China 2021 - the investing outlook in 10 charts

The investing outlook for China in 2021 explained in 10 of the best charts presented by our experts at GCC 2021.

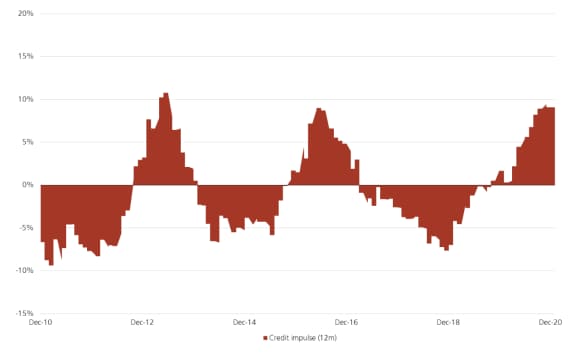

1. Credit growth may slow in 2021, and that will likely mean slower growth numbers for the economy

1. Credit growth may slow in 2021, and that will likely mean slower growth numbers for the economy

China credit impulse (y-o-y growth), Dec 2010-Dec 2020

China credit impulse (y-o-y growth), Dec 2010-Dec 2020

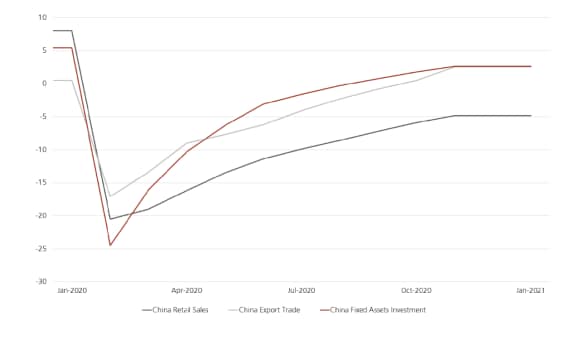

2. China’s V-shaped recovery appears to already be leveling off

2. China’s V-shaped recovery appears to already be leveling off

China retail sales, exports, fixed asset investment (y-o-y, %), Jan 2020-Jan 2021

China retail sales, exports, fixed asset investment (y-o-y, %), Jan 2020-Jan 2021

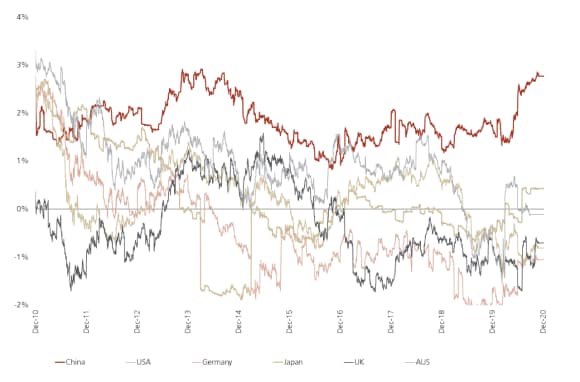

3. China sovereign yields continue to look good

3. China sovereign yields continue to look good

10-year sovereign real yields compared, Dec 2010-Dec 2020

10-year sovereign real yields compared, Dec 2010-Dec 2020

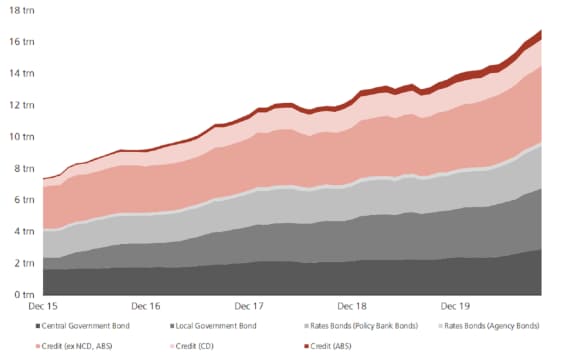

4. China’s bond market has grown in size and will likely keep growing

4. China’s bond market has grown in size and will likely keep growing

China onshore bond market, market cap (USD trillions), Dec 2015-Dec 2020

China onshore bond market, market cap (USD trillions), Dec 2015-Dec 2020

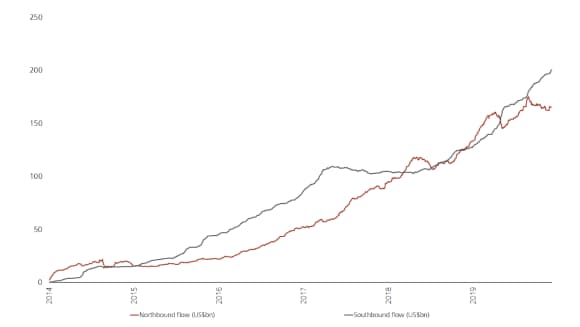

5. Inflows into China onshore equities look likely to continue growing.

5. Inflows into China onshore equities look likely to continue growing.

Cumulative net buying of Southbound/ Northbound Connect since inception (In USD bn), Nov 2014-Nov 2020

Cumulative net buying of Southbound/ Northbound Connect since inception (In USD bn), Nov 2014-Nov 2020

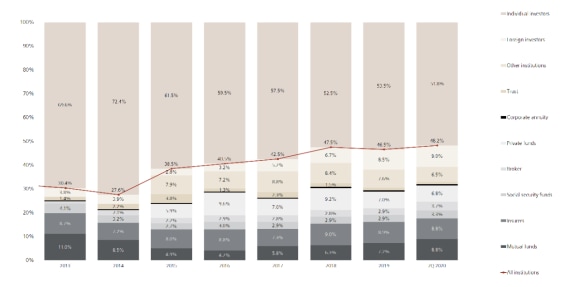

6. China A-shares are becoming more institutionalized

6. China A-shares are becoming more institutionalized

A-share investor structure (% of total free-float market cap), 2013-2Q20

A-share investor structure (% of total free-float market cap), 2013-2Q20

7. Retail investors still dominate A-shares, making turnover extremely high

7. Retail investors still dominate A-shares, making turnover extremely high

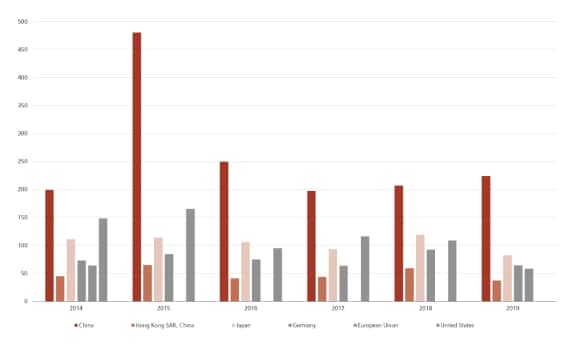

Percent turnover across region (by year)

Percent turnover across region (by year)

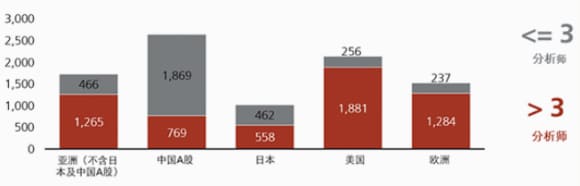

8. Analyst coverage of A-shares will remain low, opening opportunities to find underappreciated companies

8. Analyst coverage of A-shares will remain low, opening opportunities to find underappreciated companies

Coverage of companies with USD 500m market cap

Coverage of companies with USD 500m market cap

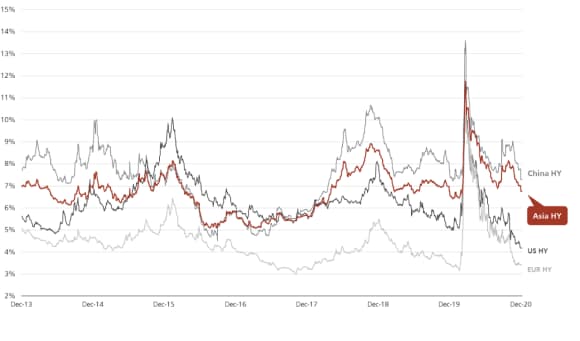

9. High yield spreads look attractive, and have the potential to close in 2021

9. High yield spreads look attractive, and have the potential to close in 2021

High yield spreads compared, Dec 2013-Dec 2020

High yield spreads compared, Dec 2013-Dec 2020

10. China will continue to be the driving force for the world economy for the foreseeable future

10. China will continue to be the driving force for the world economy for the foreseeable future

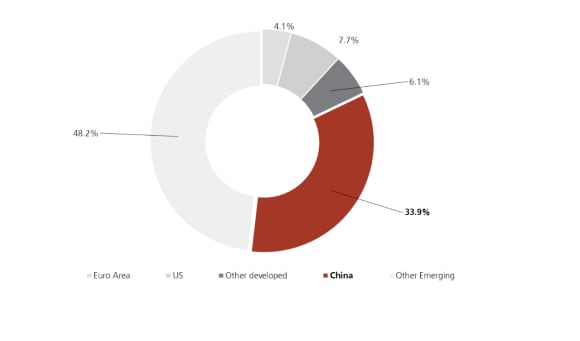

China’s contribution to global growth, 2019-2024

China’s contribution to global growth, 2019-2024