Investing in China

Opportunities for global investors.

![]()

header.search.error

Opportunities for global investors.

Why China?

China’s economic and social transformation over the past two decades has been nothing short of extraordinary. Given the blistering pace of change, many investors’ view of the country is likely years out of date.

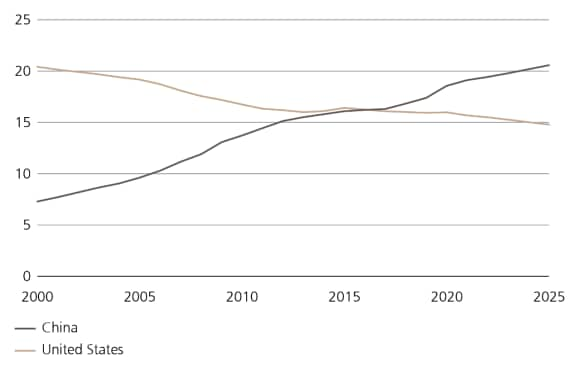

China now accounts for about 20% of the world's total economic output and 30% of annual global GDP growth, and is now larger than the US economy measured in purchasing power parity (Fig. 1). The rise in living standards has kept pace with this expansion: The percentage of the population living on less than USD 5.5 a day has plummeted from over 80% in 2000 to less than 24% today, while the middle class now makes up about 50% of the population.

This transformation been accompanied by an increase in the size and liquidity of China’s asset markets. Its equity market capitalization is 25 times larger than it was in 2002 and now makes up close to 11% of the global total (Fig. 2). The market for tradable debt securities has also grown exponentially, from USD 200 billion in 2000 to USD 15.8 trillion as of June 2020, with the vast majority of these bonds issued in local currency.

The renminbi (RMB) has evolved from being a globally irrelevant currency to the eighth most-traded currency in the world in 2019, and is gaining a spot in central banks’ international reserve allocations. RMB is positioned to become more important in the next decade due to China’s growing economy and central role in global trade, the opening up of its domestic capital markets, and the policy initiatives that support RMB internationalization.

Most of these economic, social, and financial market changes appear poised to accelerate as a result of the pandemic. China and other north Asian countries have managed to control the disease relatively successfully, allowing economic growth to normalize more rapidly, and leaving them well positioned to deliver sustainable growth in the future. This is one reason we expect returns on Chinese equities and fixed income assets to be solidly above their developed market counterparts in the coming years.

The prospect of relatively high returns may already be enough to justify larger allocations to Chinese assets, but what makes them more compelling is the size of the growth opportunities as the economy evolves. Not to be ignored is how China's strategic competition with the US offers a way to diversify portfolios from being implicitly reliant on a single economic model.

GDP as % of world total based on purchasing power parity

Market cap (equities) and total notional outstanding (bonds), in USD billions

The government's latest five-year plan makes clear its goal of reducing China's dependence on foreign technology. R&D spending is growing twice as fast as that of the US, and the country has the world’s second-largest number of “unicorns”— privately owned startups with valuations in excess of USD 1 billion. This is evident in IPO activity in 2020, as China and the US towered over other regions in terms of number and dollar value of new equity offerings. Furthermore, China is now home to the largest stock of supercomputers and industrial robots. Enabling technologies like 5G, artificial intelligence, cloud computing, and big data are powering smarter infrastructure across China.

The push toward tech-enabled infrastructure is closely linked to China’s ambitions to achieve carbon neutrality by 2060, by improving energy efficiency and supporting the transition to renewable energy and vehicle electrification. The abundance of greenfield projects as part of ongoing industrialization puts China in a unique position to leapfrog in the energy transition. We forecast that China’s green ambitions will drive a twofold rise in solar installments, 40% growth in wind installments, and a fivefold increase in electric vehicle (EV) production by 2025. China is a leader in EV battery cell technology, and limited supplies could open a path for it to penetrate foreign markets in the future.

China accounts for 57% of the global ecommerce market, and its online penetration rate is forecast to rise further from 37% currently to 64% in 2023, according to eMarketer. Further, China has emerged as a leader in the transition to cashless societies. The country’s two largest mobile payment solutions, Alipay and WeChat Pay, today claim over 500 million and 900 million users, respectively. China may also soon become the first large economy to introduce a digital currency—the “e-yuan” is sponsored by the central bank, very different in nature to decentralized cryptocurrencies such as Bitcoin— underscoring the its position as the global leader in payments technology.

China is an attractive diversifier

For global investors, the increasing accessibility of China’s rapidly growing equity and bond markets not only opens up new investment opportunities, but also offers a potential benefit to portfolios. Incorporating Chinese assets into a global portfolio can provide meaningful diversification because China’s domestically oriented economy and independent monetary policy, uncoordinated with developed market central banks, result in economic and interest rate cycles that often diverge from major global markets. For example, in 2018 the Federal Reserve hiked its policy rate by 100 basis points (bps) as the US economy was growing above trend, while the People’s Bank of China cut the reserve requirement ratio by 250bps as the Chinese economy slowed. As a result, bond yields went up in the US and fell dramatically in China.

Viewing Chinese assets through a portfolio construction lens puts the focus on their expected return and risk characteristics. In that regard, equities and bonds both have attributes that can make them valuable additions to global portfolios.

Historical correlation with MSCIACWI Index

Final thoughts

Over the past decade, China’s financial markets have experienced rapid growth, undergone significant structural reform, and opened up to global investors. These are all likely to continue. While still considered as part of emerging markets and their corresponding benchmarks and investment products, China’s equity and bond markets are already of sufficient size and opportunity that global investors should start to think of them as their own distinct category, in our view. The data and analyses presented in the preceding sections highlight the return potential of these assets and how they can benefit globally diversified portfolios.

These opportunities in China also come with complexity and risks, which is why investors should be committed to further understanding, doing due diligence on, and continually monitoring their Chinese investments. This additional effort suggest that global investors should take a long-term perspective on investing in China and its performance potential. While there will be periods, such as currently the case, when Chinese assets are attractive on a tactical horizon, addressing strategic allocations is more likely to have significant long-term benefits on portfolios.