIC-type returns

- Counter / non-cyclical exposures—where trends have been consistent with drawdowns: After-market auto parts suppliers; generic drugs

- New money opportunities to come in and recapitalize the business, protected by liquidity on balance sheet: Accounts receivable, adjusted for bad-debt expense, haircut inventory, etc., with upside from ongoing concern value

- DIP lines / restructuring—coming in senior having control over outcomes

- Convexity trades—finding highly correlated trades with ability to structure: Dislocated arb spreads; FX options correlated to crude

- Converts with variety of ways to structure, with the ability to set the arb and lock in a gain

Trade thesis: publicly-traded mortgage REIT

In March, an MBS issued by Fannie Mae and Freddie Mac experienced mortgage basis widening. The government guaranteed bonds started trading below par forcing people to sell. The Fed stepped in and offered to buy MBS through quantitative easing (QE), which caused the mortgage basis to tighten.

Since a low level of paper traded in private markets, we looked for correlated dislocations. Publicly traded mortgage REITs are levered portfolios of MBS, which were having liquidity problems and were being forced to sell. We selected the safest company named AGNC and were able to estimate a pro forma book value based on publicly available bond prices. The portfolio was purchased at a steep discount to where we estimated it should be marked. The company announced an updated book value at 30% discount to par; however, it was experiencing technical selling pressure from people receiving margin calls. We stepped in receiving a 12% coupon and because the market is normalizing, the price has been increasing by about 50%.

This is an example of a protected book of securities with high yield and low risk.

Trade thesis: rescue financing and debt restructuring

We are in leading negotiations with a restructuring advisor to a company that sells a specialized commodity. We would be coming in offering super senior capital where we are 4-5x covered and then would tender for the junior securities at a price that would cover us completely, in addition to a convert that would give us free upside if the company recovers. During our assessment, we look at accounts receivable, inventory, property plants / equipment and cash and liquidity on balance sheet. We haircut heavily and use spot pricing on any of the inventory, that is our recovery value if the business liquidates tomorrow.

This is an example of an opportunity to be covered at discounted values to liquidation with free upside in the recovery of a company.

Q&A:

Q&A:

Bruce Amlicke (BA): The situation with the economy now appears more dire. In 2008, post-Financial Crisis, we had QE to bail people out. Now you have that fully working; however, we have a longer term path to recovery, a U-shaped or potentially L-shaped recovery. This recovery could be messier due to consumer behavior changing, and ultimately we believe the carnage will be much broader and longer lasting in the corporate cycle.

BA: Right now we feel the best opportunity is to stay in the higher quality performing paper, which is a subset of companies that can survive what can be a pretty steep trough here. There is where we feel we can access excess risk premia. Longer term, we should see opportunities migrating into the distressed opportunity set, which will be longer lasting. In the meantime, we also see current opportunities in certain securities where there were losses, redemptions and illiquidity, like in the RMBS market.

BA: They are clearly detached here, and we think what's happened is that mega-cap growth companies are powering a pretty narrow equity rally. If you look more broadly at your typical S&P 500 stock, it still down quite a bit. Smaller companies are definitely going to struggle here and be more connected to issues of the debt markets. We feel that investing through corporate debt will offer a safer way to take advantage of these opportunities.

BA: What we've seen is unprecedented—you have 30 million barrels per day of excess supply of crude. We had a dire situation where the shut-in had to happen effective immediately. A lot of these smaller companies, especially in the Permian Basin are going to go away, and we should see a massive consolidation. We're just trying to stay high quality and be secured by the commodity itself. Ultimately, it's an aggressively bad situation, but what we hope to see a year from now, as supply gets shut in and demand normalizes, is that oil prices go up. The question is how much carnage and consolidation in the oil pass will occur, and here in the US how can we take advantage of that consolidation to be with the winners? But ultimately, capital formation this time versus the last time oil traded down into the 20s at the beginning of 2016 is different. Back then, hedge fund and private equity capital stepped in to provide capital relief, and that money got trapped. At this juncture, between some of those investors losing money and not coming back this time around and then the challenges of ESG, fossil fuel divestures, reduced bank lending due to ESG concerns, it's going to be tough to get capital for fossil fuel companies. It's going to be interesting, but we can't live without them and are not ready for renewables to take over. We think we're going to have a period of time where oil prices go back up and lay the ground work for an interesting opportunity.

BA: Helicopter money is ultimately what we're seeing here in the US and central banks globally. When you get into negative yield territory, it's questionable as to how beneficial this is. With the debt load stacking up, we could reach a point where debt servicing becomes an issue. We need to stabilize the economy and get through the rough patch, but the question is how do you do it and how do you use that fiscal policy? Do you print money to put in people's pockets today or create jobs to and long-term growth? I believe we need to pivot and do the latter. We're going to reach the boundaries of what's doable, and at the same time you have global supply changes that are re-orchestrated, which could be inflationary. When you factor in money printing, fiscal spending and the inflationary aspect of supply chain changes, it's setting up an interesting macro backdrop for the future. In the meantime, things are acting deflationary, but this is a temporary thing. Crude prices going higher a year from now will only exacerbate that, so it's pretty unprecedented, but reaching the outer bound of policy by the end of this year.

Joe Sciortino (JS): It depends on the market. There has been a snap back on the more liquid part of the credit markets, but we think that downgrades are going to lead to further fallout within the levered loan market. Within CLOs, the more liquid portion of the tranches (BBBs) have rallied back; however, equity pricing is actually down since the end of March. So, I think that is indicative of what's going on under the surface in credit. You've seen some bounce back in certain areas, but we expect more volatility as the market attempts to digest the fundamental impact of this crisis and that should lead to further opportunity for us.

JS: Today I think commercial real estate is the one area where we are most concerned. There just isn't clarity on how the fundamentals really affect the underlying property. If you can't underwrite the future revenues of the underlying property, then how can you get comfortable being in a debt position there? While there are some high quality properties that are being punished with the rest of the market and look attractive on the surface, this is still an area where we have concerns. Generally, we are focused on higher quality assets up in the capital structure, so areas that we would be more concerned about would be mezzanine loans or assets that are further down in quality. One area that is interesting is the multi-family space. It is defined as a commercial real estate asset, but it really has mixed fundamentals between residential and commercial real estate. We continue to monitor this area actively, as we've been pleasantly surprised by how it's performed so far and could see some attractive opportunities there.

JS: The breaking point is the downgrades, and the fact that these downgrades are coming is obvious. Most people predict a very large percentage of CLO equity will shut off over the next quarter. As the next earnings cycle comes through, we will see enough downgrades that a substantial amount of these CLOs will likely shut off. I have seen one report saying this could occur with approximately 85% of the market, but that's probably overstating because it's not a linear path. However, it's an indication of how extensive the carnage could be. We believe this will occur very quickly over the next few months.

As far as holders, there are a large percentage CLO equity tranches that are in stronger, longer, locked-up structures, like private credit or GP interests from the CLO collateral managers themselves. They generally try to own 51% of CLO equity so they have a controlling stake in it. But there are also minority equity holders that are much weaker, whether it's hedge funds or BDCs, and this is where I think you're going to see a lot of selling. These minority holders who don't have control of the CLO are experiencing extreme volatility in their pricing. Those that have to pay dividends and rely on heavy cash flows lose that utility if cash flows are cut off. There are definitely substantial portions of the market that are going to be sellers.

JS: Good question—the fallen angels area is massive. If you look at the amount of concentration into BBB paper, it's grown substantially over the last five years. The holders of that paper are in a tough situation; the biggest holders of BBB CLOs are insurance companies. If their bonds get downgraded and lose the NAIC-2 rating, then they have to take a full capital charge against it. I think it's an opportunity that could present itself as you see these downgrades come through, particularly on the CLO side. On the corporate side, there is a little more support from the Fed in that area and more support from traditional funds and investment grade products able to stay in those trades or step into them. I think it's going to be a big theme in the market, and it's just a matter of how much money will have the flexibility to either hold on to those fallen angels or step into them. It's something we will continue to monitor and could be quite an attractive opportunity for us to step into.

Explore more insights

Original articles and videos with expert analysis, views and opinions on a broad range of asset classes and themes.